The decisions of when to claim Social Security retirement benefits can be difficult and confusing. Many factors play a role, including an individual’s employment status, health, financial wellbeing, preferences, and family situation. In addition, there are several Social Security rules that affect the timing and amount of retirement benefit claims received.

On such rule is the retirement earnings test (RET). The RET applies to adults between age 62 and full retirement age (FRA) (between ages 65 and 67 depending on a person’s year of birth), who are entitled to receive Social Security retirement benefits. The rule specifies that Social Security withholds a portion of the benefit if an individual has other earnings exceeding a certain level. For example, in 2018 any earnings in excess of $17,040 were subject to withholdings. Social Security withholds $1 in benefits for every $2 of earnings in excess of the exempt amount. If earnings are above $45,360, Social Security withholds $1 in benefits for every $3 of earnings in excess of the higher exempt amount. Once a person reaches FRA, their benefits are increased to offset the withholdings.

The majority of Americans claim their retirement between the ages of 62 and FRA. However, whether the RET affects behavior is more difficult to ascertain. Existing research has shown that at least some individuals are induced to drop out of the labor market due to the RET. And in recent years, researchers and policymakers have been interested in whether and how older adults understand the rules of the RET, which may affect retirement decisions.

There is evidence that there is widespread confusion about the impact of work earnings on Social Security retirement benefits prior to FRA. In particular, people often do not know that these withholdings are not ‘lost’ to Social Security beneficiaries. Once a person reaches FRA, their monthly benefit is increased permanently to account for the months in which benefits were withheld. As a previous study has noted, ‘the mechanics of the Earnings Test are sufficiently obscure to most people that they are likely to have great difficulty deciding what is in their best interest’.[1]

In a recent study, we asked the question: Can better information improve the public’s understanding of the RET? To answer it, we conducted an online experiment that tested the effect of simple, concise information treatments on respondents’ knowledge on the rules of the RET.

We tested three distinct information treatments on a representative sample of adults through the Understanding America Study online panel (https://uasdata.usc.edu/index.php). The three treatments were

- a short, simple description of the RET,

- a treatment with detailed information and a narrative illustration of the effects of RET on benefits, and

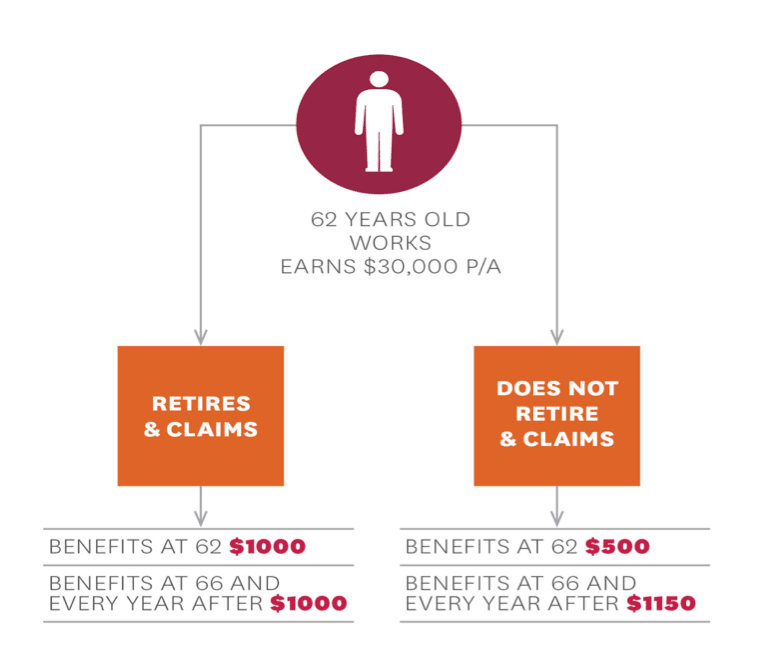

- a treatment with detailed information and a visual illustration of the effects of RET on benefits).

Once presented with the information, participants were asked a series of questions to assess their knowledge.

Treatment 3: Visual Illustration of Effects of RET on Benefits

We find that straightforward, simple information has a substantial effect on knowledge and on prospective choices regarding working and claiming benefits. Specifically, individuals given treatment 1 (the short, simple description of the RET) reduced miscomprehension by about one-third. We find that no further improvement is achieved from the additional content provided in other treatments. Our results therefore suggest that more detailed information – such as we provided in treatments 2 and 3 – does not improve knowledge; the simplest intervention yielded the same effect as the more comprehensive ones.

Our results are optimistic about the potential for education campaigns to improve people’s understanding of the RET; they show that even a very simple information campaign can reduce misunderstandings by between 30% and 50%. Still, these results are suggestive of large impacts on knowledge but not necessarily on behavior. Would people who understand the RET make different, more optimal decisions? This is a question for further research. In the meantime, since we confirm it is indeed possible to educate a significant fraction of the general population about RET with relatively accessible, straightforward information, policymakers could use these results to consider deploying simple information interventions.

[1] Brown J, Kapteyn A, Mitchell O and Mattox T (2013) Framing the Social Security Earnings Test. Wharton Pension Research Council Working Paper, 2013–06. (page 4)

You must be logged in to post a comment.