Editor’s Note: This analysis is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between Economic Studies at Brookings and the University of Southern California Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national healthcare debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings. This work was supported in part by a grant from the Robert Wood Johnson Foundation.

Congress is likely to consider adding dental, hearing, and vision coverage to Medicare in upcoming reconciliation legislation. While the precise design of these new benefits is still being negotiated, adding this coverage to Medicare is likely to have a substantial fiscal cost. For example, a proposal to add this coverage passed by the House of Representatives in 2019 was estimated to cost $358 billion over ten years. The draft reconciliation recommendations unveiled by the Chairman of the House Ways and Means Committee earlier this week closely resemble the 2019 House bill when fully phased in.

Importantly, expanding dental, hearing, and vision coverage will not be policymakers’ only goal for a reconciliation package. Within the health policy domain, policymakers appear likely to try to extend the recent temporary expansion of the Affordable Care Act’s premium tax credits and to provide coverage for low-income people who live in states that have not adopted the Affordable Care Act’s Medicaid expansion. Policymakers will also likely have objectives outside of healthcare, including continuing the temporary child tax credit expansion enacted earlier this year and expanding access to preschool. Achieving all of these objectives may be challenging given political constraints on the size of the package and on the menu of potential “pay-fors.” For this reason, reducing the cost of adding dental, hearing, and vision coverage to Medicare could increase the likelihood that the new benefits are included in a final package, reduce the risk that their inclusion crowds out other policies, or both.

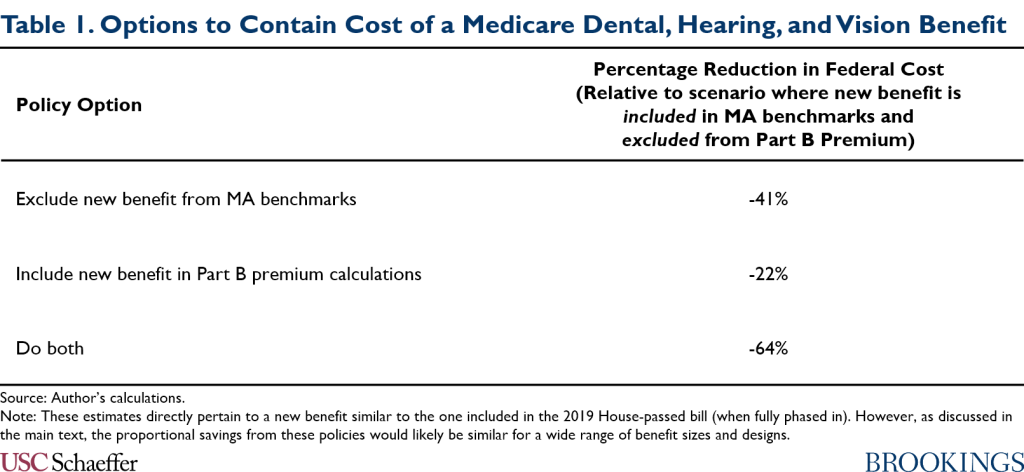

This piece analyzes two ways that policymakers could reduce the cost of adding this new coverage to Medicare without reducing the generosity of that coverage, neither of which was included in either the 2019 House bill or the recent Ways and Means Committee draft. The topline fiscal effects of these two approaches—as well as the effect of combining them—are shown in Table 1.

The first option I consider is excluding what traditional Medicare spends on the new benefits from the “benchmarks” that Medicare uses to determine payment rates for private Medicare Advantage (MA) plans. I estimate that this step would reduce the fiscal cost of introducing a benefit similar to the one in the 2019 House bill by 41%. This is because federal payments to MA plans would rise only modestly if the benchmarks excluded the new benefits, whereas they would rise substantially if the benchmarks included them. The effect on federal costs is so large because of the large and growing share of Medicare enrollment accounted for by MA. I estimate that this step would also modestly reduce the Medicare Part B premium relative to what it would be if these costs were included in the benchmarks.

The smaller increase in MA payments when the new benefits are excluded from the benchmarks would not prevent MA enrollees from receiving those benefits, which MA plans would be required to provide regardless. Rather, I estimate that MA plans would accept lower profit margins (or reduce their costs) if benchmarks excluded the new benefits, whereas those margins (or costs) would rise modestly if benchmarks included the new benefits. This is consistent with research finding that lower benchmarks cause MA plans to price more aggressively, a consequence of the imperfectly competitive nature of MA markets. Notably, MA plans currently earn healthy profits, which averaged 4.5% of revenue in 2019.

Additionally, I estimate that MA plan spending on supplemental benefits other than dental, hearing, and vision coverage would change little relative to the status quo if benchmarks excluded the new benefits. This is possible in part because MA plans would accept lower margins (or lower their costs) relative to the status quo, as noted above, and in part because MA plans could reallocate dollars they currently spend on dental, hearing, and vision coverage to other types of supplemental benefits. By contrast, spending on these other supplemental benefits would rise if spending on the new dental, hearing, and vision coverage was included in the benchmarks, primarily because MA plans would reallocate dollars they currently spend on dental, hearing, and vision coverage to other supplemental benefits.

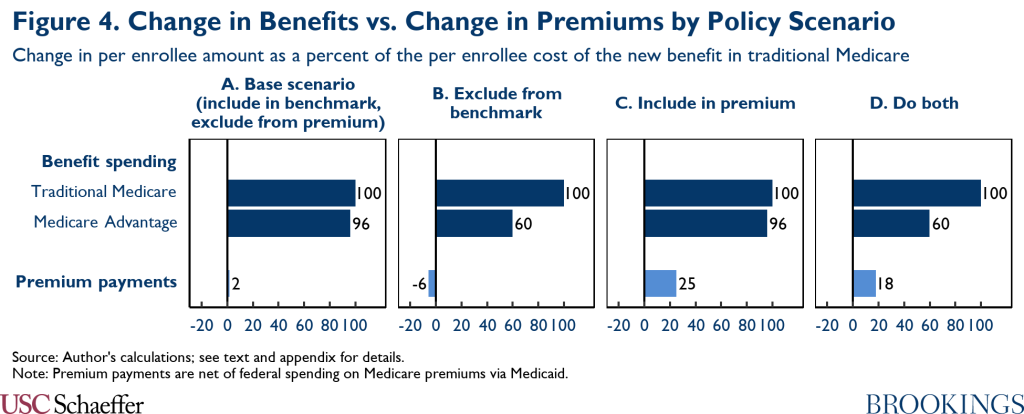

The second option I consider is to include the new benefits in the calculation of the Medicare Part B premium, just like other Part B benefits. Most beneficiaries pay premiums that cover 25% of the cost of Part B benefits, although low-income beneficiaries with limited assets are eligible to have their premiums paid by Medicaid and some higher-income beneficiaries pay higher premiums. Correspondingly, I estimate that applying the usual Part B premium rules to the new benefit would reduce the fiscal cost of creating the new benefit by 22%. Taking this step together with excluding the new benefit from MA benchmarks would reduce the fiscal cost of the new benefit by 64%. Notably, across all policy scenarios I consider, the increase in benefit spending on behalf of enrollees would greatly exceed the increase in premium payments—both in traditional Medicare and MA. This strongly suggests that the new coverage would make Medicare beneficiaries better off even if the usual Part B premium rules apply.

The remainder of this piece examines these two policy options in greater detail.

Excluding spending on the new benefit from MA benchmarks

I begin by analyzing how adding these new benefits to Medicare would affect payments to MA plans, plans’ spending on various types of benefits, and overall federal costs—and how those effects would depend on whether the cost of the new benefits was included in the MA benchmarks. The estimates I present in this section are derived from a model that is fully described in the appendix. Importantly, the model allows me to account for how the bids MA plans submit would change under different policies, which plays an important role in determining the effects of the policies examined here.

Background on payments to MA plans

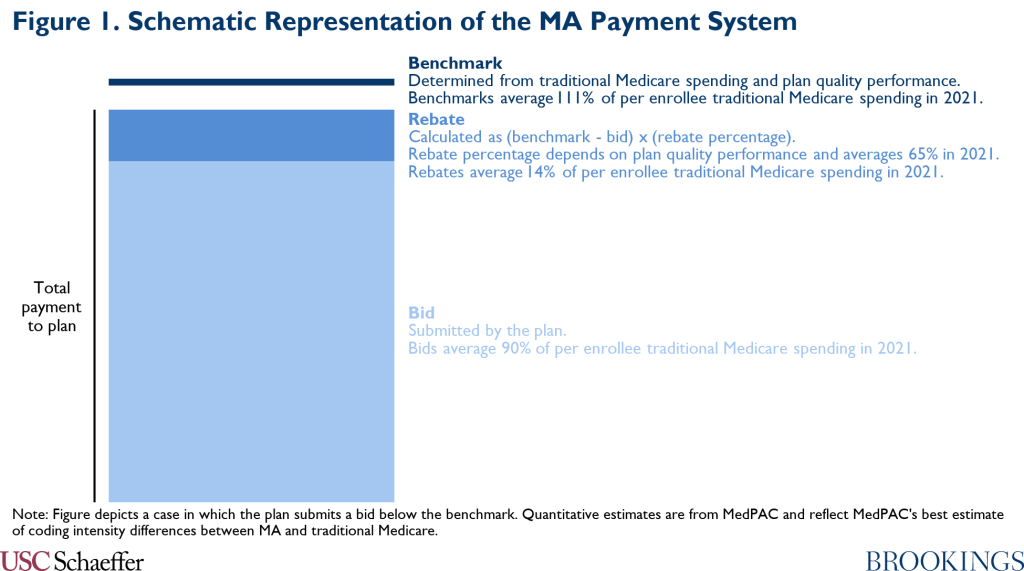

Before proceeding, I provide a brief overview of the current MA payment system. Under this system, each plan submits a bid that reflects the price at which it is willing to cover the basic package of Medicare Part A and B benefits. The plan’s bid is then compared to payment benchmarks that are set as a multiple of per beneficiary spending under traditional Medicare; the precise multiple varies by region and depends on the plan’s performance on certain quality measures. For a plan that submits a bid below the benchmark (which almost all plans do), the government pays the plan its bid plus a rebate equal to a percentage of the difference between its bid and the benchmark.[1] The rebate percentage varies based on plan quality measure performance. Plans must spend the rebate on providing supplemental benefits to enrollees.

Figure 1 illustrates this system for 2021. Bids average 90% of per enrollee traditional Medicare spending, while benchmarks average 111% of traditional Medicare spending, according to estimates produced by the Medicare Payment Advisory Commission (MedPAC).[2] In 2021, the average rebate percentage is 65%, so this combination of bids and benchmarks generates rebates averaging 14% of traditional Medicare spending. Total payments to MA plans are thus 104% of traditional Medicare spending.

MedPAC’s analysis of plan bids indicates that MA plans are using most rebate dollars to reduce enrollee cost-sharing and premiums. However, plans are using around one-fifth of rebate dollars to provide other supplemental benefits, notably including dental, hearing, and vision coverage. Indeed, virtually all MA plans offer at least some dental, hearing, and vision coverage in 2021, although that coverage is often less generous than the coverage envisioned in prominent Congressional proposals.

Effects on MA payments, benefit spending, and net revenues under different benchmark approaches

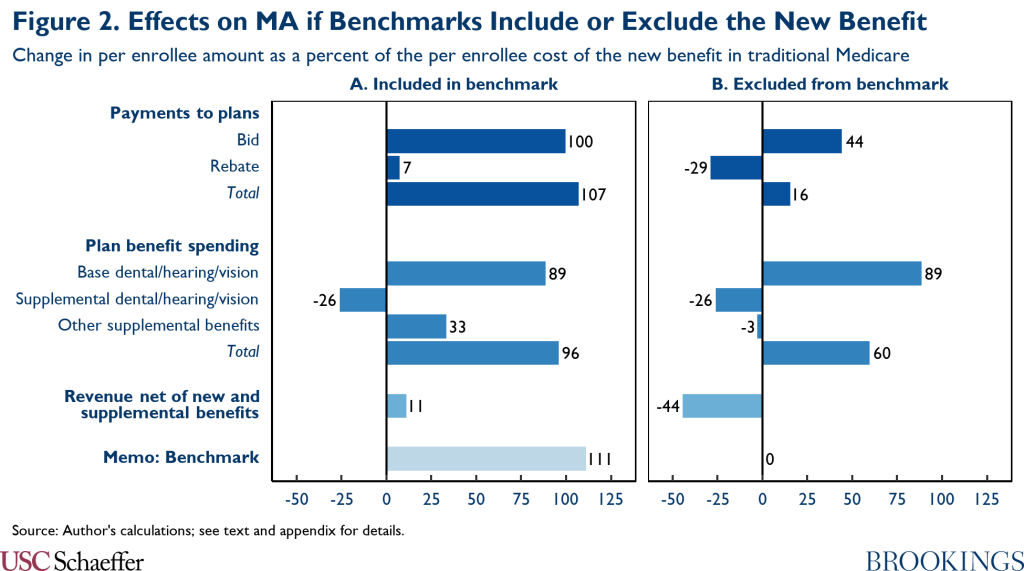

Figure 2 reports estimates of how adding dental, hearing, and vision coverage to Medicare would change what MA plans are paid, how those funds would ultimately be used, and how those effects would depend on whether the cost of the new benefits was incorporated in MA benchmarks. Full details on my methods are in the appendix, but I describe the main factors that shape these estimates below.

I note that the estimates presented in Figure 2 and throughout the rest of the main text are for a dental, hearing, and vision benefit similar in generosity to the one that would be have been created by legislation passed by the House in 2019 (once that legislation was fully phased in).[3] The basic structure of that benefit is similar to the benefit included in draft reconciliation recommendations unveiled by the Chairman of the House Ways and Means Committee earlier this week, at least in the long-run. However, as discussed in detail in the appendix, the effects of a new benefit on MA payments and federal costs would generally scale roughly in proportion (and, in some cases, exactly in proportion) to the generosity of the new benefit. For that reason, I express all of my estimates as a fraction of the per enrollee cost of the new benefit in traditional Medicare so that the estimates can be easily applied to proposals of different sizes.

I first discuss outcomes when traditional Medicare spending on the new benefits is included when calculating MA benchmarks. Outcomes for this scenario are depicted in Panel A of Figure 2:

- Payments to plans: I estimate that average MA plan bids would rise by 100% of traditional Medicare’s cost of providing the new benefit. Part of this increase reflects the fact that dental, hearing, and vision benefit would now be part of the basic Medicare benefit, so MA plans would now reflect the cost of providing those benefits in their bids. I estimate that MA plans’ cost of providing the new benefits would be 89% of traditional Medicare’s cost (reflecting an assumption that MA plans would use a range of tools to reduce utilization of the new benefits relative to traditional Medicare, in line with the reductions they achieve for current outpatient services).

The remaining increase in plan bids arises because benchmarks (which, as noted above, are set as a multiple of traditional Medicare costs that currently averages 111%) would rise by more than MA plans’ costs. There is considerable empirical evidence that higher benchmarks lead MA plans to submit higher bids, likely reflecting market power held by MA plans. Drawing on this evidence base, CBO has previously estimated that a one dollar increase in the benchmark causes a $0.50 increase in plans bids, and my model incorporates the CBO estimate. The increase in benchmarks in excess of the increase in plans’ costs of providing the basic benefit would function essentially like a standalone benchmark increase, driving the additional 11 percentage point increase in bids.

In total, bids would rise somewhat less than the benchmark, so rebates would rise modestly as well. Taking account of changes in both bids and rebates, per enrollee payments to MA plans would rise by 107% of traditional Medicare’s cost of providing the new benefit.

- Benefit spending and net revenues: The higher payments to MA plans would flow to a few different purposes. A portion would finance expanded dental, hearing, and vision coverage for MA enrollees, as MA plans would now spend substantially more on these services under the basic Medicare benefit. However, this additional spending would be partially offset by the fact that plans would no longer spend rebate dollars on providing these benefits.

The size of this offset is uncertain because there is limited data on how much plans are currently spending on these benefits. The appendix reviews the available evidence and concludes that, for a new benefit of the size considered in this analysis, redirecting plans’ current spending on dental, hearing, and vision coverage would produce an offset of around 26% of traditional Medicare’s cost of providing the new benefit; however, in light of the limitations of the available data, this estimate is subject to meaningful uncertainty.[4] This estimate implies that the net increase in MA plans’ per enrollee spending on dental, hearing, and vision coverage would be around 63% of the increase in per enrollee spending on these services in traditional Medicare.

The remainder of the increase in payments to MA plans would flow to purposes unrelated to the underlying goal of expanding dental, hearing, and vision coverage in Medicare. Spending on supplemental benefits other than dental, hearing, and vision coverage would rise by an amount equivalent to 33% of the cost of the new benefit in traditional Medicare. This is because plans could now reallocate rebate dollars currently spent on dental, hearing, and vision coverage and because the overall size of the rebate would rise relative to the status quo.

The rest of the increase in payments—a per enrollee amount equivalent to 11% of traditional Medicare’s cost of the new benefits—would constitute new net revenue to MA plans. Some of this additional revenue might ultimately translate into higher profit margins for MA plans. Some might also be dissipated by higher costs. For example, Duggan, Starc, and Vabson find that higher payments to MA plans are partly offset by higher marketing spending.[5]

I now turn to the scenario in which spending on the new benefits under traditional Medicare is excluded when calculating the MA benchmarks. This scenario is depicted in Panel B of Figure 2:

- Payments to plans: I estimate that MA plans would submit lower bids if spending on the new benefits was excluded from MA benchmarks relative to if that spending was included, consistent with the evidence discussed above on how benchmark changes affect plan bids. Specifically, I estimate that plan bids would now rise by only 44% of traditional Medicare’s cost of providing the new benefit. Additionally, because the benchmarks would not increase in this policy scenario, the increase in plan bids relative to the status quo would translate into a reduction in rebate payments. On net, per enrollee payments to MA plans would now rise only modestly, by an estimated 16% of traditional Medicare’s cost of providing the new benefit.

- Benefit spending and net revenues: This smaller increase in plan payments in this scenario relative to scenario in which the new benefits were included in the MA benchmarks would not affect MA plan spending on dental, hearing, and vision benefits because MA plans would remain required to cover all benefits included in the basic Medicare benefit—including the new dental, hearing, and vision benefits—regardless of where the benchmark was set. Rather, MA plans’ net revenue would now fall, by an estimated 44% of traditional Medicare’s cost of providing the new benefit. Additionally, the reduction in rebate payments relative to the status quo would mean that plans’ spending on supplemental benefits other than dental, hearing, and vision coverage would now fall slightly because the decline in rebate payments would slightly exceed the amount plans are currently spending on supplemental dental, hearing, and vision coverage.[6]

Effects on federal spending under different benchmark approaches

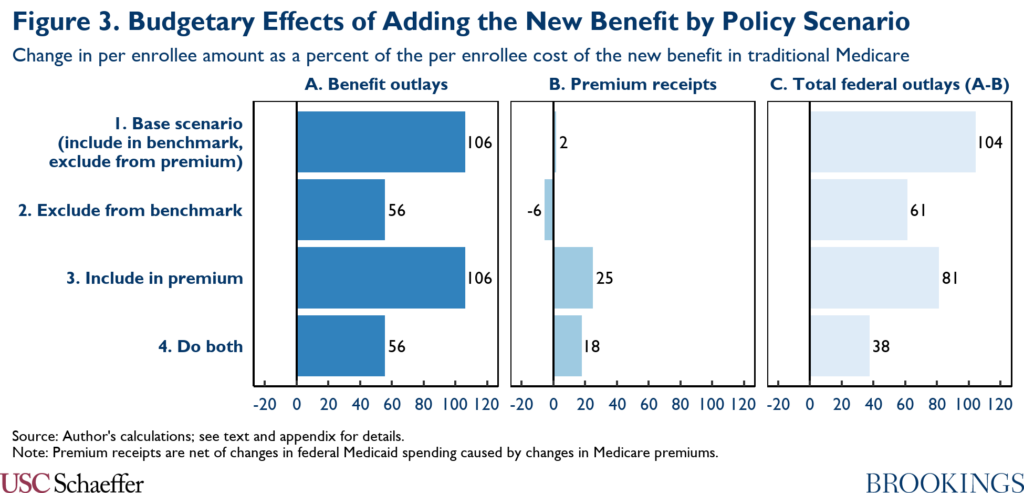

Figure 3 presents estimates of how the treatment of spending on the new benefits in MA benchmarks would affect the overall fiscal cost of adding those benefits. I focus first on Panel C of Figure 3, which reports estimates of how total federal outlays would change in various policy scenarios. Taken together, the estimates in Row 1 and Row 2 indicate that the overall federal cost of adding the new benefits to Medicare would be 41% lower in a scenario in which spending on the new benefits was excluded from MA benchmarks relative to if spending on the new benefits was included in the benchmarks.

This large effect reflects the large and growing share of overall Medicare enrollment now accounted for by MA plans. Under CBO’s most recent baseline projections, which I use to calibrate my model, private health plans will account for 55% of all Medicare enrollment (among people who hold both Part A and Part B coverage, the relevant population for these purposes) on average over the 2022-2031 period.[7]

Panel B of Figure 3 illustrates that decisions about whether to include the new benefits in MA benchmark calculations would also affect the Medicare Part B premium. This is the case even in policy scenarios like those depicted in Row 1 and Row 2 of Figure 3 where the costs of providing the new benefit are notionally excluded from Part B premium calculations.

This is because only the amounts that traditional Medicare or MA plans directly spend on the new benefits are likely to be excluded from premium calculations in practice. As the results in Figure 2 demonstrate, the change in MA plan payments caused by adding the new benefits would generally differ from the amounts that MA plans actually spend on the new benefits. In the scenario where the costs of the new benefits are included in the benchmarks, payments to MA plans would rise by more than plans’ costs of providing the new benefits, so the Part B premium would rise slightly. On the other hand, in the scenario where the cost of the new benefits is excluded from the MA benchmarks, payments to MA plans would rise by less than MA plans’ cost of providing the new benefits, so the Part B premium would fall.

A note on related policy approaches

Before proceeding, I note that the effect of excluding the new benefits from MA benchmarks would be essentially identical to the effect of adopting other policies that reduced benchmarks by similar amounts. A range of other policies for reducing MA benchmarks are commonly discussed. For example, MedPAC has proposed increasing the coding intensity adjustment (which is intended to offset MA plans’ efforts to secure larger payments by coding diagnoses more aggressively for risk adjustment purposes) or simply setting MA benchmarks as lower multiples of traditional Medicare spending than under current law.

These alternative policy approaches would have the advantage that they would avoid adding an ad hoc exclusion into the benchmark methodology. On the other hand, adopting unrelated MA payment policy changes could be more politically challenging than just excluding spending on a new benefit from the benchmark, which offers a reason that policymakers might prefer the approach considered here.

I also note that this analysis considers an approach under which spending on the new benefits would be fully excluded from the MA benchmarks. Policymakers could, of course, opt to exclude only part of the cost of the new benefits from the MA benchmarks. Outcomes under that approach would generally fall in between the two policy scenarios that I consider in this analysis, with the precise results depending on what share of the cost of the new benefits was excluded from the benchmarks.

Apply the usual Part B premium rules

Another way policymakers could contain the cost of adding dental, hearing, and vision coverage to Medicare would be to apply the usual Medicare Part B premium rules to the new benefit. The proposal passed by the House in 2019 would have excluded the new benefit from Part B premium calculations, as do the draft reconciliation recommendations released by the House Ways and Means Committee.

The base Part B premium is set to cover 25% of the cost of Part B benefits. Beneficiaries with incomes above a threshold ($176,000 for a married couple in 2021) pay higher “income-related” premiums, while beneficiaries with incomes below a threshold ($23,760 for a married couple in 2021) and limited assets are eligible to have their Part B premiums paid by Medicaid (although not all people eligible for premium assistance through Medicaid actually sign up to receive it). Taking account of both the income-related premiums contributed by higher-income Medicare beneficiaries and the premiums that the federal government pays itself via Medicaid, I estimate in the appendix that the federal government recovers almost exactly 25% of the cost of additional Part B benefit costs via premiums.

Applying these premiums to a new dental, hearing, and vision benefit could, therefore, substantially reduce the cost of such a benefit to the federal government, as shown in Panel C of Figure 3. Comparing the estimates in Row 1 and Row 3 indicates that simply applying premiums to the new benefits would reduce the overall fiscal cost of the new benefits by 22%.[8] Policymakers could also choose to both apply premiums and exclude the cost of the new benefits from MA benchmarks. Comparing Rows 1 and 4 indicates that this combination would reduce the federal cost of the new benefits by 64%.

Figure 4 places the estimated changes in premium payments in the context of the estimated changes in benefit spending on beneficiaries’ behalf. Notably, across all of the policy scenarios considered in this analysis—including scenarios where the cost of the new benefits is excluded from MA benchmarks—the increase in benefit spending would substantially exceed the increase in premium payments. One implication is that, unless Medicare beneficiaries valued the new benefits at far less than the cost of providing them, adding these new benefits to Medicare would leave Medicare beneficiaries better off even if they paid for a portion of the cost of the new coverage through higher premiums.

Conclusion

I close with some thoughts on how policymakers should decide whether to adopt the options considered in this piece. The first—and perhaps most important—question is what these policies are trading off against. Because the overall size of the reconciliation legislation is likely to be constrained, spending more on dental, hearing, and vision coverage means spending less in some other part of that legislation (unless it results in the new coverage itself being excluded from the package). The higher the value of the policies that get crowded out, the more attractive the policy options considered here should be.

The second question is how policymakers should weigh the potential downsides of the policy options considered here. With respect to excluding the new benefits from the MA benchmarks, there are two main downsides to consider. First, MA plans’ profit margins would be lower if the benefits are excluded from the benchmarks, whether measured relative to the status quo or relative to if those benefits were included in the benchmarks (provided that MA plans do not reduce their costs). Unless policymakers value MA plan profits per se, the main downside of lower MA profit margins is that fewer insurers might participate in MA. However, MedPAC estimates that MA plans’ margins averaged a healthy 4.5% in 2019 and that MA plan participation is currently very robust (and becoming more so). This suggests that a major exodus from the MA program—or, at a minimum, a damaging exodus—is unlikely. Of course, MA plans are likely to oppose policies that reduce their profits regardless, which could pose political challenges.

Second, MA coverage would include fewer supplemental benefits other than dental, hearing, and vision coverage if the cost of the new benefits were excluded from the benchmarks than if the new benefits were included. Importantly, however, the decline relative to the status quo would be very slight, as this would largely just unwind an expansion in supplemental benefits that would occur if the cost of the new dental, hearing, and vision coverage was included in the benchmarks. As a substantive matter, this suggests that the forgone supplemental benefits would be less valuable to enrollees on a dollar-for-dollar basis than existing supplemental benefits (since plans would otherwise offer the forgone benefits instead of what they offer today). As a political matter, the fact that MA enrollees would not lose much in supplemental benefits relative to the status quo (and, indeed, would gain more robust dental, hearing, and vision coverage in the base benefit) likely mitigates the risk of adverse beneficiary reactions.

With respect to including the new benefits in Part B premium calculations, the main downside is obvious: Medicare beneficiaries (except low-income beneficiaries whose premiums are paid by Medicaid) would pay somewhat higher premiums. However, two factors would likely attenuate any political sting of these premiums. First, as I discuss in the main text, Medicare beneficiaries would still be made substantially better off by the addition of dental, vision, and hearing coverage even if asked to contribute to the new coverage via premiums. Second, particularly if a new benefit is phased in gradually over time, additional premiums attributable to the new benefit might not be particularly salient to beneficiaries.

Footnotes

[1] The small number of plans that submit bids above the benchmark are paid the benchmark and collect a supplemental premium from enrollees equal to the difference between the bid and the benchmark.

[2] These estimates adjust for differences in health status between MA and traditional Medicare enrollees to the extent that those differences are captured by the MA risk adjustment system (after applying MedPAC’s best estimate of coding intensity differences between MA and traditional Medicare). Thus, they are expressed as a percentage of the cost that MA enrollees specifically would incur if enrolled in traditional Medicare. However, some evidence suggests that the MA risk adjustment system does not fully offset health status differences between MA and traditional Medicare, even with a larger coding intensity adjustment, in which case MA payments and benchmarks would be higher in relation to traditional Medicare costs than they are in the MedPAC estimates.

[3] Specifically, they reflect a scenario in which the new benefit increases per enrollee spending in traditional Medicare by 6%. The Congressional Budget Office estimated that the 2019 House bill would have increased overall Part A and Part B benefit spending in fiscal year 2029 by 6.4% relative to the agency’s May 2019 baseline projections. The estimates presented in this analysis imply that the House proposal would have increased per enrollee spending in MA by somewhat more than it increased per enrollee spending in traditional Medicare, so this estimate is consistent with an increase in per enrollee spending in traditional Medicare of around 6%.

[4] Unlike almost all of the other estimates presented in this analysis, this estimate would not scale in proportion to the size of the new dental, hearing, and vision benefit. The offset would generally be larger in the case of a smaller dental, hearing, and vision benefit and smaller in the case of a larger benefit.

[5] In principle, plans might also use some of this additional revenue to make the basic benefit more attractive, like by adopting broader networks or looser utilization controls. Duggan, Starc, and Vabson find little evidence, however, that higher payments to MA plans lead to greater healthcare utilization by MA enrollees or higher quality of care, suggesting that any efforts along these lines may have little effect on patients.

[6] A recent Wakely analysis commissioned by AHIP, a health insurance industry trade group, concludes that excluding the new benefits from MA benchmarks would cause a large decline in rebate payments. AHIP has used this analysis to argue that excluding the costs of the new benefit from MA benchmarks would require plans to make large cuts to the supplemental benefits they currently offer, whereas my estimates suggest that plans would need to make at most small cuts to other supplemental benefits under this policy.

My conclusions differ for three main reasons. First, the Wakely analysis examines a policy under which the cost of the new benefits would be excluded from the MA benchmarks and MA plans would be required to finance the new benefits entirely out of rebates, whereas I examine a policy under which MA plans could include the new benefits in their bids. Second, Wakely assumes that benchmark changes would have no effect on plan bids, which runs contrary to the empirical evidence discussed in the main text and likely leads them to overstate the decline in rebate payments. Third, Wakely solely examines changes in total rebate payments, without accounting for the fact that rebate dollars currently devoted to dental, hearing, and vision coverage could now be used to fund other supplemental benefits. By contrast, I focus on the change in rebate payments available to fund benefits other than dental, hearing, and vision coverage; this is the more relevant metric for understanding how various policy changes would affect plans’ ability to continue offering the supplemental benefits they offer today.

[7] I note that a small portion of these private health plans are not MA plans, but rather other types of private plans that are paid differently. However, data from the Centers for Medicare and Medicaid Services indicate that MA plans accounted for more than 97% of all Medicare private plan enrollment as of August 2021.

[8] This percentage is slightly lower than the 25% quoted in the prior paragraph because, as discussed in the section on MA benchmarks, the increase in payments to MA plans would exceed the amount that MA plans spent on the new dental, hearing, and vision benefits (when spending on the new benefits is included in MA benchmark calculations). Correspondingly, the amounts that would be added to the Part B premium calculation would be smaller than the total change in benefit costs due to the new benefit.

You must be logged in to post a comment.