Editor’s Note: This piece originally appeared on Health Affairs blog. This analysis is part of USC-Brookings Schaeffer Initiative on Health Policy, which is a partnership between Economic Studies at Brookings and the USC Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national health care debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings.

Surprise medical bills occur when patients cannot avoid being treated by providers outside their health plan’s contracted network—either because the provider is not chosen by the patient, for example the emergency department physician or the anesthesiologist assisting a surgery, or because patients are not even aware that the provider is involved in their care, such as a pathologist examining a biopsy.

Contracted, in-network providers have agreed to accept discounted reimbursement rates negotiated with health plans, and health plans typically charge patients lower cost sharing liability for contracted services. In contrast, patients face a triple-whammy when being treated by non-contracted providers: out-of-network providers can bill patients higher – and sometimes much higher – rates; health plans typically pay a smaller share of the charges they allow; and patients remain liable for the difference between plan allowable amounts and the amount being billed. When this happens, and there is increasing evidence that it happens often across all types of plans, patients can suffer from substantial financial harm and distress.

Even when patients are diligent in seeking an in-network hospital or lead physician, their care often involves consulting specialists – such as radiologists, anesthesiologists, pathologists, neonatologists, or assistant surgeons – who are out-of-network and whom the patient has no role in selecting. Legally, patients might be able to challenge such surprise bills in court, but existing law is not clear on what billing is permissible, and patients seldom are able or willing to undertake expensive and stressful litigation in such situations.

In addition to inflicting financial harm on those affected, the existence of these surprise out-of-network bills also undermines competition between health insurance plans, particularly as plans try to limit costs by offering narrower network products.

Surprise Balance Billing is Widespread

Two recent nationwide studies, published in Health Affairs and the New England Journal of Medicine, both found that 20 percent of emergency department visits and resulting admissions at in-network facilities involved an out-of-network physician. The Health Affairs study conducted by researchers at the Federal Trade Commission, corroborated by other recent surveys, also highlights the problem of balance billing beyond only emergency physicians. Specifically, the Health Affairs authors found that 9 percent of elective inpatient care at an in-network facility with an in-network lead physician involved at out-of-network ancillary provider, and thus could have led to a surprise medical bill. Additionally, 51 percent of all ambulance rides in their data (primarily from large employer plans) were out of network.

Survey data tells a similar story. One 2016 survey reported that 21 percent of insured non-elderly adults have, at some point in their lifetime, received care at a hospital they thought was in-network but were billed by a non-covered physician. Another national survey, from 2015, stated that, over the past year, 6 percent of households with insurance had problems paying medical bills stemming from receiving their care from a provider whom they were unaware was not in their plan’s network. (It is possible – but not clear – that better transparency regarding provider networks might have avoided some of these surprise bills.).

Importantly, there is widespread, bipartisan and stakeholder agreement that something needs be done about this problem.

Why We Need a Federal Solution

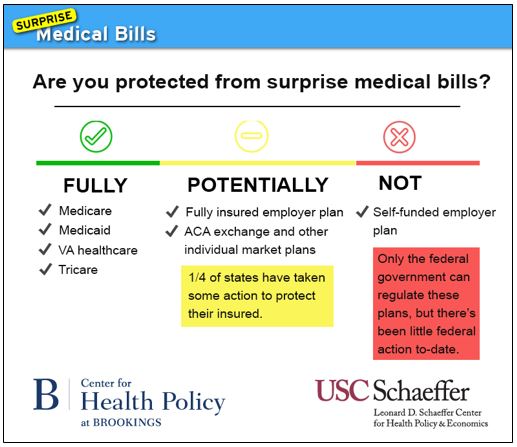

Because states play a large role in the regulation of insurance markets and are knowledgeable of local market dynamics, some have suggested that surprise balance billing should be addressed at the state level. Indeed, the scale of the problem does differ widely among states. So far, more than a dozen states have enacted various protective measures. Notably, these reform leaders are a mix of “red” states (e.g., TX, WV, UT), “blue” states (e.g., CA, NY, IL, CT, MD), and “purple” states (e.g., CO, MN, FL).

However, states cannot protect more than half of commercially-insured consumers due to an arcane federal law, known as the Employee Retirement Income Security Act of 1974 (ERISA), which exempts almost 100 million people in private insurance plans from state regulation because their plans are self-funded by employers. And based on existing evidence, there is no reason to believe that surprise balance billing is substantially less prevalent under self-funded employer plans than under other, commercially insured private plans.

A Commonwealth Fund survey found a similar prevalence of surprise medical bills in ACA marketplace and employer plans, and the recent Health Affairs study largely utilized data from big self-funded employer plans and still found that these surprise bills happen frequently.

As a result, even in the growing number of states that have enacted protections, many millions of people remain vulnerable to surprise bills.

As we argue in our White Paper, this is why federal action is needed to protect all consumers and assure a “level playing field,” particularly as narrow networks grow increasingly common for employer-sponsored as well as individual insurance.

While ERISA prevents states from addressing critical health policy issues comprehensively, there is well-established precedent for federal action that regulates self-funded employer plans. Federal law currently requires all health plans, including self-funded ones, to: 1) cover mental health care on par with physical health care; 2) cover recommended evidence-based preventive care services without any cost-sharing from patients; 3) avoid caps on total coverage amounts; 4) cover patient services provided through approved clinical trials; and 5) contribute to public funding of health services research. Preventing surprise medical billing under self-funded plans would only modestly modify the existing scope of federal requirements yet provide substantial protections that are needed to avoid systematic unfairness.

An additional impetus for federal action in this arena is that a major portion of the surprise billing problem is tied to existing federal requirements relating to emergency services. Federal law known as EMTALA (Emergency Medical Treatment and Active Labor Act) requires hospitals participating in Medicare (which is virtually all of them) to screen and stabilize patients who come to the emergency room. Also, federal law requires health plans to define emergencies as any situation where a “prudent layperson” would reasonably think immediate attention is warranted.

These requirements ensure the availability of emergency services when needed, but leave non-Medicare patients exposed to unfair balance billing after service. Emergency patients are usually treated by physicians whom the hospital does not employ and thus who negotiate independently whether or not to join health plan networks. In such situations, federal law requires that emergency patients be treated, but still allows physicians to bill privately insured emergency patients for whatever amounts health plans do not pay.

Crafting a Federal Solution

For out-of-network billing in any emergency situation, or at in-network facilities (including ambulatory surgery facilities) in which patients lack adequate notice and a meaningful opportunity to approve receiving care from non-contracted providers,[1] patients should be taken out of the equation entirely, and a path to resolution should be created directly between the provider and health plan. The same protection should also apply for common out-patient services, such as laboratory testing, diagnostic imaging, and ambulance transport, where patients frequently lack meaningful choice or adequate notice.

As noted above, at least a dozen states have attempted to implement protections, and although none of these state solutions can address the nearly 100 million consumers that are covered by self-funded employer plans, it is worth considering the strategies pursued for the half of the market that states can regulate.

Some states, such as CO, protect patients from surprise balance billing, but do not take the important subsequent step of limiting how much the insurer must pay to the provider. Therefore, insurers in CO are still liable to pay the provider’s full billed charges, which are usually highly inflated and bear little correlation to normal contracted rates, and in turn translate to higher premiums.

Other states, such as Florida (only for HMO customers), California, and New York, prohibit surprise balance billing and establish a process for determining how much the health plan must pay to the provider. Florida bases this payment rate on the “usual and customary charges” (UCR) for similar services in the geographic location, while CA requires insurers to pay the greater of average contracted rates or 125 percent of Medicare fee-for-service rates. NY takes the distinct tack of mandating the health plan establish a reasonable payment amount and disclose how it relates to the 80th percentile of the amounts made available by FAIR Health (a third-party source of data), but allowing the provider to contest and send the claim to an independent binding arbitration dispute resolution process.

Removing the patient entirely from the dispute and automatically deeming the service in-network for purposes of cost-sharing is essential. Additionally, there seems to be some consensus among states that regulation should address how much the health plan may owe the provider in surprise out-of-network billing situations, setting upper and lower bounds, or at least create a dispute resolution mechanism with similar parameters.

To address the problem of surprise balance bills comprehensively, including for consumers in self-funded employer health plans, we recommend the following federal solution.

Emergency Care:

The Affordable Care Act (ACA) has already taken two of the three key steps toward federal protection for patients who receive emergency care out-of-network. It limits the cost-sharing that health plans may impose on patients to what they would face at in-network facilities and also limits what health plans (including those that are self-funded) must pay the provider for such care to the greatest of: 1) median contracted rates for the service furnished; 2) what the health plan determines are “usual, customary and reasonable” rates, following the health plan’s normal methodology for such determinations; or 3) the amount that would be paid under Medicare.

The ACA, however, fails to limit what emergency-care providers may balance bill patients beyond the amounts that health plans allow. To fully protect patients, federal law should prohibit any balance billing by providers for emergency services, also including ambulance services. In addition, a comprehensive solution should cover the totality of a patient’s treatment after coming to the emergency room, including any care during an ensuing hospital admission (either at the same or a transfer hospital). This requirement could be imposed, similar to EMTALA, as a condition of providers’ participating in Medicare.

Non-Emergency Care:

The full federal solution outlined above for emergency services could also be extended to non-emergency care received from out-of-network providers at in-network facilities (including ambulatory surgery facilities) and for common outpatient services referred by in-network physicians, such as laboratory testing and diagnostic imaging. Doing so would reduce the need to draw sometimes difficult distinctions based on degrees of medical urgency. A comprehensive federal solution would also be more clear and cohesive.

However, as discussed earlier, lawmakers may prefer that states have some say over surprise billing protections. To create room for state remedies that are more tailored, yet allowing for comprehensive solutions, we recommend enacting a set of federal protections that serves as a default for states that fail to act but clearly authorizes states to regulate self-funded health plans in a fashion that is equally protective as a federal fallback. Several other prominent health laws, such as the Health Insurance Portability and Accountability Act and the Affordable Care Act, currently use this approach of a federal fallback that gives states considerable leeway. Specifically:

Specifically, the US should create a federal default dispute resolution process for self-funded employer plans that also applies to state-regulated issuers unless states opt to create their own process that meets minimum federal standards. Standards for the reasonableness of payment should be set by federal law for self-funded health plans and for state-regulated issuers in states that fail to enact their own standards for payment reasonableness. Such standards could either prescribe a basis for determining reasonable rates or specify reference rates that set both presumptive upper and lower bounds of reasonableness but allow dispute resolution in individual cases to determine whether a lower or higher rate is appropriate.

Prescribed or presumptive rates could be established in reference to specified multiples of either market-negotiated contracted rates or of Medicare rates. Basing rates on providers’ full prevailing charges, however, is not recommended because there is little meaningful market constraint on these “list prices.” States creating their own processes should, at a minimum, establish or clarify the standards that govern courts in determining the reasonableness of out-of-network billing under contract law.

Rather than judicial resolution, an alternative dispute resolution process could take the form of “baseball-style” or “final-offer” arbitration, in which both sides of the dispute present their best offer and the neutral arbitrator chooses one side or the other. An important element would be making publicly available the results of the decisions.

Alternative Solutions

Recognizing that amending ERISA tends to be an extremely involved, complex process, at the very least, given that states currently are unable to enact a comprehensive solution to surprise billing due to ERISA’s pre-emption of state authority over self-funded health plans, the Department of Labor could clarify through regulation that states are free under ERISA to regulate payment rates to providers by self-funded health plans. Doing so would at least allow states to enact patchwork measures that reach most of the market.

To be more protective but still allow significant state flexibility while limiting changes to ERISA, a federal-state hybrid approach could be undertaken that dovetails protections from both jurisdictions, by preserving exclusive federal authority over self-funded employers while states retain their traditional oversight of providers and of fully-insured health plans. If the state’s chosen solution is simply to set limits on how much providers can charge and health plans must pay, then federal law could simply require that those state-imposed requirements apply uniformly to self-funded health plans. If, however, a state creates a dispute resolution mechanism between plans and providers for surprise bills (as many have done), federal law could require self-funded plans to participate in that process, as part of their duties under ERISA.

Alternatively, either the federal government or states could seek to address surprise balance billing by encouraging or effectively requiring hospitals to increase in-network physician participation, utilizing various bodies of law (conditions of Medicare participation, facility licensure, health plan regulation, etc.). Such strategies would need to be pursued carefully and with periodic evaluation, however, to avoid unduly influencing the competitive balance between providers and plans in different markets, which could have unintended adverse consequences for either insurance costs or network adequacy.

Summing Up

No matter the solution, protecting all patients covered by health insurance from surprise balance billing should be the ultimate goal. Any of the approaches we detailed would improve greatly on the status quo, although we believe that the primary federal solutions recommended can protect the most patients with the least amount of market imbalance between providers, insurers, and hospitals.

[1] Adequate notice should be defined in a way that gives patients a meaningful option to choose in-network providers. Elements of adequacy should include: notice sufficiently in advance of treatment, an estimation of the costs of electing non-network providers, and direction about how to request in-network providers. It is doubtful, therefore, whether notice can ever be adequate in many prototypical surprise billing situations. Advance notice obviously is not possible for urgent care. For non-emergency hospital care, patients might be able to consider an alternative primary physician, but it is doubtful whether they realistically could select alternative consulting or assistant physicians.

You must be logged in to post a comment.