This brief focuses on the role of the Schaeffer Center in demystifying the broken pharmaceutical distribution system and providing policy solutions that benefit patients. Through sophisticated and rigorous analysis of drug costs, the Schaeffer Center created an evidence-based playbook for federal and state policymakers to tackle distortions in the drug distribution system. Policymakers have heeded that call, adopting legislation to increase transparency and new rules on prescription drug rebates. Through timely analysis, peer-reviewed publications, op-eds, media engagement, and presentations to regulators such as the Federal Trade Commission, the Schaeffer Center is the go-to resource for insight and policy on reining in prescription drug costs.

Learn More:

Informing the Debate: Follow the Money

Prescription drug spending accounted for about 10% of all health care spending in 2019, with this rate expected to grow over time. Higher drug spending has profound implications. Patients face higher out-of-pocket costs for the medicines they need, leading to lower levels of drug adherence, worse health outcomes, and higher health care costs. Federal and state budgets are strained by ever-rising costs for Medicare and Medicaid. And health insurers and employers pay higher premiums or shift even more costs to employees. Given these burdens, higher prescription drug spending has unsurprisingly led to calls for government intervention and policy change.

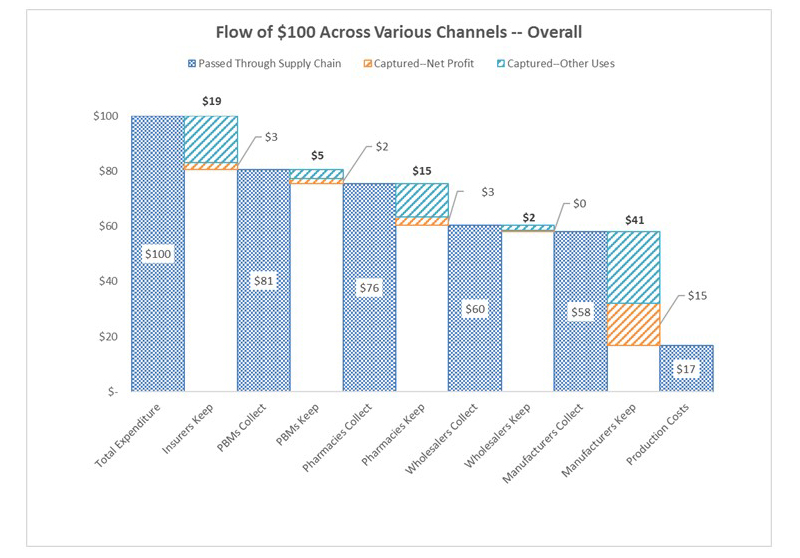

To help advance evidence-based reforms, Schaeffer fellows set out to “follow the money” and expose the opaque and complex system used to distribute and pay for prescription drugs. In 2017, Neeraj Sood and colleagues authored a seminal analysis of the pharmaceutical distribution system and found that $1 out of every $5 spent on prescription drugs goes towards profits.

Even more illuminating, $58 of every $100 spent by patients for retail prescription drugs goes to the drug manufacturer while $41 flows to middlemen like wholesalers, pharmacies, pharmacy benefit managers (PBMs), and insurers. These findings, the researchers concluded, demand greater transparency of drug pricing policies and more competition.

Policy Solution: Sharing the Global Expense of Medical Innovation

While the advantages of medical innovation are felt all over the world, the United States carry a disproportionate amount of the financial burden. American consumers spend nearly three times as much on medications as their European counterparts — and 90% more as a share of income. Indeed, between 64% and 78% of worldwide pharmaceutical profits are made from the U.S.

If … the United States could persuade its trading partners to tilt their policies modestly in favor of higher prices, to stimulate innovation, they could help their future patients without unduly harming existing ones.

Washington Post Editorial Board

Using an economic-demographic microsimulation, Dana Goldman and Darius Lakdawalla estimated that a 20% increase in European pharmaceutical prices would generate $7.5 trillion in healthcare gains for that continent and $10 trillion in gains for the U.S. over the next 50 years. So encouraging other wealthy countries to shoulder more of the burden of drug discovery would ultimately benefit the entire world — especially since these savings could help power continued subsidies to improve healthcare in developing nations.

Granted, getting consumers used to low prices to pay more can be a challenge. However, as the Washington Post editorial board observed in a May 2018 column inspired by this research, “If … the United States could persuade its trading partners to tilt their policies modestly in favor of higher prices, to stimulate innovation, they could help their future patients without unduly harming existing ones.”

Policy Solution: Increased Transparency

Policymakers heeded this call for greater transparency in the pharmaceutical distribution system. In 2018, Congress banned gag clauses in contracts between pharmacies, PBMs, and insurers after Schaeffer Center researchers found that copayments paid by patients exceeded drug costs to the insurer in almost one of every 4 claims analyzed.

More recently, Congress required insurers and employers to submit annual data on pharmacy benefits and drug costs to federal regulators. This data must include, for instance, the 50 drugs with the greatest increase in expenditures over the prior year, total spending, and how premiums are impacted by rebates, fees, or other remuneration paid by drug manufacturers. This information will be compiled in a public report on drug reimbursement, pricing trends, and the role of prescription drug costs in driving premium increases or decreases.

Additional federal reforms may be on the agenda. Bipartisan leaders on the Senate Finance Committee previously championed legislation to improve drug pricing transparency while reducing gaming. Those leaders have voiced a continued interest in advancing similar reforms in the 117th Congress and recently completed a bipartisan investigation on the skyrocketing price of insulin, following similar investigations into the prices and distribution of opioids and hepatitis C therapies.

At the same time, state legislatures have aggressively adopted prescription drug-pricing laws. In a comprehensive review of these laws, Martha Ryan and Neeraj Sood found that only six states enacted effective transparency laws. No state went so far as to require disclosure of real transaction prices at each stage of the pharmaceutical distribution process, data that the researchers argue is needed to inform truly effective public policy solutions that reduce prices by eliminating excess profits.

Policy Solution: Ending Kickbacks for Pharmacy Benefit Managers

Schaeffer Center faculty also illuminated the murky roles of middlemen in the pharmaceutical distribution system and the link between drug rebates and list prices. These analyses helped spur new federal regulations and state laws to regulate PBMs and tamp down on rebates that raise drug prices and patient out-of-pocket costs.

Public and private payers have long relied on PBMs to administer their prescription drug coverage. Historically, PBMs have leveraged their pooled purchasing power to negotiate lower drug prices with manufacturers and thus enable insurers and employers to offer cheaper coverage. As part of these negotiations, PBMs have secured rebates from drug manufacturers for various prescription drugs.

But, as Schaeffer Center researchers have shown, these rebates (or kickbacks) are not always what they seem and play a significant role in rising drug prices. As Dana Goldman and Anupam Jena explained in a Washington Post op-ed in 2018, this system has broken down and PBMs no longer act in the interest of those they purport to serve.

As the industry has become heavily consolidated with just three PBMs accounting for 85% of the market, PBMs have more leverage than ever to negotiate rebates from drug manufacturers. But this arrangement has created perverse incentives to raise, not lower, drug prices. Research led by Neeraj Sood found a positive correlation between drug rebates and list prices: on average, a $1 increase in rebates is associated with a $1.17 increase in a drug’s list price. This has significant downstream effects for patients. The higher the list price, the larger the rebate—and the more a patient might pay when they fill their prescriptions.

Recognizing these concerns, the Department of Health and Human Services (HHS) finalized a rule to eliminate a regulatory safe harbor for PBMs under the Medicare Part D program. The rule is controversial: after heavy criticism, it was “withdrawn” before being revived by executive order and ultimately finalized in November 2020. In finalizing the rule, HHS concluded that the current rebate system increases financial burdens for Medicare Part D beneficiaries and eliminating the safe harbor under the federal Anti-Kickback Statute will reduce patient costs at the pharmacy counter. HHS seemingly agreed with Goldman and Jena who argued that patients, not PBMs, are “the ones who deserve a safe harbor.”

A chief criticism of HHS’s rule focused on the fact that eliminating the PBM safe harbor would increase premiums for Medicare Part D beneficiaries. By eliminating rebates, the rule eliminates a key source of revenue for PBMs who, in turn, raise premiums to make up for the lost rebate revenue. But, as Erin Trish and Dana Goldman explained, any premium increases would be modest and felt by only 13 of the 43 million Medicare Part D beneficiaries. For those 13 million beneficiaries, premiums would rise by an average of only $4.31 per month.

The fate of the rebate rule, which was finalized in the waning days of the Trump administration, is yet to be determined. The rule could be revoked or amended by the Biden administration, or invalidated by Congress under the Congressional Review Act. Congressional invalidation of the rule maybe even more attractive in light of the rule’s $177 billion price tag; Congress could use savings from invalidating the rule to help offset the cost of pandemic relief and coverage expansion under the Affordable Care Act. Even if the executive or legislative branches leave the rule in place, it has already been challenged in court, and its fate may ultimately lie in the judicial branch. Schaeffer Center experts will continue to track, analyze, and study this and other policies related to rebates and the broader pharmaceutical distribution system.

On the Horizon: The Future of Prescription Drug Policy

Addressing high prescription drug costs remains a high priority for patients and policymakers alike. A new Congress and White House will consider additional legislative and administrative proposals to help rein in drug costs. And governors and state legislatures are likely to be even more aggressive in tackling prescription drug-related issues following a Supreme Court decision that allowed states to regulate PBMs and clears the path for additional state regulation of health care costs.

To aid federal and state policymakers in their pursuit of innovative and evidence-based public policy, Schaeffer Center experts have begun seeding the next wave of ideas to rein in pharmaceutical costs. These proposals, among others, include:

- Encouraging competition for generic drugs to keep prices in check, reducing regulatory barriers to value-based pricing, reviewing incentives for brand-name drug manufacturers, and requiring even greater transparency.

- Modernizing the Medicare Part D program through structural changes, such as requiring private plans that administer this benefit to bear more financial responsibility through changes to plan design and reinsurance and exploring ways to share rebates with beneficiaries by, say, basing cost-sharing on net prices, rather than list prices.

- Reforming the insulin supply chain and enabling rebates to be used to lower patient out-of-pocket costs for insulin.

You must be logged in to post a comment.