Healthcare Reform

Our work in Healthcare Reform

-

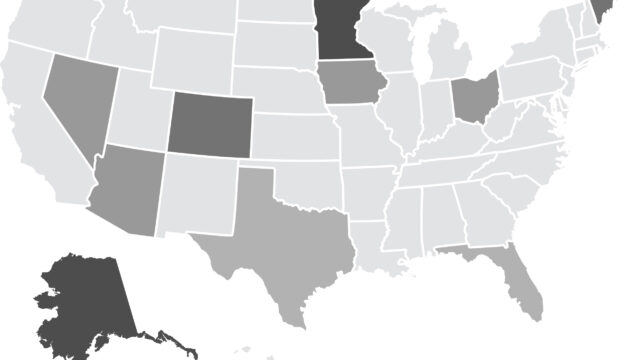

Stabilizing and Strengthening the Individual Health Insurance Market

Mark Hall examines the causes of instability in the individual market and identifies measures to help improve stability based off of interviews with key stakeholders in 10 states.

Categorized in -

Can MIPS Be Salvaged?

The goal of the Merit-Based Incentive Payment System, or MIPS, was to encourage clinicians to deliver more efficient, higher-quality care, but many observers have raised concerns that MIPS will fail.

Categorized in -

(De)stabilizing the ACA’s Individual Market: A View from the States

Market stabilization is currently the most critical regulatory issue that public policy officials are facing. We present strategies for stabilizing the individual market.

Categorized in -

Coverage Gains Among Higher-Income People Suggest the ACA’s Individual Mandate Had Big Effects on Coverage

Matthew Fielder discusses the effects of the Affordable Care Act’s individual mandate and potential consequences of it’s repeal.

Categorized in -

How did the ACA’s Individual Mandate Affect Insurance Coverage? Evidence from Coverage Decisions by Higher Income People

Matthew Fiedler presents evidence that the ACA’s individual mandate did indeed cause substantial increases in insurance coverage.

Categorized in -

Fixing Health Care: Driving Value Through Smart Purchasing and Policy

Alex Azar outlined the challenges and opportunities for public and private action in the healthcare system.

Categorized in -

New Payment Strategy Could Help States Treat More Hepatitis C Patients While Encouraging Innovation

A curative treatment exists for chronic hepatitis C infection, yet many Medicaid beneficiaries do not have access to these drugs. Neeraj Sood and his colleagues have developed a novel pricing strategy to expand access.

Categorized in -

The Case for Reforming Competitive Bidding in Medicare Advantage

Schaeffer Initiative experts propose reforming the way that fixed monthly payments to MA plans are determined, replacing the current, overly complex structure with one that would enhance competition, simplify beneficiary choice through standardization, and save an estimated $10 billion annually.

Categorized in -

What’s Ahead for the Individual Health Insurance Market?

The Brookings Institution’s Hutchins Center on Fiscal and Monetary Policy and the USC-Brookings Schaeffer Initiative for Health Policy will co-host an event examining where the individual insurance market is today and where it is heading.

Categorized in -

How to Interpret the Cadillac Tax Rate: A Technical Note

The Affordable Care Act’s excise tax on employer-sponsored plans, commonly referred to as the “Cadillac tax,” imposes a 40 percent excise tax on employer-provided health benefits with a cost in excess of specified thresholds.

Categorized in