The great recession, which hit the world at the end of 2007 affected workers and families in the U.S. in very different ways. Workers with low socioeconomic status (SES) – those with fewer skills and education, as well as racial and ethnic minorities – were especially hurt by the downturn. Foreclosures were concentrated among minorities, and households with lower incomes.

While the COVID-19 pandemic and the impending recession feel unprecedented, one pattern is eerily familiar. Low-SES workers and households are most likely to be hit hardest again. In a survey we conducted in the Understanding America Study between March 10 and March 16, we asked respondents three questions about how the COVID-19 pandemic might affect their work and income. We asked whether their jobs allow them to work from home if required. We also asked how likely they think it is that they will lose their job or run out of money within the next three months.

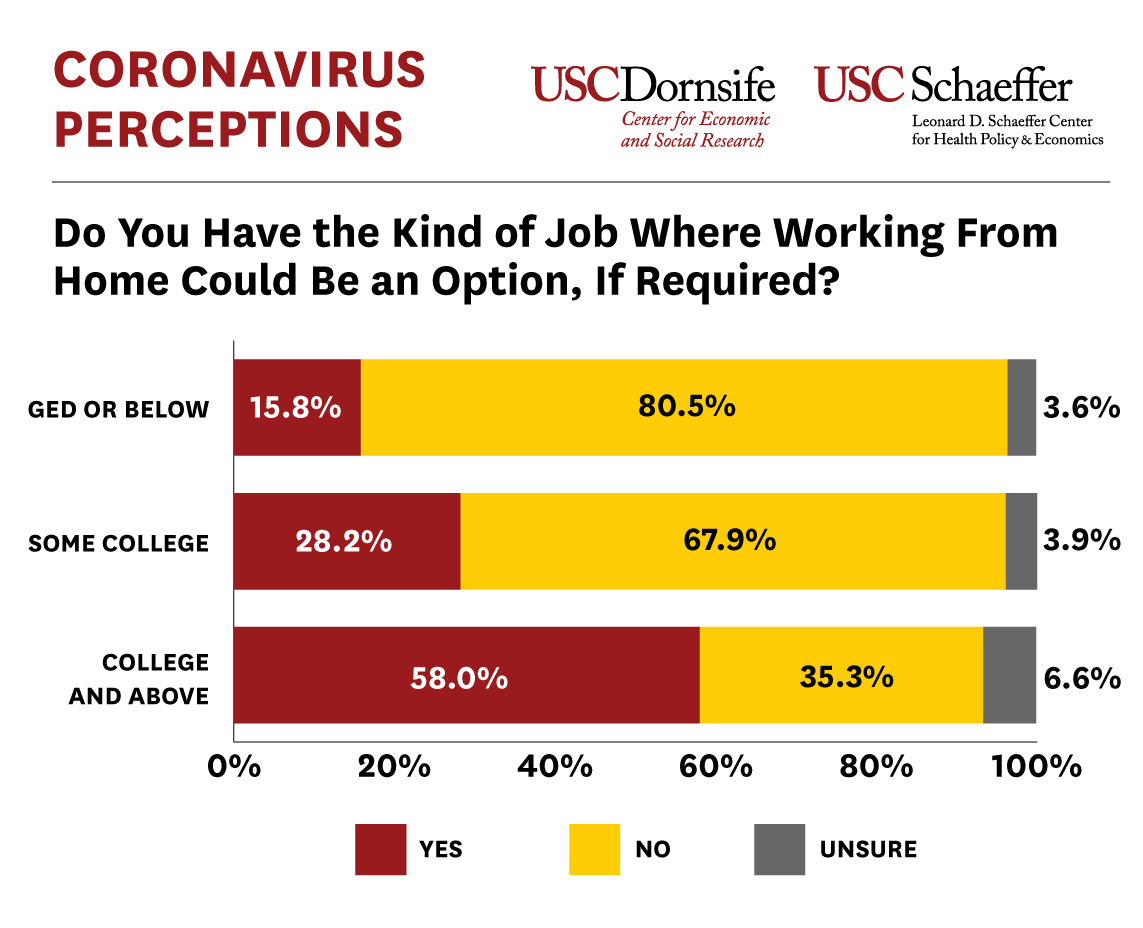

The figure below shows how the ability to work from home varies by education. Fifty-eight percent of people with a college degree say that working from home is an option, while only 16 percent of respondents with a GED or high school education say that working from home is possible. A similar breakdown by income shows that about 55 percent of respondents with household incomes above $75,000 believe they can work from home if needed. For incomes below $50,000 that it drops to below 30 percent. Comparisons by race show that 42.5 percent of whites have the option of working from home, compared to about 31-32 percent of blacks and Hispanics/Latinos.

While white-collar workers can meet remotely through teleconferences, Slack, email and other applications, many blue-collar jobs require face-to-face and physical interactions that cannot be carried out remotely. Retail clerks and people in vocational trades must be physically present to carry out their jobs. This requirement makes them vulnerable to quarantine restrictions that mandate the closure of non-essential businesses and otherwise limit in-person economic activity.

When asked for the percent chance they we will lose their job as a consequence of the coronavirus epidemic, patterns are very similar. Compared to those with a college degree, workers with a high school education perceive nearly-double the chance they could lose their job in the next three months (13.5% versus 8%). Similarly, workers with household incomes below $25,000 perceived a risk of unemployment that was nearly three times higher than workers with household incomes greater than $75,000 (18.7% versus 6.5%). Whites report an average probability of job loss equal to about 8 percent, while Hispanics/Latinos believe their probability of job loss is more than twice as high (18%).

The pattern is similar, but even more pronounced when asked about the probability of running out of money in three months. For example, among low income households that probability is above 20 percent, while for the highest incomes it is only one third as high, about 7 percent. Whites on average report a probability of running out of money in three months equal to about 10 percent, while blacks think that probability is twice as high (19%), and Hispanics/Latinos report a probability that is two and a half times higher; they believe that on average they have a 25 percent chance of running out of money in three months. We will see whether these perceptions are accurate in the coming months. However, they suggest that COVID-19 is translating into substantially greater economic insecurity for low-SES people.

Of course, there is also a big difference between the effect of the Great Recession and the one triggered by the COVID-19 pandemic. The Great Recession was related to economic imbalances in the housing market, and was not directly about the viability of face-to-face jobs. In the current crisis, the need to work face to face exposes low-SES workers to additional infection risks that high-SES workers can avoid. Disparities in access to healthcare may further compound this pattern. The people who are most vulnerable to the economic effects of the pandemic, are also most likely to have their health compromised as a result.

The authors are researchers at the Center for Economic and Social Research at the USC Dornsife College of Letters, Arts, and Sciences; all results cited in this blog are based on survey data posted here.

You must be logged in to post a comment.