A key goal of health insurance is to protect individuals against the risk of large unexpected medical expenditures. This function is particularly important for seniors, as nearly half of lifetime medical expenses are incurred after age 65. Given the potentially devastating financial consequences of a health shock, it is crucial to understand the protection health insurance, in particular Medicare, offers against medical expenditure risk. The relative size of this risk protection might have important policy implications. Several recent proposals (see NYT, WSJ and WT) to address rising Medicare spending and long-term federal budget shortfalls involve increasing the Medicare Eligibility age (MEA), which could significantly increase medical expenditure risk exposure among 65 and 66-year-olds who would be no longer covered by Medicare.

In new research, we investigate the role that Medicare plays on elderly exposure to medical expenditure risk and related financial strain. One empirical challenge to addressing this question is that less healthy people (with higher medical expenditures) tend to be more likely to take up health insurance, therefore a simple correlation between insurance (through Medicare or other sources) and medical expenditures will tend to under-estimate the risk protection role of health insurance. We overcome this challenge by exploiting the age-based eligibility for Medicare. Because Medicare provides nearly universal health insurance coverage for those ages 65 and over, it creates a discontinuity in insurance coverage, allowing us to understand its effects by comparing medical expenditure risk and financial stress for those who are just about to turn 65 to those who just recently turned 65.

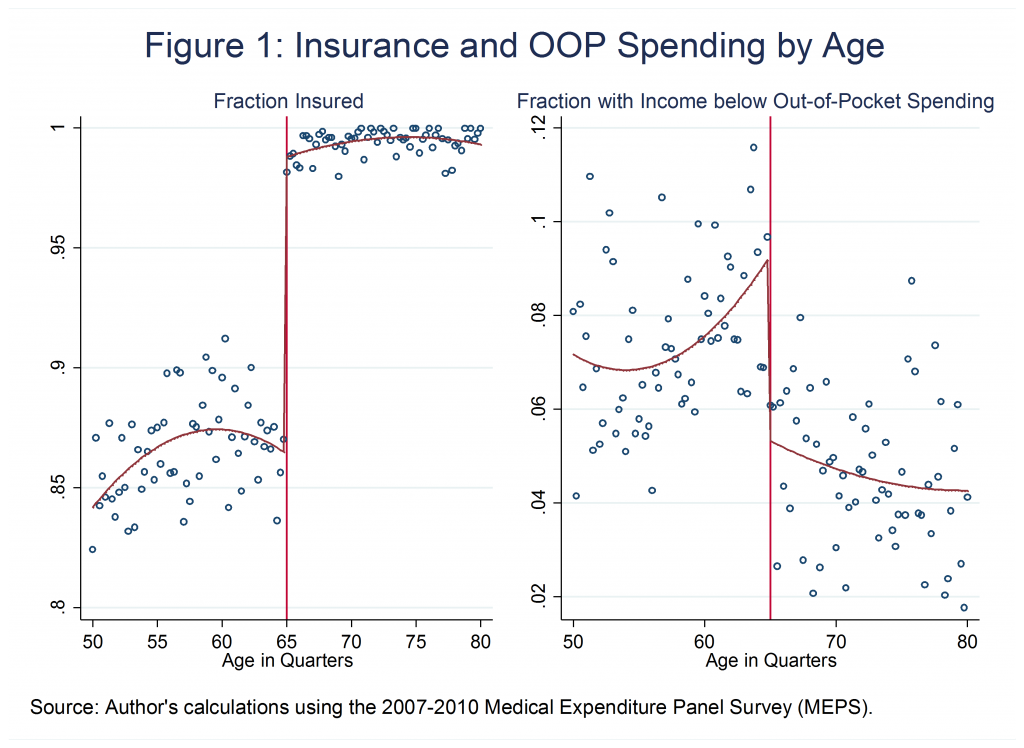

Figure 1 shows the effects of Medicare on insurance coverage and exposure to out of pocket medical spending. The left panel illustrates how insurance coverage “jumps” at age 65 to virtually universal coverage. Medicare extends health insurance to approximately 14 percent of elderly who were uncovered before turning 65 and increases insurance generosity for a number of those who had insurance pre-65. As a consequence, it also affects their financial lives. The right panel shows that the fraction of elderly with out-of-pocket medical costs that exceed income drops by almost half at age 65, from approximately 9 to 5 percent.

Our work also shows that Medicare has its largest effect on high health spenders: while it decreases median out-of-pocket medical spending by 15 percent, its effects on the top 5 percent of spenders is closer to 50 percent. Medicare also substantially reduces subjective measures of financial stress such as reporting having medical bill problems, being contacted by collection agencies due to medical bills, and having to borrow and to use savings to pay for medical bills. All these reports drop by approximately one third as individuals turn 65. Moreover, the value of Medicare’s risk protection for the elderly has increased over time, being larger for recent years (2007-2010) than the 1996-2006 time period.

Besides varying by time period, the effects of Medicare differ across sub populations. The reductions in out-of-pocket spending are restricted to those with at least a high school education, probably because the big medical spenders before age 64 are likely to be more educated. In contrast, the drops in financial stress indicators such as medical bill problems and collection activity are largest for high school dropouts, who usually have less of a financial buffer to deal with unexpected medical spending.

A welfare analysis using an expected utility framework shows that the out-of-pocket expenditure risk protection afforded by Medicare translates into a welfare gain that covers 18 percent of the program’s social costs. This calculation does not include the stress benefits of reduced financial strain or any direct health benefits associated with transitioning to Medicare at age 65. Previous research suggests that these benefits can be substantial.

What policy lessons do these findings hold? Increasing the Medicare eligibility age (MEA) would result in a substantial decline in insurance coverage and increase in out-of-pocket expenditures and medical-related financial stress. Those in the right tail of the expenditure distribution would see an increase of several thousand dollars per year in out-of-pocket medical expenses and a consequent substantial financial loss. Accounting for the persistence in health status, those faced with a negative health shock might have high costs for multiple years, increasing the policy’s financial consequences.

While the Affordable Care Act (ACA) should attenuate the expenditure risk consequences of increasing the MEA, its success will be limited by the decision of many states, including large states such as Texas, Florida, and Louisiana, to opt out of the Medicaid expansion. Even though recent enrollment reports have shown a decrease in the number of uninsured by 5 to 9 million people due to the ACA (through Medicaid expansions and the introduction of health insurance exchanges), the proportion of US adults lacking insurance was still high at 13.4 percent in May 2014. In Texas, Florida, and Louisiana over 15 percent of the population remains uninsured. How the ACA will affect the financial consequences of increasing the MEA depends not only on how effective it is in reducing uninsurance but also on the relative generosity of the coverage newly gained. If those ages 65 and 66-years-old who are not eligible for insurance via Medicaid are unable to afford private options or can only afford plans that are substantially less generous than Medicare, increasing the MEA would increase their exposure to the risk of high medical costs.

This post is based on the paper, ‘The Effects of Medicare on Medical Expenditure Risk and Financial Strain’, in the American Economic Journal: Economic Policy 2015. The post also appeared in the LSE American Politics and Policy blog.

You must be logged in to post a comment.