Key Takeaways

- California’s $3 billion investment in the California Institute for Regenerative Medicine was unprecedented and has been the source of some controversy.

- We find the measure created over 56,000 jobs and added approximately $10 billion to the state’s economy.

- The potential to make therapeutic advances in areas such as diabetes, cancer, or stroke would pay enormous returns.

- Stem cell research is a worthwhile investment for Californians.

Abstract

There is significant controversy surrounding public investment in stem cell research by the federal government. In 2004, California voters passed a $3 billion bond measure to fund the California Institute for Regenerative Medicine. We argue there is a strong economic justification for stimulating basic research and therapeutic development in this field. The direct and indirect (through supply-chain effect) economic benefits of the funding were substantial: by our estimate, the initiative created more than 56,000 jobs and added around $10 billion to the state’s economy. The real benefits from this investment, however, will accrue with therapeutic advances. Four CIRM-funded studies are currently in stage-three clinical trials and show promising advances in kidney failure and ALS therapies. Further, our analysis finds that if diabetes research led to a reduction in the incidence of diabetes of just 10% in California, we estimate that would be worth $60 billion to its residents. If CIRM could marginally accelerate one therapeutic discovery of this magnitude, the return to California would more than justify the initial investment.

Background

In 2004, California voters overwhelmingly passed the California Stem Cell Research and Cures Initiative. This proposition authorized $3 billion in bond funding to launch the California Institute for Regenerative Medicine (CIRM). CIRM does not do research itself, but rather funds stem cell research in California. Early investment supported facilities where scientists could work. Later funding focused on clinical research, including cancer, diabetes, heart disease, blindness, and Alzheimer’s disease. CIRM will disburse its final funds next fiscal year. Given this context, it is worth considering whether continued public investment by a single state makes economic sense.

Public Research Stimulates Private R&D

The first question is whether public research investment advances scientific discovery. This issue is not unique to biomedicine—economists often worry that public investment ‘crowds out’ private enterprise, often inefficiently. In some industries, the crowding out is obvious. When the government chooses to build a new public road, for example, one can easily see how it would discourage private investors from building a competing rail line.

When it comes to biomedicine, however, the calculus is different. Scientific discovery is a fundamentally risky process, and some of the basic research is so risky that the private sector will often not undertake it. With a new rail line using established technology, it is relatively straightforward to estimate what it will take to build, who will use it, and how much they will pay. With a new biological cell line, it is much harder to predict the clinical pathway and ultimate therapeutic benefit.

Government takes on much of this risk, and most Americans see the value of doing so. It is rather remarkable that, even in these rancorous and fiscally challenging times, the National Institutes of Health gets strong bipartisan support and large budget increases.[1]

And evidence suggests these investments eventually pay off. A $1 investment in basic research —even with great uncertainty about its potential market applicability—can stimulate an additional $8.38 of U.S. industry R&D investment over the next eight years.[2] Internationally, the evidence is even more compelling. Explicit partnerships like the Global Alliance for TB Drug Development bring together philanthropic donors (such as the Gates Foundation) with the public and private sectors to tackle global diseases. Overall, it seems clear that public biomedical investment does not crowd out private investment and likely stimulates it.

Much of CIRM’s early work was basic research, but there is also evidence that later stage, clinical investments will also spur additional investment in the United States—albeit in a more muted manner. A $1 investment in clinical research stimulates $2.35 of private R&D over 3 years.[2] The bottom line is that public investment in biomedicine will stimulate new R&D, and investments in basic research—of the sort that CIRM makes – yield the greatest benefit.

Federal Research Support Wavers

Scientific progress in medicine requires sustained support given the lengthy development process. It took decades of public and private research to develop successful antiretroviral therapy for HIV infection.[3] Unfortunately, waves of ethical and political conflict have impeded progress in embryonic stem cell research. The debate goes back to 1979, when an NIH Ethics Advisory Board issued guidelines for early research. The result was a “14-day rule”[4] stipulating that intact human embryos used in experiments must not be allowed to develop beyond 14 days or beyond the appearance of the primitive streak —a key structure in early organism development.

The NIH revisited the issue in 1994 when Director Harold Varmus empaneled a group of experts to advise the agency on funding embryonic research. Reflecting the mood of the times, the panel received over 30,000 letters, cards, and signatures on petitions during eight months of deliberation. After the panel issued recommendations,[5] President Bill Clinton signed an appropriations rider known as the Dickey-Wicker amendment that prohibited Health and Human Services (HHS) (including NIH) from funding research in which human embryos are created or destroyed, but research using those stem cells was considered acceptable.[6]

In 2000, Presidential candidate George W Bush brought the issue to a head when he cited opposition to research “that involves the destruction of live human embryos”.[7] As President, he worked out a compromise. He permitted the federal government to fund research on stem-cell lines already derived from human embryos (21 lines in total), but he would not fund research on new stem-cell lines. During Bush’s presidency, Congress twice attempted to overturn the policy, but he vetoed the bills each time. It was during this tumultuous time that California stepped into the fray and passed Proposition 71, creating CIRM. Ultimately, President Barack Obama overturned the Bush-era policy in 2009 through executive order.[8]

California’s $3 billion investment in the California Institute for Regenerative Medicine in 2004 has resulted in over 56,000 jobs created and added approximately $10 billion to the state’s economy.

Public Investment Has Direct and Indirect Economic Benefits

Any public investment impacts the economy as suppliers of equipment gear up production and employees spend their income on other goods. These initial purchases in turn catalyze ripple, or supply-chain, spending. Economists build input-output models to capture these direct and indirect impacts. In CIRM’s case, public investment also spurs private spending. Using well-established regional and national input-output models, independent researchers at the University of Southern California found substantial economic benefits to California and to the rest of the U.S.[9]

They estimate the total economic impact of CIRM operating expenditures and CIRM direct and leveraged grants initiated through 2018, but whose spending is spread out through 2023, would be a $10.7 billion increase in gross output (sales revenue) and more than 56,000 additional full-time equivalent jobs. This additional output also brings in additional tax revenue that offsets some of the public costs, including $641 million for California and local governments and $727 million in federal revenue.[9] CIRM creates high quality jobs: half of the new U.S. jobs have salaries considerably higher than the state average, and many are concentrated in medical and health-related research.

These quantified estimates are based on the stimulus created by CIRM grants, co-funding, partnership funding, leverage funding of the Alpha Stem Cell Clinics, follow-on funding, and CIRM operating expenditures, but the majority of these impacts result from CIRM grants themselves. A qualitative analysis of impact on venture capital, licenses, and contributions to biotechnology clusters in California suggests that CIRM has spurred significant growth in these areas as well.[9]

The Real Benefits Come From Preventing or Alleviating Disease

The real question for CIRM is whether it will produce new therapies over the long-term. Although it is too soon to know for sure, four studies in stage-three clinical trials indicate promising advances in kidney failure and amyotrophic lateral sclerosis (ALS). Royalty payments are starting to emerge, but these are modest. However, the right way to think about a long-term investment is to put it in terms of appropriately discounted expected benefits. That is, if the project is successful, what are the benefits to Californians, the nation, and international collaborators incorporating the time-value of money? We can then assess whether the risk of success warrants such investment.

In stem-cell research, the potential benefits are substantial. We used the Future Elderly Model, an economic-demographic microsimulation, to examine the impact of possible benefits in California and the United States. FEM is well-suited to this purpose, having been used to assess the financial risk from new medical technologies,[10] the long-term costs of obesity,[11] trends in disability,[12] the cost of treating cancer,[13] and the health and economic value of preventing disease. Underlying support for the development of FEM came from the National Institute on Aging, the Department of Labor, the MacArthur Foundation, and the Centers for Medicare & Medicaid Services.

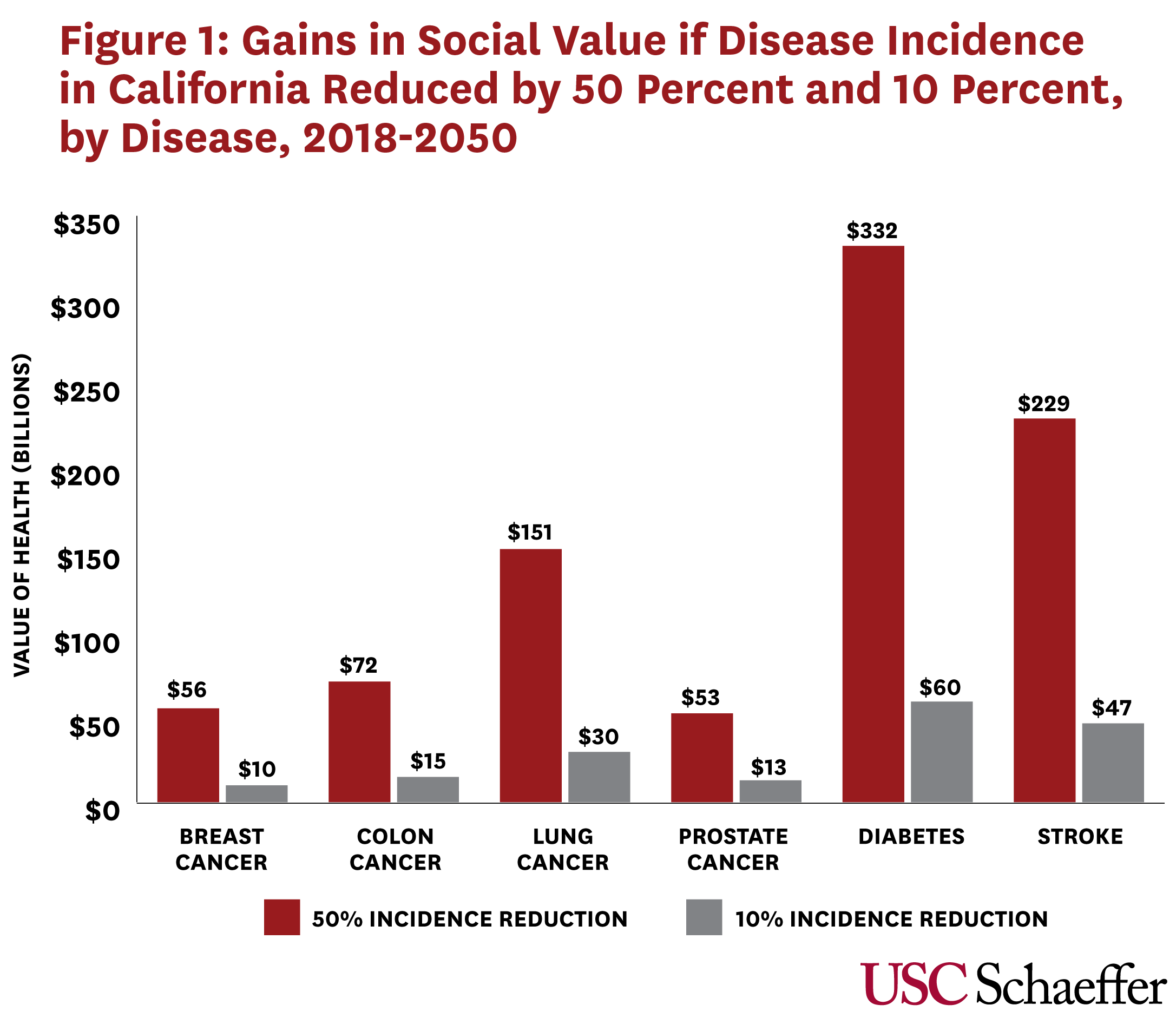

The model follows a representative cohort of Americans (and Californians) over time, generating snapshots of their health and disability. We measure health benefits using quality-adjusted life-years (QALYs), and – to translate health into dollars – we value each QALY at $150,000. We find enormous payoffs from potential health gains as a result of research advances. For example, a scientific advance that decreases diabetes incidence in Californians 51 and older by 50 percent translates to a $332 billion gain between 2018 and 2050 in social value based on QALYs valued at $150,000 (Figure 1). Even a more modest decline in diabetes incidence—10 percent—results in a gain of social value of $60 billion over the same period.

For cancer, the potential gains from a 50-percent reduction in the incidence of breast cancer would be $56 billion between 2018 and 2050 in California, $72 billion for colon cancer; $151 billion for lung cancer, and $53 billion for prostate cancer. A 10% reduction in incidence would generate $10 billion in social value for breast cancer, $15 billion for colon cancer, $30 billion for lung cancer, and $13 billion for prostate cancer.

As a society, we underinvest in better health… The public sector has an important role to play in therapeutic advances, and California has taken a strong leadership role.

These potential benefits are so large that it demonstrates strong expected return—even if the likelihood of success is very low. For example, if CIRM-funded research were to discover a treatment that would reduce the incidence of diabetes by 10%, it would be worth $60 billion in California. If there is only a 5% chance of discovering this modest reduction in incidence, then the investment would return $3 billion in expected value (=5% chance of success * $60 billion). Thus, an effective diabetes intervention alone would justify CIRM’s entire original portfolio of investment.

Policy Implications

In 2004, California voters, concerned by inadequate federal investments in stem cell research, made finding cures a priority for the state. In the ensuing 15 years, CIRM has funded 60 clinical trials, with targeted enrollment of more than 3,500 patients. Put in the context of potential value, the CIRM investment would be worthwhile if it increased our chances of therapeutic success even modestly.

Whether CIRM is making the most efficient investments with its research dollars is an important question, but also one best left to the scientists and public officials overseeing the program. What we can say is that scientific progress takes time, but future innovations are worth the wait. The question of whether treatments will be worth the high start-up costs need to be evaluated in the context of social value, which is rarely considered fully.[14]

Improvements in life expectancy due to medical research added approximately $5 trillion per year to U.S. wealth, according to the best estimates.[15] In the meantime, California is already enjoying some benefits. The state’s investment in physical and institutional infrastructure, research, education and training, research translation, research application, and clinical trials have produced substantial dividends of output, income, employment, and tax revenues. As a society, we underinvest in better health. This has put a strain on our social institutions and public programs. The public sector has an important role to play in therapeutic advances, and California has taken a strong leadership role in research ripe with controversy but also great potential.

References

1. American College of Cardiology. Bipartisan Congressional FY20 Spending Package Increases Medical Research Funding, More. Latest in Cardiology 2019; Available from: https://www.acc.org/latest-in-cardiology/articles/2019/12/19/12/07/bipartisan-congressional-fy20-spending-package.

2. A. A. Toole, Does Public Scientific Research Complement Private Investment in Research and Development in the Pharmaceutical Industry? The Journal of Law and Economics, 2007. 50(1): p. 81-104.

3. National Institute of Allergy and Infectious Diseases. Antiretroviral Drug Discovery and Development. 2018; Available from: https://www.niaid.nih.gov/diseases-conditions/antiretroviral-drug-development.

4. Aach, J., et al., Addressing the ethical issues raised by synthetic human entities with embryo-like features. eLife, 2017. 6: p. e20674.

5. Ad Hoc Group of Consultants to the Advisory Committee to the Director, Report of the Human Embryo Research Panel. National Institutes of Health, 1994. 1.

6. Foht, B., Embryo Ethics, 15 Years Later — Pro-Lifers Owe a Debt of Gratitude to George W. Bush. National Review, 2016.

7. CNN, Candidate Bush opposed embryo stem cell research. Inside Politics, 2001.

8. Rovner, J. and J. Gold, Obama Lifts Restrictions On Stem Cell Research. NPR, 2009.

9. Wei, D. and A. Rose, Economic Impacts of the California Institute for Regenerative Medicine (CIRM). 2019, Schaeffer Center for Health Policy and Economics, Sol Price School of Public Policy, University of Southern California.

10. Goldman, D.P., et al., Consequences of health trends and medical innovation for the future elderly. Health Affairs, 2005. 24 Suppl 2: p. W5R5-17.

11. Lakdawalla, D.N., D.P. Goldman, and B. Shang, The health and cost consequences of obesity among the future elderly. Health Affairs, 2005. 24 Suppl 2: p. W5R30-41.

12. Chernew, M.E., et al., Disability and health care spending among Medicare beneficiaries. Health Affairs, 2005. 24(6): p. W5R42-W5R52.

13. Bhattacharya, J., et al., Technological advances in cancer and future spending by the elderly. Health Affairs, 2005. 24 Suppl 2: p. W5R53-66.

14. Experts in Chronic Myeloid Leukemia, The price of drugs for chronic myeloid leukemia (CML) is a reflection of the unsustainable prices of cancer drugs: from the perspective of a large group of CML experts. Blood, 2013. 121(22): p. 4439-42.

15. Murphy, K.M. and R.H. Topel, The Value of Health and Longevity. Journal of Political Economy, 2006. 114(5): p. 871-904.

You must be logged in to post a comment.