A USC study comparing Medicare Part D prescription drug prices with those paid by Costco members finds that the federal government overpaid on roughly half of the most common generic medicines in 2018.

The findings suggest that policymakers should take a closer look at the practices of intermediaries who effectively negotiate drug prices on behalf of Medicare but don’t necessarily pass on the savings to beneficiaries and taxpayers.

“Our analysis shows that in systems like Costco’s, where incentives are set up to deliver value directly to the consumer at the pharmacy counter, that’s what happens,” said Erin Trish, associate director of the USC Schaeffer Center and an assistant professor of pharmaceutical and health economics at the USC School of Pharmacy. “It’s time to fix those incentives in the Medicare Part D system to put the patient first.”

The analysis appears today as a research letter in JAMA Internal Medicine.

Medicare Part D Overspends

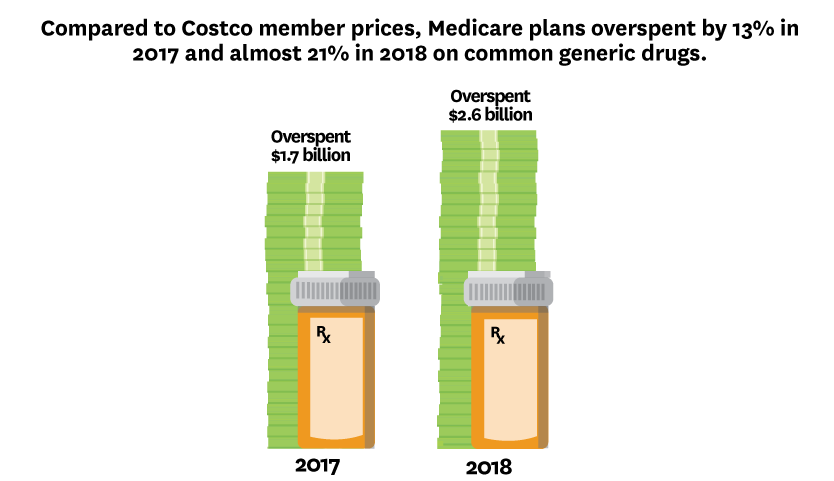

The researchers compared what Medicare Part D plans paid for the most common generic prescriptions, including patient out-of-pocket payments, to the cash prices available to Costco members for the same prescriptions in 2017 and 2018.

Sign up for Schaeffer Center news

Among the findings:

- Across more than 1.4 billion Medicare Part D claims for 184 products, Medicare plans overspent by 13% in 2017 and almost 21% in 2018 compared to Costco member prices.

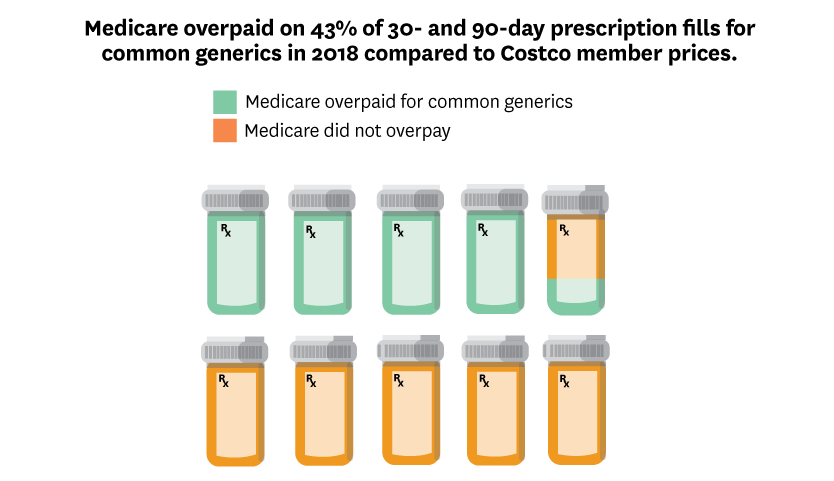

- Medicare plans paid more than Costco members on almost 53% of 90-day fills analyzed in 2018. On all 30- and 90-day prescription fills, Medicare plans overpaid 43% of the time.

“Efforts to reduce prescription drug prices tend to focus on brand-name medicines, but the opaque pharmaceutical supply system can also cause health plans and taxpayers to overpay for generics,” said Geoffrey Joyce, director of health policy at the USC Schaeffer Center and chair of the Department of Pharmaceutical and Health Economics at the USC School of Pharmacy.

Medicare Part D is administered through private plans that negotiate via pharmacy benefit managers, or PBMs, on behalf of the Medicare system. PBMs are large, sophisticated agents that actively negotiate the prices paid for every drug in all of the plans they cover.

The problem, say the authors, is PBMs and other intermediaries in the system do not seem to be passing all of the savings from the negotiated prices to the plans and the patients.

Negotiated Savings Don’t Make it to Beneficiaries

“There is lots of price competition among manufacturers for these drugs but that competition isn’t benefiting the consumer,” said Karen Van Nuys, executive director of the USC Schaeffer Center’s Value of Life Sciences Innovation Program and assistant professor at the USC Price School of Public Policy. “These are not small-market drugs where there might be only one supplier who can name their price.”

Given that generic drugs account for 22% of Part D spending, policymakers working on drug pricing reform should focus on the full distribution system, including intermediaries.

“Intermediaries are especially important because each one adds a layer of complexity that increases the costs borne by patients and payers,” added Van Nuys. “We need to look at whether they are also adding comparable value.”

Costco, a membership-only warehouse that is the fifth largest retailer in the world, has 80 million members in the United States. It has more than 500 locations and offers nationwide shipping.

More than 45 million Americans are enrolled in Medicare Part D, which provides coverage for outpatient prescriptions.

In addition to Trish, Joyce and Van Nuys, other study authors include Rocio Ribero and Laura Gascue. Funding for this study was provided by the USC Schaeffer Center.

You must be logged in to post a comment.