The American Health Care Act (AHCA), which was passed by the House of Representatives on May 4, would alter how the costs of state Medicaid programs are shared between the federal government and states. In “Effects of the Medicaid Per Capita Cap Included in the House-Passed American Health Care Act,” (PDF) Loren Adler, Matthew Fiedler, and Tim Gronniger examine how this change in Medicaid’s financing structure would affect states’ Medicaid programs. Under the current Medicaid program structure, the federal government pays for a specified share of the cost of medical care for eligible individuals, while state governments pay for the remainder. The AHCA would cap the total amount of federal funding that states could receive for each person they enroll, a structure commonly referred to as a “per capita cap.” The cap on federal funding, which would take effect in 2020, would be set based on states’ per enrollee spending in 2016. Thereafter, the cap would be adjusted based on changes in the Consumer Price Index for Medical Care (CPI-M), as well as changes in the share of enrollees in a set of specified eligibility categories.To gain insight into the likely effects of this change in Medicaid’s financing structure, the authors examine how state and federal budgets would have been affected if a similar proposal had been implemented in the recent past. In particular, they use state-level data on historical Medicaid spending published by the Kaiser Family Foundation to examine how states would have fared in 2011 had a cap with the structure specified in the AHCA been implemented in 2004 based on spending levels in 2000. The authors chose this time period because of the ready availability of suitable data.The analysis reaches five main conclusions:

- Implementing a Medicaid per capita cap during the 2000s would have reduced federal Medicaid funding to more than half of states.We estimate that a cap like the AHCA’s, had it been implemented beginning in 2004 based on spending in 2000, would have lowered federal spending on Medicaid by $17.8 billion in 2011, requiring an 11 percent increase in state funding to maintain their Medicaid programs in their 2011 form. As illustrated in Figure 3 in the report, the required increase in state Medicaid spending to maintain pre-cap funding levels in 2011 would have varied dramatically, with one state requiring a 77 percent increase and eight other states requiring at least a 25 percent increase, while no change would have been required in just under half of states.

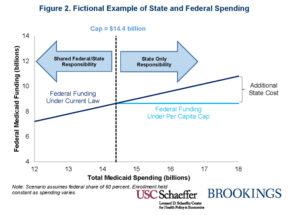

- Due to the “one-sided” nature of the AHCA’s per capita cap, there would have been no winners among the states, only losers. States receive reduced federal matching funding if their spending is above the AHCA cap in a given year, but do not receive additional federal funding relative to current law if spending is below the cap, as illustrated in Figure 2 in the report. This means that no state would have received more funding under a per capita cap than under current law in any year. This is an underappreciated feature of a per capita cap, which greatly magnifies the federal budgetary savings from the proposal. It is also an important difference relative to true capitation or block grant proposals under which a state would receive a fixed payment for each enrolled individual or for the program overall.

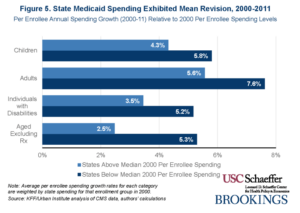

- States that had a low level of Medicaid spending per enrollee in the base year were much more likely to see funding reductions under this proposal. More than 85 percent of estimated federal spending reductions would have occurred in states with below-median per enrollee costs in 2000. This reflects the fact that states with relatively low spending in 2000 tended to experience faster cost growth in subsequent years, as illustrated in Figure 5 in the report. This type of “mean reversion” is a common feature of health care spending trends that is likely to recur in the future. If the goal of a per capita cap is to encourage more efficient health care provision, this feature is challenging to justify. The states seeing the largest cuts in federal funding are likely to be those with less opportunity to reduce spending without harming beneficiaries.

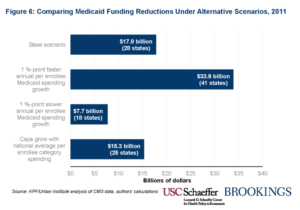

- States would have seen much larger Medicaid funding reductions if spending had grown even moderately faster, and the risk is asymmetric. If Medicaid per enrollee spending had grown just one percentage point faster annually from 2000 through 2011, the reduction in federal funding due to a per capita cap would have been $33.9 billion, nearly double the base scenario’s $17.8 billion, as illustrated in Figure 6 in the report. The reduction in federal funding would have been smaller if spending had grown more slowly, but the magnitude of the risk to states is asymmetric due to the one-sided nature of the cap; since states can never receive more funding than under current law, they bear the full risk of higher spending growth, but capture only part of the benefit of lower spending growth. Notably, medical inflation fails to capture many of the factors that affect overall health care spending trends, most importantly trends in health care utilization. Therefore, a spending cap based on medical inflation, like the AHCA’s, leaves states at risk of facing cuts that are significantly larger than expected if utilization increases due to demographic changes, changes in residents’ health status, public health emergencies, changes in medical practice patterns, or the arrival of new medical technologies.

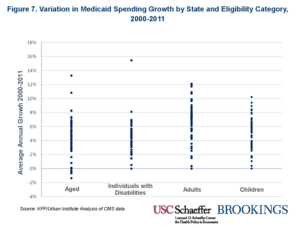

- A per capita cap would have generated large funding reductions even if the target growth rates under the AHCA were set to match national spending trends exactly, because the caps still would not have accounted for state-specific trends. Even if the spending targets for each beneficiary category had exactly matched actual cost growth for that beneficiary category nationwide, a per capita cap would still have generated reductions in federal funding for state Medicaid programs of $15.3 billion in 2011, just 14 percent smaller than the base scenario’s $17.8 billion, as illustrated in Figure 7 in the report. This result occurs because spending growth varied widely across states, so states seeing above average growth would still have experienced significant cuts in this scenario, while because of the “one-sided” nature of the cap, states seeing below average growth would still have been largely unaffected by the cap.

You must be logged in to post a comment.