Employer-sponsored plans are how a majority of workers obtain health insurance. Of course, not all plans provide the same level of coverage and not all workers fall in the same income bracket. These differences, coupled with a new tax through the Affordable Care Act (ACA), may lead to some unintended consequences for low-income workers, according to a new paper released in the AMA Journal of Ethics by Bradley Herring, Associate Professor at John Hopkins Bloomberg School of Public Health and Erin Trish, Research Assistant Professor at the USC Schaeffer Center for Health Policy and Economics.

Currently, employer-sponsored health coverage is excluded from typical federal and payroll taxes. Individuals in high-income tax brackets with employer-sponsored plans benefit more from not paying taxes on their health insurance benefits than low-income workers who face lower marginal tax rates. Though the Cadillac tax appears to have been designed in part to target this unequal effect, the analysis by Trish and Herring finds that the Cadillac tax may actually serve to exacerbate this inequity rather than reducing it.

What is the Cadillac Tax?

The ACA’s excise tax on certain employer-sponsored plans is set to be introduced January 1, 2018. Often referred to as the Cadillac Tax, this tax targets the top of the line plans that give the most generous level of benefits—the so-called Cadillacs of health plans. Starting in 2018, the 40% tax will be applied to high cost health plans, defined as health plans with premiums above $10,200 for individuals and $27,500 for family coverage.

These generous plans are targeted because they shield customers from the full cost of care by removing copays and offering low or no deductible options, and thereby encourage excessive consumption of health care. The tax is intended to encourage employers to offer plans that are more consumer-driven instead of these Cadillac plans. The goal is for employees to have a better understanding of the true cost of their health care, be better informed spenders and help trim down unnecessary health care costs.

“Just as an excise tax on cigarettes aims to reduce smoking, the Cadillac tax aims to get employees to switch to less generous coverage to avoid paying the tax,” explain Herring and Trish in the paper.

How Does the Current Tax Exclusion Impact Workers?

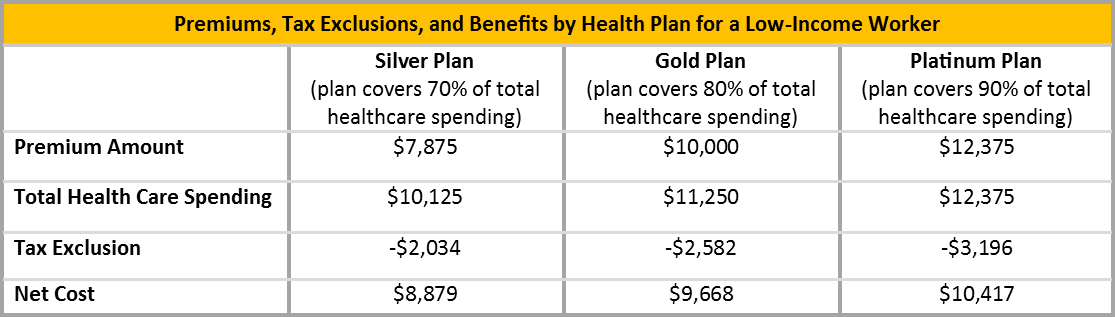

To understand an enrollee’s net costs, Trish and Herring work through the financial outcome for low- and high-income workers taking into account costs, benefits, and tax exclusions. They assess the effects before and after the Cadillac Tax for three representative health plans: silver (with the plan covering 70% of total healthcare spending), gold (80%), and platinum (90%).

The authors show more generous plans with higher premiums inherently result in a larger tax-exclusion benefit, regardless of the workers income level which encourages participation in these more generous plans. To illustrate this concept, the authors provide a numerical example using hypothetical silver, gold, and platinum tiered plans and the tax brackets for low and high-income workers, before the tax is applied.

As you can see in the table above, the tax exclusion for a low-income worker with the silver plan is $2,034, whereas the tax exclusion for the same worker with the platinum plan is $3,196. The comparison shows that the tax exclusion provides an inherent incentive to obtain relatively more generous plans.

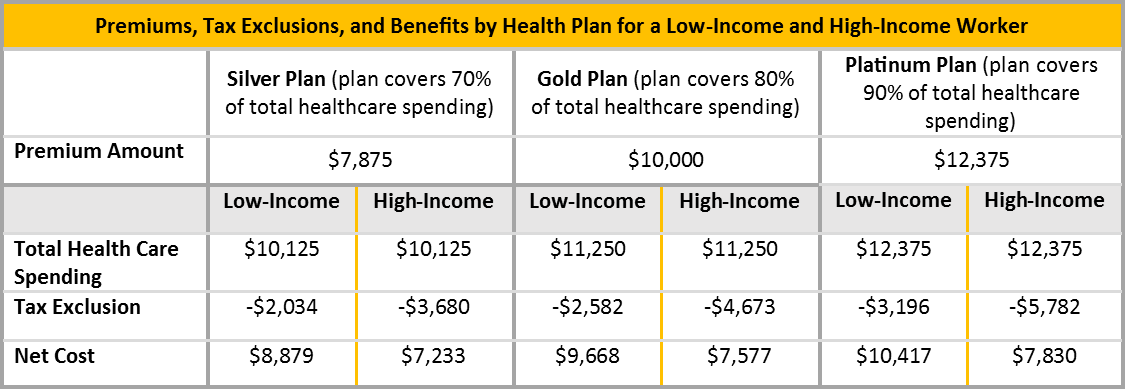

This is also an issue of equity, especially when considering the tax exclusion increases with a worker’s marginal tax rate. Below the premiums, tax-exclusions, and benefits by health plan are compared for a low-income and a high-income worker. The tax exclusions for the same hypothetical silver and platinum plans for a high-income worker are larger than the exclusion received by the low-income worker. The magnitude of the tax exclusion disproportionately benefits high-income workers compared to low-income workers when comparing the same level plans.

How Will the Cadillac Tax Impact Low-Income and High-Income Workers?

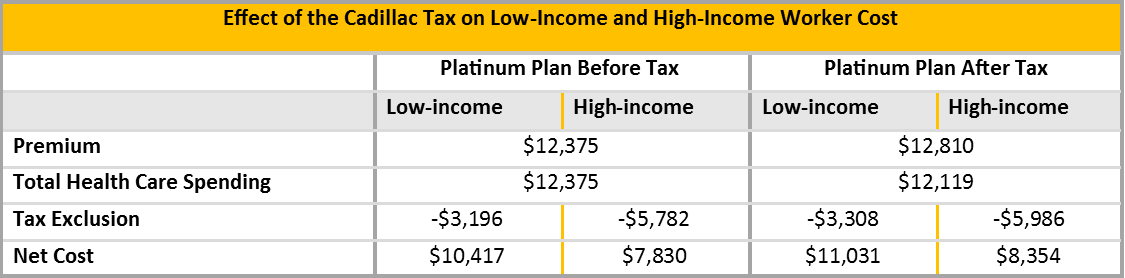

Finally, Herring and Trish applied the Cadillac Tax to the hypothetical platinum-level plan to look at whether the excise tax would affect these patterns. The subsidy coupled with the Cadillac Tax actually impacts low-income workers to a greater degree than high-income workers assuming both workers are in the same high-cost health plans: low-income workers had a larger decrease in the net tax benefit and a larger increase in net cost compared to high-income workers.

This can be best seen when examining the increase in the net cost when the Cadillac Tax is applied. For a low-income worker, the researchers found the net cost of the plan to increase by $614. The net cost of the plan for a high-income worker only increased by $523, which is 15% less than the increase for the low-income individual. This is because higher-income workers in higher tax brackets receive a relatively larger subsidy to offset premiums, including the portion of higher premiums attributable to the Cadillac tax. Effectively, the tax (though targeted at high-cost plans) is regressive and imposes a higher cost on low-income workers.

The tax exclusion for employer-sponsored insurance has been a longtime source of inefficiency and inequity in US healthcare,

“The tax exclusion for employer-sponsored insurance has been a longtime source of inefficiency and inequity in US healthcare,” Trish explained. She went on to say, “Our findings suggest that, while implementing the Cadillac tax may take an initial step toward reducing this inefficiency, it will actually result in increased inequity across workers of different income levels.”

Much of the debate recently has been centered on implementation challenges and the threshold being benchmarked to the Consumer Price Index which many feel won’t keep up with the rising cost of health care, this issue of equity is also of paramount importance when discussing the who will pay the tax and what those effects are. Though one might argue that high-income workers are more likely to have the plans that will be affected by the Cadillac Tax, this hasn’t necessarily been found to be true. Though high-income workers are more likely to be insured by their employer, the researchers point out there is no evidence to show that high-income workers with insurance have more generous benefits than low-income workers with insurance.