What’s the latest in health policy research? The Essential Scan, produced by the Schaeffer Initiative for Innovation in Health Policy, aims to help keep you informed on the latest research and what it means for policymakers. To receive the Essential Scan in your inbox, sign up here.

$17.8 billion less in federal Medicaid funding in 2011 had a per capita cap taken effect in 2004

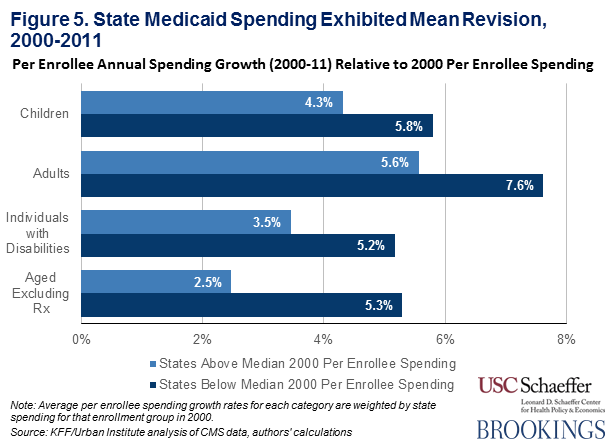

Loren Adler, Matthew Fiedler, and Tim Gronniger estimate that federal funding for Medicaid would have been $17.8 billion lower in 2011 had a per capita cap like the one proposed in the American Health Care Act been implemented in 2004. The per capita cap’s impact would have varied dramatically across states, with one state requiring a 77 percent increase in its funding to have maintained pre-cap funding levels and eight others requiring an increase above 25 percent, while 22 states would not have experienced a cut. Notably, the mechanism is a cap, not an allotment, and thus the risk is one-sided; hence, over half of states would have seen reduced funding but no states would have received additional funding. States with lower pre-cap Medicaid spending were more likely than states with high spending to see reductions under the cap, which challenges the argument that the cap encourages efficiency. Full article here.

Loren Adler, Matthew Fiedler, and Tim Gronniger estimate that federal funding for Medicaid would have been $17.8 billion lower in 2011 had a per capita cap like the one proposed in the American Health Care Act been implemented in 2004. The per capita cap’s impact would have varied dramatically across states, with one state requiring a 77 percent increase in its funding to have maintained pre-cap funding levels and eight others requiring an increase above 25 percent, while 22 states would not have experienced a cut. Notably, the mechanism is a cap, not an allotment, and thus the risk is one-sided; hence, over half of states would have seen reduced funding but no states would have received additional funding. States with lower pre-cap Medicaid spending were more likely than states with high spending to see reductions under the cap, which challenges the argument that the cap encourages efficiency. Full article here.

“This analysis shows how poorly targeted a Medicaid per capita cap would be.”

– Paul Ginsburg, PhD, Director of the Schaeffer Initiative

Medical claims of individual market insurers increased 7.3 percentage points under ACA’s 80/20 rule

Steve Cicala, Ethan M.J. Lieber, and Victoria Marone estimate that individual market insurers with a historically low share of premium dollars spent on medical care had an increase in claims costs 7.3 percentage points higher following the Affordable Care Act’s 80/20 medical loss ratio (MLR) requirement than they would have had otherwise. MLR is a measure of the share of premium dollars that is spent on medical costs. The ACA aimed to control costs by requiring insurers maintain a MLR of 80 percent or more, or else insurers must refund beneficiaries the difference. For this study, the authors considered “treated” insurers as those historically with MLRs below 80 percent, while “untreated” insurers had MLRs that would have been in compliance prior to the requirement, as well as all nonprofits because of their exempt status. The authors find that insurers with below-required MLR adjusted their claims costs to the MLR requirement increasingly over time, with a 4.8 percent increase in the first year of being subject to the MLR, 9.5 percent in the second year, and 11.2 percent in the third year. The authors point out that their study does not determine the source of the increase under MLR, which could include any combination of increase in plan generosity or less effort to reduce provider prices. These findings call into question the efficacy of the ACA’s MLR requirement as a cost-control measure, and highlight the need for further study on the source of increases. Full article here.

Insurers in state-run marketplaces outperformed those in federally facilitated marketplaces, while well-established insurers saw similar individual market financial performance in 2013 and 2014

Mark A. Hall, Michael J. McCue, and Jennifer R. Palazzolo find that 45 percent of individual-market insurers in state-run marketplaces had positive profit margins in 2014, as compared to 28% in in federally facilitated marketplaces. Moreover, 24 insurers in state-run marketplaces turned around from losses in 2013 to profits in 2014, as compared to four in the federally facilitated marketplaces. Among insurers with an established presence and significant enrollment, the median financial performance was roughly the same in 2013 and 2014 with an average loss of 4 percent. These findings provide an early look at insurer performance on the individual marketplaces and the impact a state’s involvement in Affordable Care Act implementation may have on the functionality of the individual markets. Full article here.

32 percent of novel therapeutics saw new safety risk after FDA-approval, 2001-2010

Nicholas S. Downing, Nilay D. Shah, Jenerius A. Aminawung, and co-authors find that 71 of the 222 novel therapeutics approved by the U.S. Food and Drug Administration between 2001 and 2010 were affected by new safety risks discovered after their initial approval. Among the 123 observed new safety risks, three resulted in a withdrawal of the drug, 61 in new risk information included in packaging materials, and 59 in public communication of the new safety risk. These discoveries of post-market risk were more frequent among biologics, psychiatric therapeutics, and accelerated and near-regulatory deadline approval. These findings highlight the importance of continuous post-market monitoring for safety risks of novel therapeutics. Full article here.

Policies limiting pharma marketing to physicians associated with 1.67 percentage point decrease in market share of those drugs

Ian Larkin, Desmond Ang, and Jonathan Steinhart find that enactment of policies limiting pharmaceutical “detailing” at academic medical centers (AMC) were associated with a 1.67 percentage point decrease in the market share of detailed drugs and a 0.84 percentage point increase in the market share of non-detailed drugs. These findings were statistically significant for 6 of 8 major drug classes. Pharmaceutical detailing refers to the communication and marketing, which can include one-on-one communication, meals, and small gifts, by pharmaceutical sales representatives with physicians over the “details” of the drug’s benefits and risks. Adding to the literature associating pharmaceutical detailing and prescribing habits, these findings suggest that pharmaceutical detailing may influence physicians’ prescribing habits and that policies that limit such interaction can lead to reduced detailed drug prescribing rates. Full article here.

Click here to receive The Essential Scan email.

Editor’s Note: The Essential Scan is produced by the Schaeffer Initiative for Innovation in Health Policy, a collaboration between the Center for Health Policy at the Brookings Institution and the USC Schaeffer Center for Health Policy & Economics. To receive the Essential Scan in your inbox, sign up here.

You must be logged in to post a comment.