Financial prospectus documents are meant to provide investors with decision-relevant information about an investment product’s key characteristics including objectives, fees, and risk. In practice, however, these disclosures are often complex and many investors do not understand the presented information. Prior research has indicated that financial disclosures often go unread, that consumers are confused by the complex language and terminology used, and that the convoluted nature of the text can allow firms marketing financial products to hide unfavorable information, such as high fees that can reduce portfolio performance.

Increasingly, financial prospectuses are being provided to consumers electronically. In a series of recent experiments, joint with Oded Nov and colleagues at NYU, we examined whether we could leverage an online environment to redesign financial prospectus documents to improve investor comprehension, investment decisions, and performance. In particular, we examine whether applying social annotation (exposing consumers to online comments made by other users) and accordion navigation design (arranging content into a vertically stacked list of clickable headers) to prospectus documents can improve investor outcomes.

Retirement Saving Simulation

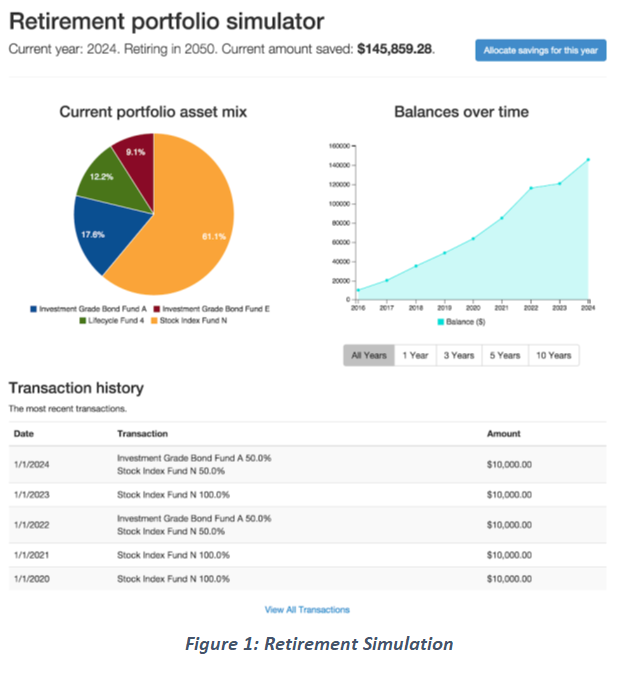

To examine how social annotation and accordion navigation design can influence investment knowledge and performance, we developed and employed a retirement savings simulation designed to mimic the process of saving for retirement (Figure 1). In the simulation, participants are asked to accumulate $1.5M in retirement assets over the course of 35 years (periods) and are incentivized to attain performance as close to that goal as possible. Each period participants are given a hypothetical $10,000, which can be allocated across ten possible investments: three stock funds, three bond funds, three target date funds, and a money market fund. Volatility, attribute ratings, and importantly investment fees vary across funds such that within each investment class one fund clearly has the best characteristics. The money market fund has no fees, zero volatility and return and represents a choice not to invest.

When selecting funds, participants are able to click on a fund’s name to access the investment’s prospectus. Prospectuses used in the simulation are derived from existing investments, though we modified numerical information (e.g. fees) to create better and worse investment choices.

Social Annotation

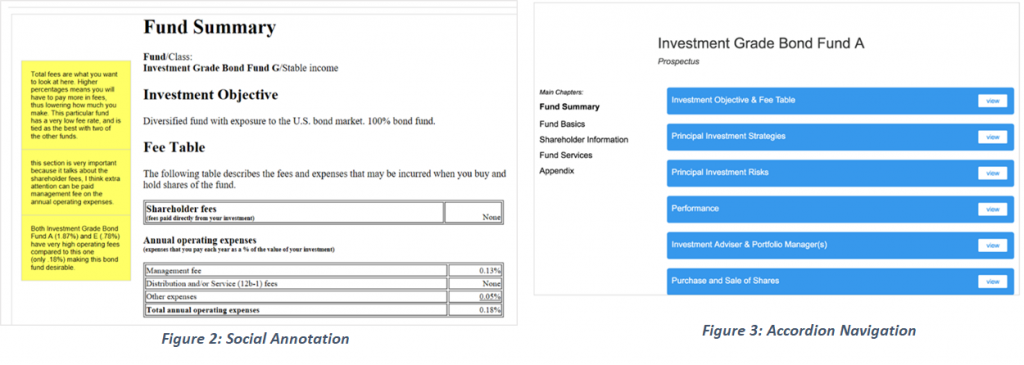

Social annotations are consumer generated comments. This social content can provide important contextual information and is often written in a manner that many individuals find easily accessible. Prior research has suggested that social annotation can improve consumer comprehension and task performance in other complex environments, particularly among novices.

To generate social annotations for our prospectuses, we recruited pre-study participants from Amazon Mechanical Turk (MTurk) and asked these participants to make comparative comments about the available investments. From this procedure, we obtained three to five comments for each section of each prospectus. The vast majority of comments accurately described the investments and we did not edit (or exclude) any of the participant generated comments.

Accordion Navigation

An accordion navigation design arranges information into a vertically stacked list of headers that can be clicked to reveal or hide content. The use of this design allows for a lot of information to exist in a small space. It minimizes the need for participants to scroll through and scan less relevant information—thereby reducing the cognitive load. Prior studies have found that similar designs improved speed and accuracy in finding needed information in health industry settings.

Experiments

To examine the efficacy of social annotation and accordion navigation design in improving investor knowledge and outcomes, we recruited subjects from MTurk to participate in two experiments. Subjects completed a short survey measuring basic demographic characteristics, and importantly, prior investment experience, and subsequently took part in the retirement savings simulation. In the simulation, participants were randomized into a treatment condition (social annotation or accordion navigation design) or a control condition. Treatment participants in the social annotation experiment viewed prospectuses with the comparative comments generated by pre-study respondents (placed in the margins, Figure 2), while treatment participants in the accordion navigation design experiment viewed prospectus documents in the collapsible format (Figure 3). Control group participants in both experiments viewed prospectus information in the standard format. Importantly, the underlying information contained in the prospectus was identical across conditions.

Across the experiments, we find that the novel treatments improved inexperienced investors’ performance in the simulation. In the social annotation experiment, novices mean gap from goal in treatment was $151,949, significantly lower than the $191,266 mean gap for novices in control (p=0.043). Similarly, in the accordion navigation experiment, novices randomly assigned to treatment had a mean gap from goal of $133,737, significantly lower than the $186,733 gap for novices in control (p=0.005). Improved performance in treatment was driven in part by investing in lower fee funds, particularly in the social annotation experiment. Social annotation had no discernable effect on performance for investors with considerable (intermediate or above) investment experience. Somewhat surprisingly, experienced investors randomly assigned to the accordion navigation design performed worse than their counterparts in control (mean gap from goal of $203,961 vs. $123,894, p<0.001) and invested more in high fee funds. We find little impact of either treatment on perceived (self-reported) understanding of the disclosures.

Our experiments suggest that both social annotation and accordion navigation design can be effective ways to help empower non-experts, who often make uninformed investment decisions. Surprisingly, we also found that novel informational displays may adversely affect experienced investors – experienced investors in the accordion design treatment performed more poorly in the simulation than their counterparts in control. The competing findings might be explained by the usefulness of the new design for novices who don’t have much experience with conventional disclosures, and by experienced investors’ difficulty in reconciling the new design with the traditional presentation of information to which they have become accustomed. Ultimately, more research is needed to examine whether the positive effects for novices transfer to less controlled settings, and whether the negative effects replicate in other samples and contexts.

This research was supported by a grant from the FINRA Investor Education Foundation. All results, interpretations and conclusions expressed are those of the research team alone, and do not necessarily represent the views of the FINRA Investor Education Foundation or any of its affiliated companies.

You must be logged in to post a comment.