Abstract

Prescription drug overpayments (also known as “clawbacks”) occur when commercially insured patients’ copayments exceed the total cost of the drug to their insurer or pharmacy benefit manager. While the practice has been acknowledged and discussed in the media, it has never been quantified in large samples. We use pharmacy claims data from a large commercial insurer, combined with data on national average drug reimbursements, to identify claims that likely involved overpayments. In 2013, almost one quarter of filled pharmacy prescriptions (23%) involved a patient copayment that exceeded the average reimbursement paid by the insurer by more than $2.00. Among these overpayment claims, the average overpayment is $7.69. Overpayments are more likely on claims for generic versus brand drugs (28% vs. 6%), but the average size of the overpayment on generic claims is smaller ($7.32 vs. $13.46). In 2013, total overpayments amounted to $135 million in our sample, or $10.51 per covered life. With over 200 million Americans commercially insured in 2013, these findings suggest the practice of overpayments may account for a non-negligible share of overall drug spending and patient out-of-pocket costs.

Watch a short video on prescription drug overpayments (also known as “clawbacks”). Karen Van Nuys, Geoffrey Joyce, Rocio Ribero, and Dana Goldman use pharmacy claims data from a large commercial insurer, combined with data on national average drug reimbursements, to identify claims that likely involved overpayments.

Introduction

Recent increases in prescription drug prices and patients’ ability to afford them have received much attention from policymakers and the media, with particular focus on patients’ out-of-pocket (OOP) expenditures for drugs. For insured patients, an important element of OOP spend is the copayment, a fixed dollar amount paid per prescription by the patient. The term “copayment” suggests that the patient and insurer are sharing the total cost of the drug — the patient pays the copayment, and the insurer pays the remaining cost. But recent investigations have shown that on some prescription claims, the total cost of the drug is less than the patient’s copayment, and the insurer or pharmacy benefit manager (PBM) keeps the difference in what is known as a “clawback.”1-9 Some pharmacists have expressed frustration that they are bound by “gag clauses” in their contracts with insurers and PBMs not to disclose to patients when they could save money by not using their insurance because of such practices.10,11

Numerous lawsuits have been filed against insurers12-21 and pharmacies22,23 for this practice, and several states have taken legislative steps to prevent it, including Maryland in 2007, Arkansas in 2015, Louisiana in 2016, and North Dakota, Georgia, Connecticut, Maine and Texas in 2017;24-31 similar legislation is currently pending in North Carolina and New York.32,33 For the most part, these investigations and lawsuits have relied on anecdotes and examples to demonstrate the phenomenon — we know of no analysis that uses large-scale data to quantify how frequently it occurs, or the dollar values involved. This is primarily due to the unavailability of reliable data on the prices actually paid by commercial insurers for prescription drugs.

In this paper, we analyze commercial pharmacy claims data combined with a short-lived national survey of pharmacies concerning the drug prices paid by commercial insurers, the National Average Retail Price, or NARP. Although NARP data provide a national average of transaction prices rather than the transaction prices themselves, comparing transaction-level copayments from pharmacy claims to the national average transaction price paid by commercial insurers provides a sense of how frequently these overpayments may be happening, and their general magnitude. We can also identify the types of drugs that are more likely to be subject to overpayments.

Methods

Pharmacies collect patients’ copayments and pass them to PBMs, who then reimburse the pharmacy a negotiated rate to cover drug costs, dispensing fees, and any markup. Overpayments occur when the copayment exceeds the reimbursement negotiated between the PBM and the pharmacy. To assess the frequency of these overpayments, we compared copayments with the national average reimbursement received by pharmacies for commercially insured patients for the same prescription.

Our reimbursement data come from a survey by the Centers for Medicare & Medicaid Services which was published for six months beginning in January 2013, the National Average Retail Price. The survey was authorized in the Deficit Reduction Act of 2005, which sought to reduce spending on mandatory programs such as Medicaid. The Act provided for a monthly national survey of retail prices for Medicaid-covered outpatient drugs; these benchmarks could then be used by state Medicaid pharmacy programs to evaluate their reimbursement methods. NARP data are based on 50 million retail pharmacy transactions from independent and chain pharmacies nationwide. They measure per-unit mean reimbursement to retail pharmacies for commercially insured patients for over 4,000 common outpatient drugs, listed by 11-digit national drug code (NDC), and represent the total cost to the PBM, including dispensing fees and pharmacy markup.34

Our copayment data come from a 25 percent random sample of Optum ClinformaticsTM Data Mart pharmacy claims from commercially insured patients in the first half of 2013. These data represent 9.5 million prescriptions filled by 1.6 million subscribers during that period. Each claim contains the name of the drug and its NDC, the quantity filled and the copayment paid by the beneficiary. Data from First Databank is used to characterize whether each NDC corresponds to a brand or generic drug.35

To identify overpayments, we compare the copayment on each claim to the NARP reimbursement on the same NDC for customers with commercial third-party insurance in the quarter when the claim was filled. Since NARP represents a national average, actual reimbursements will vary around that average; the fact that a copayment on one transaction exceeds the NARP reimbursement does not necessarily mean that the copayment exceeded the reimbursement on that specific transaction. Therefore, we conservatively identified overpayments only on claims in which the copayment exceeded the NARP by more than $2.00 for reimbursements below $20 or 10 percent of the NARP for reimbursements above $20. We do not count overpayments on claims that had positive deductibles (0.2% of all claims).

Results

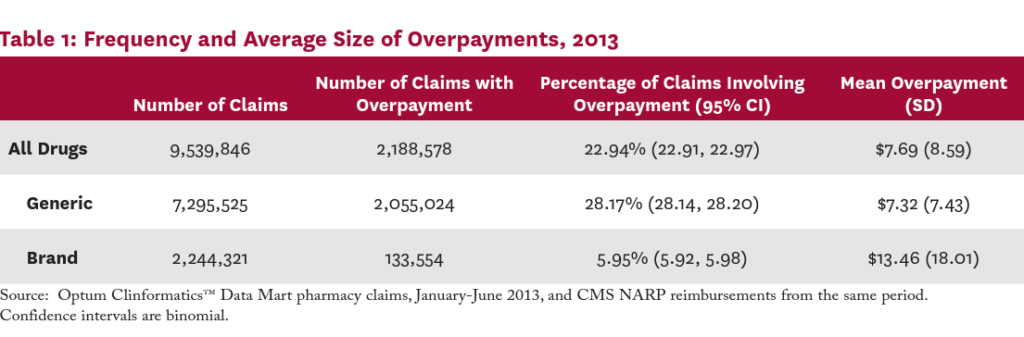

Table 1 presents the frequency of overpayments and the average overpayment size overall and by generic status among the 2013 pharmacy claims data. Twenty-three percent of all claims involved an overpayment. The overpayment rate for generic drug claims was significantly larger than for brand drug claims (28.17% vs. 5.95%; P<0.001). Among claims with an overpayment, the mean overpayment size was $7.69; the average overpayment was significantly larger for brand drug claims than for generics ($13.46 vs. $7.32; P<0.001).

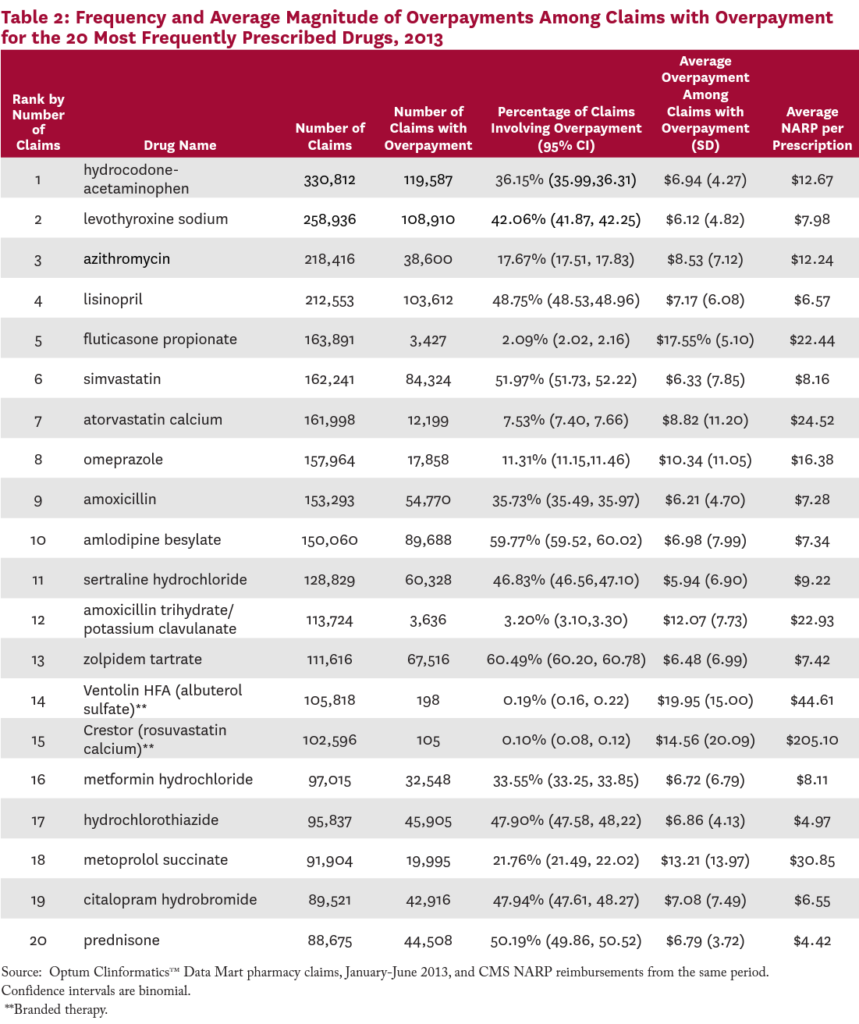

Table 2 lists the 20 most commonly prescribed drugs in the claims data, the frequency with which each involved an overpayment, and the average size of the overpayment when it existed. Among the 20 most popular prescription drugs in 2013, nine involved overpayments more than 40 percent of the time. Claims for the most commonly prescribed drug, the narcotic hydrocodone-acetaminophen, involved an overpayment 36 percent of the time.

For the drugs on this list, the average dollar value of the overpayment, when one existed, ranged from $5.94 on sertraline hydrochloride (an antidepressant), to $19.95 on Ventolin HFA (an inhaled bronchodilator). For sixteen of these 20 most commonly prescribed drugs, the size of the average overpayment was more than 50 percent of the NARP reimbursement for the drug.

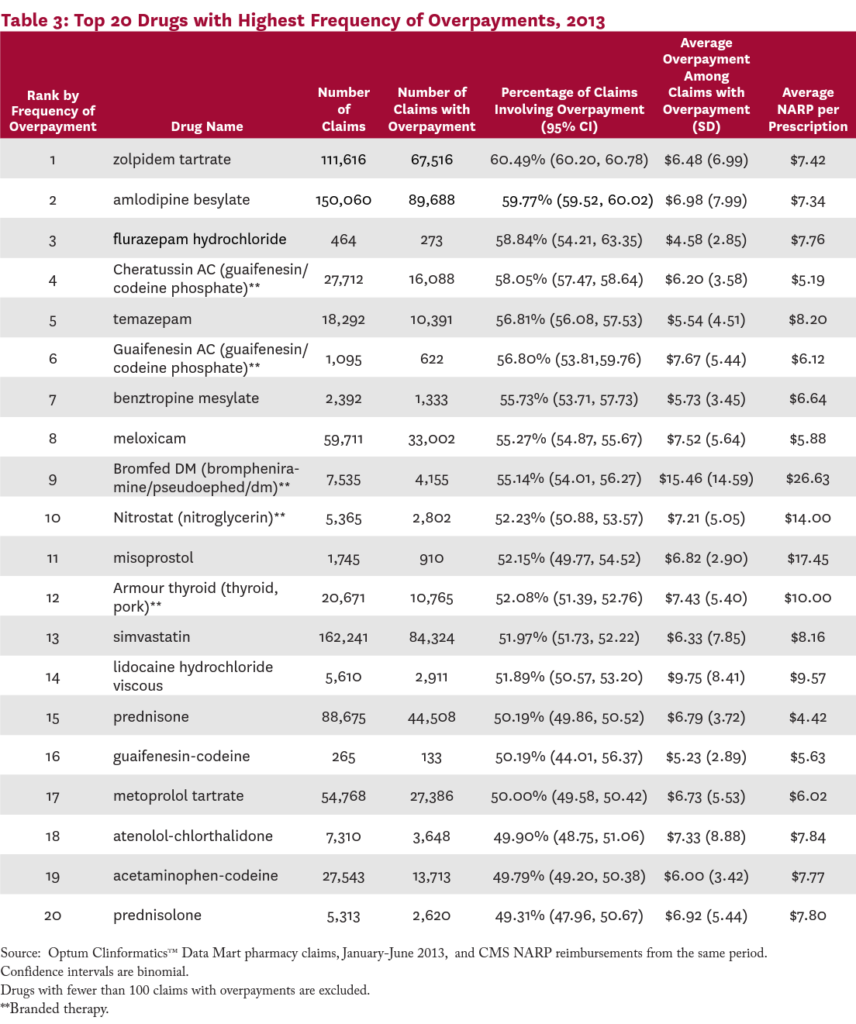

Table 3 presents the 20 drugs most likely to involve an overpayment. The top drug, zolpidem tartrate (a popular insomnia treatment), involved an overpayment 60.5 percent of the time, followed by amlodipine besylate (a calcum channel blocker; 60%), flurazepam hydrochloride (another insomnia medication; 59%), and Cheratussin AC (a narcotic cough suppressant/ expectorant; 58%). The list includes medications for a wide range of common conditions, including insomnia, high cholesteral, hypertension, pain, cough, and inflammation.

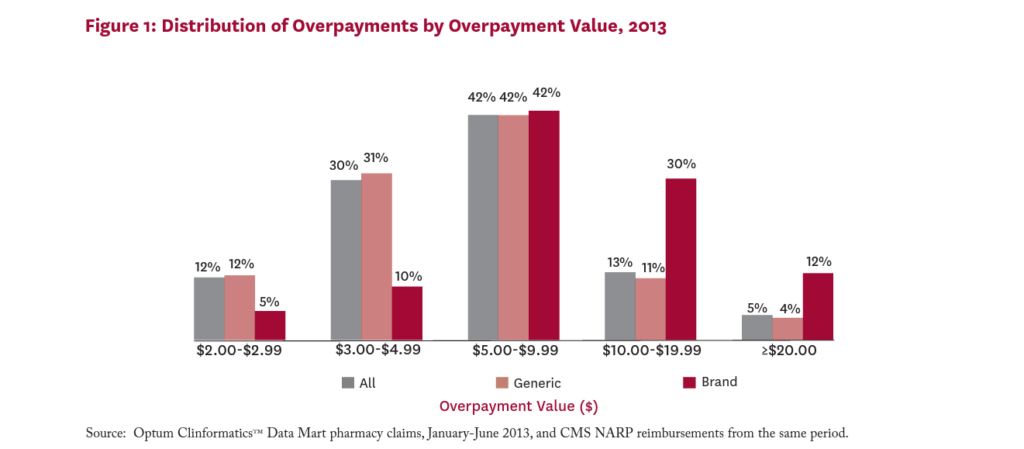

Figure 1 shows the distribution of average overpayments among claims with overpayment. While 12 percent of all overpayments were worth less than $3, sixty percent were worth $5 or more. Eighteen percent of all overpayments were worth $10 or more per claim. Among claims for brand drugs with overpayments, 42 percent involve overpayments worth $10 or more.

Overpayments in Medicare Part D

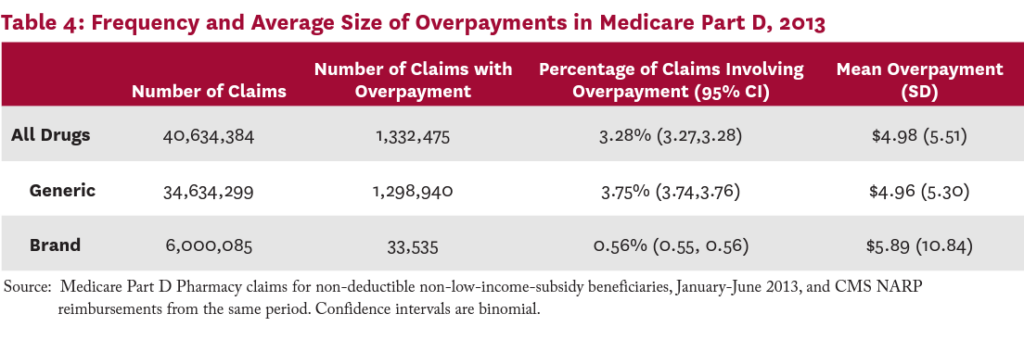

To explore the validity of our overpayment measurement method, we applied the same method described above to Medicare Part D claims of a 20 percent random sample of Medicare beneficiaries in 2013. This analysis was restricted to non-subsidized beneficiaries filing claims in the nondeductible phase of their coverage. We would expect to find very few overpayments among Medicare claims, since Medicare outlaws the practice of overpayments. Specifically, the Prescription Drug Benefit Manual states that “Part D sponsors must ensure that their payment systems are set up to charge beneficiaries the lesser of a drug’s negotiated price or applicable copayment amount in all phases of the benefit.”36 Despite this requirement, some overpayments do apparently occur on Medicare claims — the National Community Pharmacists Association surveyed their members about overpayments in 2016; 59 percent of survey respondents reported that overpayments were indeed taking place on Medicare Part D claims in their practices.37 Nevertheless, we would expect to find fewer overpayments taking place in Medicare claims compared to commercial claims.

In fact, when we compare the copayments on Medicare Part D claims to NARP reimbursements, we find only 3.3 percent of Medicare claims involving an overpayment as defined by our methods. These results are summarized in Table 4.

Discussion

Despite growing legal and regulatory concerns regarding prescription drug overpayments, large-scale empirical analyses of the phenomenon have been lacking. To our knowledge, this is the first example of such an analysis. Using data from the first half of 2013 — the only period for which survey data on actual reimbursements were available — we find that overpayments occurred on 28 percent of commercial pharmacy claims for generic drugs and 6 percent for brand drugs. While these figures may seem surprisingly high, one analyst has commented that overpayments are “far from outliers,” occurring on 10 percent of pharmacy transactions.9 Another anecdotal estimate by an independent pharmacist puts the figure at 20 to 25 percent of claims in 2016.1 Our results are consistent with these anecdotal estimates, and suggest that the practice is not rare.

Overpayments appeared on a wide variety of frequently-prescribed drugs, including anti-inflammatories, statins, antibiotics, diuretics, cough and cold, sleeping aids and antihypertensive medications. While average overpayments were relatively small on a per-claim basis ($7.69 on average), the popularity of the drugs with overpayments means that the total dollar amount associated with the practice was significant. In our dataset alone, we estimated that total overpayments were worth over $135 million in 2013, or $10.51 per member per year. By comparison, one large PBM reported its clients spent $10.67 per member on metformin in 2016.38 With over 200 million Americans covered by commercial insurance in 2013,39 such overpayments could account for significant total costs.

Policy Implications

While our data do not speak directly to the question of who benefits from overpayments, pharmacists report that insurers and pharmacy benefit managers keep the overpayments as profit.1,2 As such, overpayments directly increase patient OOP expenditures. Previous research has shown that cost-related medication non-adherence is common and associated with increased use of medical services and negative health outcomes.40 By raising patient costs at the point of sale, overpayments are likely to exacerbate these effects, and measures that discourage or prohibit the practice should be considered as opportunities to reduce patients’ OOP expenditures.

Some states, including Maryland, Arkansas, Louisiana, North Dakota, and Georgia have already banned the practice of overpayments. Recent legislation passed in Minnesota, Louisiana, Georgia, North Dakota, Connecticut, Maine, and Nevada specifically bans gag clauses that prevent pharmacists from disclosing actual prices of drugs to customers.25-29, 41-42 As the purpose of such gag clauses is to keep patients in the dark when they are overpaying, eliminating these clauses will enable patients to better protect themselves from the practice. The now-discontinued NARP survey allowed us to examine the frequency and size of overpayments. Reinstating that survey or a variation of it, such as that recently mandated in Florida43 for the 300 most commonly prescribed drugs, would enable ongoing monitoring of the practice.

Limitations

A key limitation of our analysis is the lack of transaction-level data on the insurer- or PBM-negotiated reimbursement paid on each prescription. Instead we used NARP data, which capture average transaction prices paid by commercial insurers, including dispensing fees. While NARP is considered an accurate measure of average transaction prices, transaction-level variation by geography, payer, or pharmacy will be subsumed into the average. We therefore calculated overpayments conservatively, as the difference between actual copay and national average reimbursement, minus a buffer equal to the greater of $2 or 10 percent of the average reimbursement. As an estimate of the actual overpayments that could be measured if the reimbursement on each transaction were available, our overpayment measure may be too high or too low. Data on transaction-level reimbursements would be needed to solve this issue definitively.

Additionally, NARP reimbursement data are available only for the first half of 2013, and our pharmacy claims data come from a single large insurer, which may not be representative of the commercially insured population in the US. The current prevalence of overpayments nationwide, and their magnitude, could be higher or lower.

Conclusion

Many US patients struggle to afford their out-of- pocket healthcare expenses, and cost-related medication non-adherence is common, leading to higher medical expenditures and poorer health outcomes. At the same time, the US healthcare system is grappling with issues of how to afford innovative therapies such as hepatitis C cures and cancer immunotherapies that meaningfully improve patient outcomes, medical expenditures and overall social welfare. Game-changing therapies for high-prevalence diseases like diabetes and Alzheimer’s may soon be on the horizon, adding to the affordability challenge. In such an environment, every opportunity should be taken to create room in existing healthcare budgets to afford such innovations. While eliminating overpayments cannot generate enough savings to solve this problem completely, it would be a step in the right direction.

The interactive graphic below shows how frequently the co-payment exceeds the price of commonly prescribed drugs, and provides the average overpayment per drug.

References

- Olstad, Jay and Ekert, Steve. Who’s Profiting from Prescription Overcharges? KARE11 Minneapolis. [Online] November 18, 2016. Retrieved on May 17, 2017 from: http://www.kare11.com/news/investigations/whosprofiting-from-prescription-overcharges/347424661

- WRAL Investigates. Buying generic medication? You might be paying too much. WRAL.com. Updated Nov, 4, 2014. Retrieved May 17, 2017 from: http://www.wral.com/buying-generic-medication-youmight-be-paying-too-much/14142893/

- Appleby, Julie. Filling a prescription? You might be better off paying cash. Kaiser Health News. [Online] June 24, 2016. Retrieved October 18, 2017 from: http://khn.org/news/filling-a-prescription-you-mightbe-better-off-paying-cash/

- Belk, David. Are you paying way too much for your medications? The Huffington Post – The Blog. Updated December 14, 2013 Retrieved October 23, 2017 from: https://www.huffingtonpost.com/david-belk/healthcare-costs_b_4066552.html

- Mahony, Edmund H. Cigna Accused of Cheating Prescription Drug Buyers. Hartford Courant. October 14, 2016 Retrieved October 24, 2017 from: http://www.courant.com/news/connecticut/hc-prescription-benefit-class-action-1015-20161014-story.html

- Milano, Ashley. Humana Class Action Says Insurance Co. Inflates Prescription Copays. Top Class Actions. November 15, 2016 Retrieved October 23, 2017 from: https://topclassactions.com/lawsuit-settlements/lawsuit-news/349419-humana-class-action-says-insuranceco-inflates-prescription-copays/

- Hiltzik, Michael. The ‘clawback’: Another hidden scam driving up your prescription prices. Los Angeles Times. August 9, 2017 Retrieved October 23, 2017 from: http://www.latimes.com/business/hiltzik/la-fi-hiltzikclawback-drugs-20170809-story.html

- Zurik, L. and T. Wright. United/Optum defends prescription ‘overpayment program’. FOX 8 WVUE New Orleans May 9, 2016 Retrieved October 23, 2017 from: http://www.fox8live.com/story/31927914/zurik-unitedoptum-defends-prescription-overpayment-program

- Bilski, Jared. The ‘clawback’ crisis: Is your pharmacy benefit manager ripping you off? CFO Daily News March 30, 2017 Retrieved February 23, 2018 from: http://www.cfodailynews.com/the-clawback-crisis-isyour-pharmacy-benefit-manager-ripping-you-off/

- Probasco, Jim. Why Pharmacists Can’t Warn You About Over-Priced Drugs. Investopedia March 21, 2017 Retrieved October 23, 2017 from: http://www.investopedia.com/insights/why-pharmacists-cant-warn-you-about-overpriced-drugs/

- Hopkins, Jared S. You’re Overpaying for Drugs and Your Pharmacist Can’t Tell You. Bloomberg News. February 24, 2017. Retrieved October 18, 2017 from: https://www.bloomberg.com/news/articles/2017-02-24/ sworn-to-secrecy-drugstores-stay-silent-as-customersoverpay

- Perry et al v. Cigna Corporation et al (D. Conn. 2016) Case 3:16-cv-01904 Document 1 Filed November 17, 2016 Retrieved October 23, 2017 from: http://wvue.images.worldnow.com/library/46af372a73fd-450a-a77e-8f26561ceb9a.pdf

- Mohr et al v. UnitedHealth Group Inc. et al (D. Minn. 2016) Case 0:16-cv-03352-JNE-BRT Document 4 Filed October 4, 2016 Retrieved October 19, 2017 from: https://consumermediallc.files.wordpress. com/2016/10/4.pdf

- Watson et al v. OptumRx, Inc. et al (D. Cal 2016) Case 8:16-cv-02106 Document 1 Filed November 23, 2016 Retrieved October 23, 2017 from: https://www.bloomberglaw.com/public/desktop/ document/Watson_v_OptumRX_Inc_et_al_Docket_ No_816cv02106_CD_Cal_Nov_23_201?1508791093

- Waldrop et al v. Humana, Inc. and Humana Pharmacy Solutions, Inc. (D. Kentucky 2016) Civil No. 3:16-cv706-GNS Filed November 10, 2016 Retrieved October 23, 2017 from: https://www.courthousenews.com/wp-content/ uploads/2016/11/Humana.pdf

- Davis et al v. OptumRx, Inc., Cigna Health and Life Insurance Company et al Case 8:16-cv-02165-DOCJCG (D. Cal 2016) Document 1 Filed December 7, 2016 Retrieved October 23, 2017 from: https://www.courtlistener.com/docket/4555321/gaildavis-v-optumrx-inc/

- Fellgren, Hawks et al v. UnitedHealth Group Inc. et al (D. Minn. 2016) Case No. 0:16-cv-03914-JNE-BRT Filed November 15, 2016 Retrieved October 23, 2017 from: http://www.krcomplexlit.com/wp-content/ uploads/2017/01/FirstAmendedComplaint012017.pdf

- Mastra et al v. UnitedHealth Group Inc. et al (D. Minn 2016) Case 0:16-cv-04119-JNE-BRT Document 1 Filed December 8, 2016 Retrieved October 23, 2017 from: https://www.law360.com/dockets/download/5849ec3c6 13d04110b000007?doc_url=https%3A%2F%2Fecf.mnd. uscourts.gov%2Fdoc1%2F10116495057&label=Case+Fil ing

- Negron et al v. Cigna Corporation and Cigna Health and Life Insurance Company (D. Conn. 2016) Civil No.16-cv-1702 Class Action Complaint Demand for Jury Trial Filed October 13, 2016 Retrieved October 23, 2017 from: http://www.trbas.com/media/media/acrobat/2016-10/70101951992280-14091252.pdf

- Smith et al v. United HealthCare Services, Inc. and United HealthCare Insurance Company (D. Minn. 2004) Case 0:00-cv-01163-ADM-AJB Document 119 Filed November 8, 2004 Retrieved October 23, 2017 from: http://files.courthousenews.com/2016/10/06/Settlement. pdf

- Stevens et al v. UnitedHealth Group Inc. et al (D. Minn. 2016) Case 0:16-cv-03496-JNE-BRT Filed October 14, 2016 Retrieved October 20, 2017 from: https://www.scott-scott.com/cnt/cp/unitedhealth_ group_complaint.pdf

- Schultz et al v. CVS Health Corporation (D. Rhode Island 2017) Case 1:17-cv-00359 Document 1 Filed August 7, 2017 Retrieved October 23, 2017 from: https://www.bloomberglaw.com/public/desktop/document/Schultz_v_CVS_Health_ Docket_No_117cv00359_DRI_Aug_07_2017_ Court_D/1?1508787047

- Grabstald et al v. Walgreens Boots Alliance, Inc., (N. D. of Ill 2016) Case: 1:17-cv-05789 Document #: 1 Filed: August 9, 2017 Retrieved October 23, 2017 from: https://www.hbsslaw.com/uploads/case_downloads/ wagreens-clawback/hagens-berman-grabstald-v-walgreens-generic-drug-overpricing-clawback.pdf

- State of Arkansas. Regular Session, 2015. Senate Bill 542. An Act to Modify the Responsibilities of a Pharmacy Benefits Manager and Patient Rights Regarding Payment for Pharmacists Services; and for Other Purposes. Enacted April 4, 2015 Retrieved October 30, 2017 from: http://www.arkleg.state.ar.us/assembly/2015/2015R/ Pages/BillInformation.aspx?measureno=SB542

- State of Connecticut Public Health Committee. An Act Concerning Contracts Between a Pharmacy and a Pharmacy Benefits Manager, The Bidirectional Exchange of Electronic Health Records and The Charging of Facility Fees by a Hospital or Health System. CT-SS Bill No. 445. Public Act No. 17-241. 2017. Enacted July 10, 2017. Effective date January 1, 2018. Retrieved October 18, 2017 from: https://www.cga.ct.gov/2017/ACT/pa/pdf/2017PA00241-R00SB-00445-PA.pdf

- State of Georgia. 2017-2018 Regular Session – SB No. 103. An Act to amend Chapter 64 of Title 33 of the Official Code of Georgia Annotated, relating to regulation and licensure of pharmacy benefits managers. Effective date August 1, 2017. Retrieved October 30, 2017 from: http://www.legis.ga.gov/Legislation/en-US/display/20172018/SB/103

- State of Louisiana. 2016 Regular Session LA SB131 Limits costs for pharmacists’ services. Effective date August 1, 2016 Retrieved October 30, 2017 from: https://legiscan.com/LA/text/SB131/id/1420030

- State of Maine. S.P. 10 L.D. 6 An Act to Prohibit Insurance Carriers from Charging Enrollees for Prescription Drugs in Amounts That Exceed the Drugs’ Costs. Passed to be Enacted in concurrence May 2, 2017. Retrieved October 30, 2017 from: https://legiscan.com/ME/text/LD6/2017

- State of North Dakota. Senate Bill No. 2258. Session 2017-2018. Pharmacy claim fees and pharmacy rights; to provide a penalty; and to provide for application. Passed April 6, 2017 Signed by Governor 04-05. Retrieved October 30, 2017 from: https://legiscan.com/ND/text/2258/id/1580390/North_ Dakota-2017-2258-Enrolled.pdf

- State of Maryland. Insurance Code Section 15-842 (2010) Copayment or coinsurance for prescription drugs and devices limited. Retrieved October 30, 2017 from: https://law.justia.com/codes/maryland/2010/insurance/ title-15/subtitle-8/15-842/

- State of Texas. An Act relating to amounts charged to an enrollee in a health benefit plan for prescription drugs covered by the plan. Passed June 6 2012 Effective date: September 1, 2017 SB1076 Retrieved October 30, 2017 from: https://legiscan.com/TX/text/SB1076/id/1624568

- State Of New York. 2017-2018 Regular Sessions. Bill No. A07504. An Act to Amend the Insurance Law and the Education Law, In Relation to Copayments for Prescription Drugs. Introduced in Assembly April 28, 2017 Retrieved October 30, 2017 from: http://assembly.state.ny.us/leg/?default_fld=&bn=A0 7504&term=2017&Summary=Y&Actions=Y&Text= Y&Committee%26nbspVotes=Y&Floor%26nbspVot es=Y

- State of North Carolina. Session 2017, Session Law 2017-116, House Bill 466. An Act Relating to the Regulation of Pharmacy Benefit Managers. Passed on July 18, 2017 Retrieved October 30, 2017 from: https://legiscan.com/NC/bill/H466/2017

- The Centers for Medicare & Medicaid Services. Part I: Draft Methodology for Estimating National Average Retail Prices (NARP) for Medicaid Covered Outpatient Drugs. s.l.: CMS, 2012. Retrieved October 18, 2017 from: https://www.medicaid.gov/medicaid-chip-programinformation/by-topics/prescription-drugs/downloads/narpdraftmethodology.pdf

- First Databank MedKnowledge Documentation. September 2012.

- The Centers for Medicare & Medicaid Services. Medicare Prescription Drug Benefit Manual Chapter 5 (updated) September 11, 2011

- NCPA. Survey of Community Pharmacies. National Community Pharmacists Association. [Online] June 2016. Retrieved October 18, 2017 from: http://www.ncpa.co/pdf/dir_fee_pharamcy_survey_ june_2016.pdf

- Express Scripts. 2016 Drug Trend Report. Retrieved November 27, 2017 from: http://lab.express-scripts.com/lab/drug-trend-report

- Barnett, J. and M. Vornovitsky. Health Insurance Coverage in the United States: 2015. Current Population Reports. US Census Bureau. September 2016

- Goldman, D., G. Joyce and Y. Zheng. Prescription drug cost sharing: associations with medication and medical utilization and spending and health. JAMA July 4, 2007;298(1):61-9.

- State of Nevada. An Act Relating to Prescription Drugs. SB 539 Passed June 5, 2017 Retrieved October 30, 2017 from: https://www.leg.state.nv.us/App/NELIS/ REL/79th2017/Bill/5822/Text

- State of Minnesota. Minnesota Statutes Chapter 151. Sec. 214. Payment Disclosure. Passed February 19, 2004. Retrieved November 9, 2017 from: https://www.revisor.mn.gov/statutes/?id=151&year=2 013&format=pdf

- State of Florida. HB 589. Prescription Drug Price Transparency; Requires AHCA to collect data on retail prices charged by pharmacies for 300 most frequently prescribed medicines; requires agency to update website monthly. Effective Date: June 9, 2017. Retrieved October 30, 2017 from: https://www.flsenate.gov/Session/Bill/2017/00589

You must be logged in to post a comment.