By 2019, more than 50% of all Medicare physician payments will be delivered through non-fee-for-service payment models as the move to new payment models accelerates with the implementation of the Medicare Payment Reform (MACRA) legislation.

Most of these models position primary care physicians (PCPs) as the “quarterbacks” of the healthcare team- coordinating care to generate better quality at lower cost. With this new team dynamic, there is an implicit deal made: PCPs will create more economic value through better managing cost and quality of services and in return, they, or whoever employs them, will earn additional revenue in the form of shared savings, bonuses, or as profits in capitation. Not surprisingly, PCPs have strongly held that they deserve large portions of the additional value they generate. In primary care-led practices that performed well in early versions of these risk-based payment models, PCPs have been earning substantially more money—often more than specialists have in their markets.

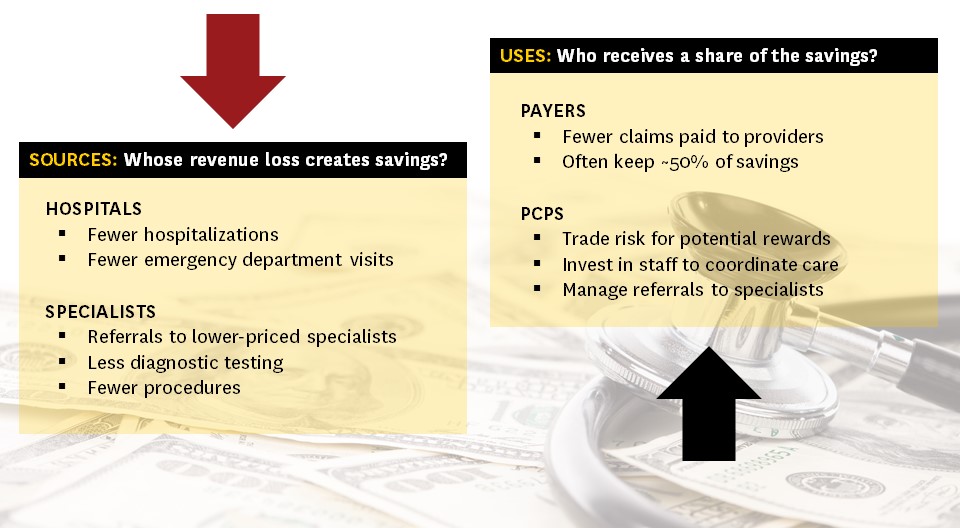

The challenge with increasing pay to PCPs is that money used to pay PCPs is zero-sum: the payer’s “shared savings” are at the loss of some providers’ revenues. In this case, providers include hospitals, labs and specialists and their respective losses are the result of fewer hospital stays, labs and images, and procedures.

In a perspective article published July 14, 2016 in the New England Journal of Medicine we discuss the magnitude of losses that this income redistribution is going to place on hospitals, hospital-centric health systems employing lots of specialists, and private practice specialists. We illustrate that small, and plausible, changes in referrals or commercial insurance prices will have a large impact on specialist’s incomes. For example, a 10% reduction in Medicare patient imaging demand equates to a $35,000 reduction in a radiologist’s income, and a 5% commercial insurance price reduction for interventional cardiology equates to a $25,000 reduction in a cardiologist’s income.

Hospitals and health systems will have a hard time responding to both the demands of their PCPs and specialists. PCPs will be tempted to flee to PCP-led groups offering to pay them much more than they can earn in specialist- or hospital-centered groups. Specialists will want to be rewarded for avoiding RVUs (relative value units associated with care they deliver) that erode savings and in some cases will have income guarantees negotiated in the fee-for-service era. Even where specialists do not have income guarantees, the prospect of lowering wages seldom goes smoothly. Some health systems may be able to “right size” their specialist workforce to preserve incomes, but reducing specialists is—to the say the least—very hard to do.

Regardless, if hospitals and health systems do not tackle these thorny specialist income challenges, they are likely to lose their PCPs or lose unsustainable amounts of money by paying PCPs more and specialists the same when their payers are keeping up to 50% of the lost revenue as their “share” of the savings.

Our perspective discusses both offensive and defensive strategies that specialists could take to reduce the risk that they lose their jobs, lose their referrals, or lose their incomes. In all cases, the first step for specialists is to objectively understand where they perform today in terms of cost, quality, total cost over the course of a year, for specific patient populations (Medicare, commercial, Medicaid) and for specific diseases or procedures. With this insight, they can figure out how to achieve competitive differentiation. For some, it will mean having a reliably low cost (e.g., for routine procedures or imaging). For others it will be by delivering objectively higher quality, at higher prices, when quality matters (e.g., for complex surgeries or medical conditions). Quality may also mean coordinating a patient’s care across a full episode, or helping to avoid hospital readmissions or long stays in skilled nursing facilities. Finally, others may differentiate around their institutional brand and ability to drive self-referrals (e.g., Hospital for Special Surgery).

Regardless, specialists who do not act now to position themselves for an era of PCPs wielding more power and economic muscle could be caught flat footed with falling incomes and re-wired referral systems.

For PCPs, they should rejoice in the reality they can finally be paid like the quarterbacks they have dreamt of becoming. That said, it is not a foregone conclusion that they will be paid like a quarterback, unless they fully redesign their practice to manage cost, quality, and a patient-level reliably. They will also have to embrace team-based approaches, data analytics, and expanded patient access (both seeing patients in person as needed without regard for the schedule and by email, text, video as often as necessary to keep them out of the hospital). The potential for higher incomes comes with greater accountability for performance. If they fall short on any of these fronts their incomes could fall, even relative to today, as losses from poorly managed risk comes out of their pockets.

Both specialists and PCPs face immediate challenges as the new models for delivering and paying for care continue to change the health care landscape. The transition is going to be painful for many. We think that many hospital-led health systems will unravel over these physician income tensions just as they did in the 1990s.

But we are optimistic that these new risk-based payment models are better approaches for delivering value than the current fee-for-service system. We think that tighter relationships aligned around cost and quality between PCPs and specialists will lead to genuine teamwork based on mutual interest in care coordination, data sharing, and ultimately patients engaged in achieving their best possible clinical outcomes.

You must be logged in to post a comment.