Policy solutions must address the intermediaries who benefit.

Schaeffer Center White Paper Series | DOI: https://doi.org/10.25549/m589-2268

Key Takeaways

- Generic prescription drugs save the U.S. healthcare system money overall.

- Growing evidence shows that U.S. consumers often overpay for generics as pharmacy benefit managers game opaque and arcane pricing practices to pad profits.

- Greater transparency across the generic prescription drug supply chain and policies to spur competition and deter anticompetitive practices can reduce generic drug costs for patients.

Abstract

Growing evidence indicates U.S. consumers and employers and the government often overpay for generics as pharmacy benefit managers (PBMs) and their affiliated insurer companies game opaque and arcane pricing practices to pad profits. PBMs played an essential early role in driving U.S. uptake of generics. However, PBMs’ current practices—coupled with market distortions within the pharmaceutical supply chain—have inflated retail generic prices. Commercial tactics such as spread pricing, copay clawbacks and formularies that advantage branded drugs over less expensive generics have funneled the savings from low-cost generics into intermediaries’ pockets, rather than the pockets of patients. Greater transparency across the generic supply chain and policies to spur competition within the generic industry can help ensure that patients continue benefiting both clinically and financially from generics.

A press release covering this white paper’s findings is available here.

Introduction

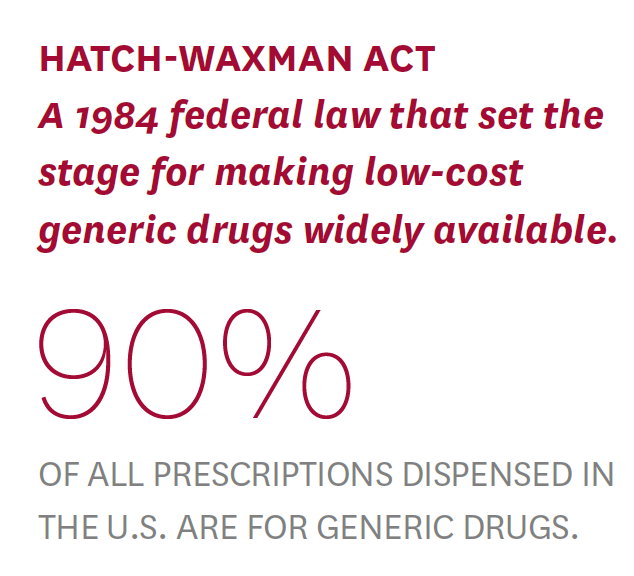

Over the last 50 years, innovative drugs have delivered enormous health benefits, especially for people with chronic conditions like diabetes and heart disease—even reducing other healthcare spending in some cases.1 But new branded drugs are costly to develop and expensive to purchase, especially in the United States. Nearly four decades ago, Congress crafted a compromise designed to spur drug discoveries and speed lower-cost generics to market by enacting the Drug Price Competition and Patent Term Restoration Act, known as Hatch-Waxman. The 1984 law jump-started production of therapeutically equivalent but lower-cost generics and set the stage for a rare cost-containment success story in U.S. healthcare: The United States leads the developed world today in using generic prescription medications.2

At the time, California Democratic Congressman Henry Waxman, working with Utah Republican Senator Orrin Hatch, brought branded and generic industry leadership together to develop the compromise agreement that gave the branded industry longer monopolies while the generic industry got an abbreviated drug approval process.3 For generics, the goal was to create a viable market that could drive prices down to competitive levels—close to marginal production costs—after a branded drug’s patent expiration. Following the law’s enactment, manufacturers rapidly introduced generic drugs into the U.S. market, extending the societal benefits of less expensive versions of essential medicines in perpetuity.

Generics: An American Success Story

Generics have made high-value and lifesaving medications more affordable and accessible and overall continue to save the U.S. health system money. The rapid and deep embrace of generic prescription drugs in the U.S. ticked all the elusive healthcare value boxes: lower costs and increased patient access while maintaining quality. In the U.S., generics are dispensed 97% of the time when available, growing from 78% of all dispensed prescriptions in 2010 to 90% in 2020.4 Generics account for only a slice—about 18%—of overall U.S. retail prescription drug expenditures, which reached nearly $350 billion in 2020.5,6 Nonetheless, by one estimate, U.S. use of generic and biosimilar drugs in place of branded drugs in 2020 saved $338 billion, with 10-year estimated savings from generics of nearly $2.4 trillion.7

As Drugs Play Bigger Role in Care, Their Insurance Becomes Key

Hatch-Waxman’s passage coincided with a particularly productive era in scientific discoveries that led to new medicines to treat many chronic conditions, including high cholesterol, high blood pressure, diabetes, depression and gastric reflux. Fueled by such blockbusters as Zoloft, Lipitor, Zantac and Nexium, sales of branded drugs jumped more than tenfold between 1984 and 2009, from $20 billion to $250 billion.8

As these groundbreaking but expensive therapies came to market, insurance coverage became increasingly important in enabling millions of patients to afford prescription drugs. Employers, eager to recruit and retain workers with a new benefit, expanded coverage of prescription drugs. By 1994, more than 50% of dispensed prescription drugs were covered by insurance.9 The 2006 Medicare expansion of Part D outpatient drug coverage further increased prescription drug use.10 Starting in the 1990s, insurers and PBMs introduced tiered drug formularies, with patient cost-sharing amounts tied to a drug’s tier. Low-cost drugs with equal or superior efficacy and safety—often generics—were placed on preferred tiers, where patients could get the best deals using their insurance benefits with minimal out-of-pocket cost. Higher-priced branded drugs had greater patient cost sharing.11

But insurance coverage can introduce drawbacks as well. When a third party pays for any product or service, the end consumer faces little or no incentive to seek the best price, and sellers respond accordingly by raising prices and increasing profits. Consider car insurance: A typical auto insurance plan does not cover oil changes, a routine service that is readily available at mechanics and express oil shops throughout America. In addition to being more price sensitive to the cost of oil changes because they bear it fully, consumers are unlikely to overpay for oil changes because they have many providers to choose from and can easily compare prices. In turn, oil change providers have every incentive to attract more business by competing on price. However, when getting auto body repairs after a covered accident, consumers pay little attention to the cost because, after paying their deductible, insurance pays the rest. The same is true for covered medicines. Most insured people rarely know the price of their prescriptions— they know what they spent at the pharmacy but not what their insurance paid. A lack of transparency about the actual cost of generic medicines—by one estimate, generic versions of many critical medicines can be profitably produced at a 99% discount from the price of the brand drug12—leads to widely varying generic prices across insurers, PBMs and pharmacies. Yet insured patients have few incentives to shop around to find the lowest price if it only saves their insurer money.

Brand and Generic Drug Makers Initially Prosper

The branded drug industry flourished in the wake of Hatch-Waxman, with U.S. per capita prescription spending increasing an inflation-adjusted estimated 138% between 1984 and 2019.13 As blockbuster branded drugs used by millions began losing patent protections—Zoloft, for example, in 2006—and became available as generics, branded drug manufacturers raised prices on their remaining patented drugs to make up for lost revenue from the so-called patent cliff.14 However, more recently, spending growth has been driven by the introduction of new branded drugs and the increased volume of branded prescriptions rather than price increases.15

The generics industry also prospered initially after Hatch-Waxman, competing vigorously to bring the large backlog of older off-patent medications to market at lower prices. But in recent years, as PBMs, insurers, wholesalers, pharmacies and the government pressed generic manufacturers for lower prices, the industry consolidated, resulting in fewer companies making certain generics.16 Reduced competition led to higher prices,17 and manufacturing problems that shutter production, even for a short time at one company, can now spark shortages of important drugs.18 Responding to these issues, high prices and shortages, groups ranging from a nonprofit like Civica Rx to a public-benefit corporation started by billionaire Mark Cuban have launched initiatives to manufacture generics that had been subject to shortages and price gouging.19

Intermediaries Prevent Consumers From Seeing the Full Benefits of Generic Savings

Despite generic entry driving down prices relative to branded drugs,20 consumers are not benefitting fully from the lower prices because middlemen—PBMs and insurers—are reaping the financial benefits rather than passing the full savings to consumers. Among privately insured beneficiaries, a 2021 study concluded that generic drug price declines between 2007 and 2016 were not fully passed through to consumers.

Researchers found that direct out-of-pocket payments by insured consumers to pharmacies for generic prescription drugs declined by about 50% during that time, while the total price—out-of-pocket consumer payment plus the price paid to the pharmacy by the insurer—fell by nearly 80% during the same period.21

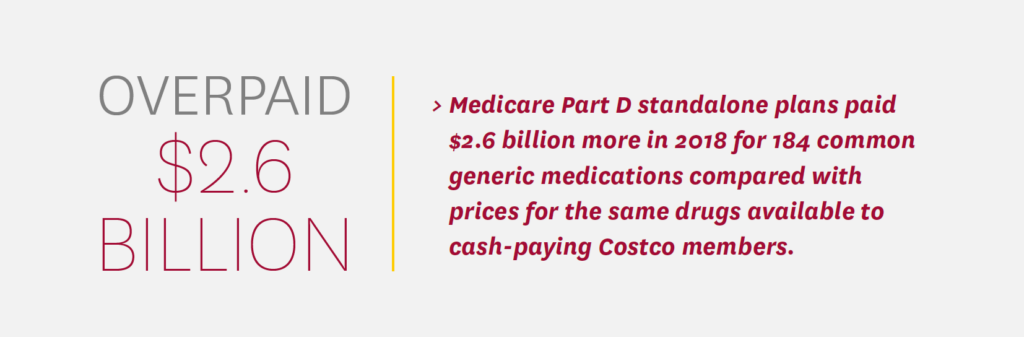

A growing body of research shows that the federal government and Medicare beneficiaries are also overpaying for generic prescription medications. An analysis by Schaeffer Center researchers, for example, found that Medicare Part D standalone drug plans paid $2.6 billion more in 2018 for 184 common generic medications compared with prices for the same drugs available to cash-paying Costco members.22 The researchers also found such overpayments in a convenience sample of commercial claims, although they were slightly less common than in Medicare claims.

The three largest PBMs—CVS Caremark, Express Scripts and OptumRx—operate respectively under the umbrella of large insurers Aetna CVS Health, Cigna and UnitedHealth Group.23 Such vertical integration and consolidation contributes to opaque and inflated generic drug prices. PBM and insurer practices such as copay clawbacks, spread pricing and profit-oriented formulary design enable overpayment on generic drugs.

Copay Clawbacks

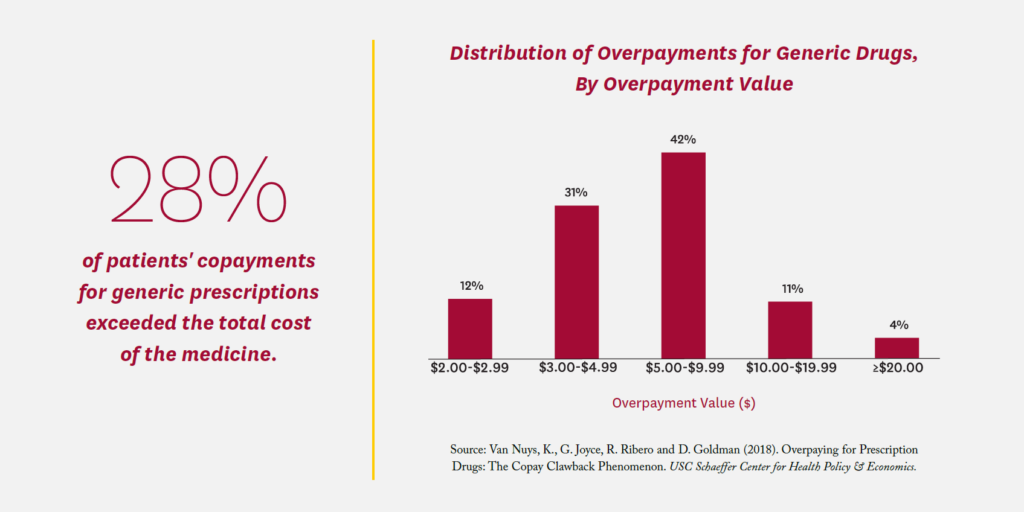

A 2018 Schaeffer Center study found that commercially insured patients’ copayments for a generic prescription exceeded the total cost of the medicine more than a quarter of the time (28%), with an average overpayment of $7.32.24 Total overpayments in the commercial claims studied amounted to $10.51 per member per year. Known as a copayment “clawback,” the practice was abetted by “gag clauses” in PBM/ insurer contracts that prevented pharmacists from telling consumers they could save money by paying the cash price; Congress outlawed such gag clauses in 2018.25 However, PBM contracts commonly require pharmacies to give the PBM their lowest price when accepting reimbursement for a prescription.26 As a result, pharmacies are careful to set cash prices higher than their negotiated PBM rates. Without prohibition of such anticompetitive contract clauses, pharmacies will not offer competitive cash prices for fear of triggering these best-price clauses.

Spread Pricing

Many PBM contracts enable intermediaries to collect large margins on transactions through a practice known as spread pricing. In such arrangements, when a beneficiary fills a prescription, the PBM reimburses the pharmacy one price while charging health plans a higher price and pockets the difference or “spread.” Because neither the health plan nor the pharmacy knows what the other side was paid or charged, the practice hides the PBM’s margins from scrutiny. In 2018, Ohio’s auditor of state conducted an audit of PBM services to the state’s managed Medicaid plans, finding that the average spread on generic prescriptions filled by Medicaid managed care beneficiaries was 31.4%, costing state taxpayers $208 million in one year.27 As a result, Ohio mandated that its Medicaid managed care plans renegotiate all PBM contracts from spread pricing to “pass-through” models in which PBMs charge plans only the amount paid to pharmacies plus a fixed fee per transaction.

Profit-Oriented Formulary Designs

Many formularies, as currently constructed, do not prioritize lower-priced medicines. Instead, they favor the use of branded medications that bring in lucrative manufacturer rebates but not necessarily lower prices for consumers, employers or the government. Rebates are a form of price concession paid by a pharmaceutical manufacturer to the insurer or PBM. Pharmaceutical companies rebate back a percentage of the price to the insurer or PBM in return for coverage of the medicine. Rebate amounts vary based on coverage tier, administrative restriction (e.g., prior authorization), market competition and market share. PBMs keep a share of these rebates, increasing their bottom lines, and pass the remainder to insurers. As a result, both commercial and Medicare drug plans often are slow to put new generics, which typically do not pay rebates, on the formulary.28 Another study of Medicare prescription drug plan formularies found that plans regularly place branded drugs on lower tiers than their lower-cost generic competitors, with 72% of Medicare Part D formularies on at least one occasion assigning a lower cost-sharing tier for branded products compared to multisource generic medicines.29 This may be due to the perverse incentives created by rebates: Plans may prefer the higher-priced branded version of a drug because it offers a large rebate, rather than its generic equivalent that offers no rebate. Beyond rebates, PBMs often charge manufacturers administrative fees that are calculated as a percent of a drug’s list price, providing additional incentives for PBMs to prefer higher-cost drugs over lower-cost alternatives.

Such practices lead to significant distortions when higher-priced, rebated medicines are favored over cheaper alternatives such as authorized or multisource generics. Among the PBMs that typically set and oversee such formulary practices, the top three control nearly 80% of retail prescription claims in the U.S.30 Such market power, coupled with a lack of transparency about the actual costs of producing generics, gives PBMs significant pricing clout.

Implications and Potential Solutions

Overall, generic medications continue to save the U.S. health system money—an estimated $330 billion annually—but growing evidence shows U.S. consumers and employers, as well as the government, often overpay for generics as the big PBMs and their affiliated parent companies game opaque and arcane pricing practices to increase their profits.

Generics accounted for 90% of U.S. prescriptions but only 18% of drug expenditures—and about 3% of all U.S. healthcare spending in 2020.31 While generics represent a relatively small share of U.S. healthcare spending, market distortions and business practices that prioritize higher intermediary profits over lower system costs result in patients paying billions of dollars in higher out-of-pocket costs for generics as purchasers essentially sanction and pay inflated prices that may be 13% to 20% too high, according to a recent analysis of Medicare claims for the most common generic drugs.32 The bottom line is that many patients are simply overpaying for generic drugs as middlemen profit from lack of price transparency and supply chain inefficiencies.

Current PBM and insurer practices also may contribute to quality issues and care fragmentation. Cash-only pharmacies like Blueberry Pharmacy and Mark Cuban’s Cost Plus Drug Company that cut out middlemen, and entities like GoodRx that offer discounted prices, enable patients to save money by paying cash rather than using their insurance to fill generic prescriptions. While just 4% of U.S. prescriptions filled in 2020 were paid in cash, 97% of these were for generic drugs.33 Patients who pay cash generate no claims data, threatening an important information source for care coordination.

The Hatch-Waxman bargain struck nearly 40 years ago was predicated on the widespread availability of low-cost generics once branded patents expire. Importantly, removing inefficiencies and lowering prices in generic markets will not affect returns on investment in developing new drugs because the savings will come from downstream middlemen rather than drug innovators. Thus, future innovation will likely be unaffected.

Possible policy approaches fall into two categories.

1. Policies to Regulate PBM Commercial Practices

- Restrict rebate contracting to remove financial incentives for a PBM/insurer to cover a branded medicine instead of its less expensive generic version.

- Require formulary tier placement of generics to reflect total cost to the health system. Such an approach would make formularies do what they were originally intended to do—steer patients toward lower-cost alternatives, rather than steering them toward higher-profit alternatives.

- Require transparent PBM reporting that enables regulators and others outside the industry to see where the money flows in generic drug transactions.

- Require PBM contracts to use fixed fees per transaction rather than calculate fees as a share of drug costs, which creates incentives for PBMs to prefer higher-cost drugs.

2. Policies to Improve the PBM Market

- Reexamine the PBM market from an antitrust perspective. Consider breaking up dominant players and reducing concentration in horizontal market segments and in self-dealing vertically integrated corporate structures.

- Impose fiduciary requirements on PBMs and insurers, forcing them to act in the best interests of patients and clients rather than solely in the interests of their shareholders.

- Provide audit rights for employer and government purchasers to determine actual prices paid by PBMs and insurers to pharmacies.

- Encourage transparent pass-through PBM models that operate with a commitment to cost transparency. Instead of using tactics such as spread pricing, rebate retention and clawbacks that are designed to obfuscate a PBM’s actual costs, transparent PBMs disclose their actual costs to clients.34 A transparent PBM commits to passing through all discounts and rebates received to the health insurance carrier and earns its revenue by charging straightforward administrative fees to the carrier, often structured as a flat fee per prescription.

- Encourage a transparent, competitive cash market for low-cost generic drugs, and let consumers decide whether to fill their prescriptions using insurance or cash. The economic case for insurance is strongest for large, unpredictable expenditures. Most generic drugs are low cost, and many treat chronic conditions, so their usage is highly predictable, meaning there is little economic rationale for insuring them. A robust, competitive cash market would require that pharmacies be protected against retaliation from PBMs so that posted cash prices reflect their true, competitive costs. It would also require implementing alternative systems to track patient adherence, drug interactions and other elements of care coordination for patients who pay with cash. If a competitive cash market were available, some health plans could even decide to eliminate low-cost generic drugs from coverage altogether. The savings could be used to fund accounts from which beneficiaries could pay for prescriptions purchased with cash. The costs of most such prescriptions in a competitive cash market would be modest: Among the 184 most commonly prescribed generic drugs in Medicare Part D in 2018, 90% could be purchased at Costco for less than $20 for a 30-day supply.

Support for this white paper was provided by the USC Leonard D. Schaeffer Center for Health Policy & Economics. The USC Schaeffer Center is funded by foundations, corporations, government agencies, individuals, and an endowment; a complete list of sponsors can be found in our annual reports (available here). The views expressed herein are those of the authors and do not represent the views of the Schaeffer Center nor its sponsors. Trish has served as a consultant and litigation expert on matters in the hospital, health insurance, health information technology and life sciences sectors. Popovian has and continues to serve as a consultant and advisor to the biopharmaceutical industry, healthcare coalitions, not-for-profit organizations, a blockchain technology company, and PBMs.

This paper has undergone the Schaeffer Center white paper quality assurance process, led by Emmett Keeler, Schaeffer Center Senior Fellow and Quality Assurance Director. In addition, the paper was reviewed by two scholars not affiliated with the Schaeffer Center.

References

- Congressional Budget Office. (2012) Offsetting Effects of Prescription Drug Use on Medicare’s Spending for Medical Services. https://www.cbo.gov/sites/default/files/112th-congress-2011-2012/reports/MedicalOffsets_One-col.pdf.

- Mulcahy, A. W., C. M. Whaley, M. Gizaw, D. Schwam, N. Edenfield and A. U. Becerra-Ornelas. (2021). International Prescription Drug Price Comparisons: Current Empirical Estimates and Comparisons with Previous Studies. Santa Monica, CA: RAND Corporation. https://www.rand.org/pubs/research_reports/RR2956.html.

- Engelberg, A. (2020). “Unaffordable Prescription Drugs: The Real Legacy of the Hatch-Waxman Act.” STAT, December 16. https://www.statnews.com/2020/12/16/unaffordable-prescription-drugs-real-legacy-hatchwaxman-act.

- IQVIA Institute for Human Data Science. (2021). “The Use of Medicines in the U.S.: Spending and Usage Trends and Outlook to 2025.” May 27. https://www.iqvia.com/insights/the-iqvia-institute/reports/the-use-of-medicines-in-the-us.

- IQVIA, 2021.

- Centers for Medicare & Medicaid Services. (2020). “National Health Expenditure Data. Table 2: Aggregate and Per Capita Amounts, by Type of Expenditure.” https://www.cms.gov/Research-Statistics-Data-and-Systems/StatisticsTrends-and-Reports/NationalHealthExpendData.

- Association for Accessible Medicines. (2021) The U.S. Generic & Biosimilar Medicines Savings Reports. October. https://accessiblemeds.org/sites/default/files/2021-10/AAM-2021-US-Generic-Biosimilar-Medicines-Savings-Report-web.pdf.

- Engelberg, 2020.

- Pink Sheet. (1994). PCS Manages 21% of Retail Dispensed Prescriptions—Walsh America Data; Out-of-Pocket Scripts Dip Below 50% of Market, HMO Formulary Compliance Nears 90%. March 14.

- Lichtenberg, F., and S. Sun. (2007). The impact of Medicare Part D on Prescription Drug Use by the Elderly. Health Affairs, 26 (6). https://doi.org/10.1377/hlthaff.26.6.1735.

- Health Affairs. (2017). “Formularies.” Health Policy Brief, September 14. https://www.healthaffairs.org/do/10.1377/hpb20171409.000177.

- Engelberg, A. (2021) “Outdated Rule Increases Medicare’s Costs for Generic Drugs by $26 Billion a Year.” STAT, September 10. https://www.statnews.com/2021/09/10/outdated-rule-increases-medicare-costs-generic-drugs-26-billion-per-year.

- Authors’ calculation. Spending data from the National Health Expenditure Accounts (2019) at https://www.cms.gov/ResearchStatisticsDataandSystems/StatisticsTrendsandReports/NationalHealthExpendData/NationalHealthAccountsHistorical and population data from the U.S. Census Bureau (1984) at https://www2.census.gov/library/publications/1984/demographics/P25-959.pdf and (2019) at https://www.census.gov/newsroom/pressreleases/2019/popest-nation.html.

- DeRuiter, J., and P. L. Hobson. (2012). “Drug Patent Expirations and the ‘Patent Cliff.’” U.S. Pharmacist, June 20. https://www.uspharmacist.com/article/drug-patent-expirations-and-the-patent-cliff.

- IQVIA, 2021.

- Gagnon, M. A., and K. D. Volesky. (2017). “Merger Mania: Mergers and Acquisitions in the Generic Drug Sector from 1995 to 2016.” Globalization and Health, 13(1): 62. https://globalizationandhealth.biomedcentral.com/articles/10.1186/s12992-017-0285-x.

- Berndt, E. R., R. M. Conti and S. J. Murphy. (2017). “The Landscape of US Generic Prescription Drug Markets, 2004-2016.” National Bureau of Economic Research Working Paper No. 23640. July. https://www.nber.org/papers/w23640.

- U.S. Food and Drug Administration Drug Shortages Task Force. (2019). Drug Shortages: Root Causes and Potential Solutions. https://www.fda.gov/media/131130/download.

- Johnson, L. A. (2021). “Groups Make Own Drugs to Fight High Drug Prices, Shortages.” Associated Press, August 10. https://apnews.com/article/healthscience-business-drug-prices-4f89f4aef1aebf6cef72f0f9acb3ed8f.

- Kamal, R., C. Cox and D. McDermott. (2019). “What Are the Recent and Forecasted Trends in Prescription Drug Spending?” Peterson-KFF Health System Tracker. February 20. https://www.healthsystemtracker.org/chart-collection/recent-forecasted-trends-prescription-drug-spending.

- Frank, R. G., A. Hicks and E. R. Berndt. (2021). “The Price to Consumers of Generic Pharmaceuticals: Beyond the Headlines.” Medical Care Research and Review, 78 (5): 585–90. https://journals.sagepub.com/doi/abs/10.1177/1077558720921100.

- Trish, E., L. Gascue, R. Ribero, K. Van Nuys and G. Joyce. (2021). “Comparison of Spending on Common Generic Drugs by Medicare vs Costco Members.” JAMA Internal Medicine, 181 (10): 1414–16. https://jamanetwork.com/journals/jamainternalmedicine/article-abstract/2781810?guestAccessKey=89d9de51-fc11-4451-97aa-90b352b7867b.

- Fein, A. (2021). “The Top Pharmacy Benefit Managers of 2020: Vertical Integration Drives Consolidation.” Drug Channels, April 6. https://www.drugchannels.net/2021/04/the-top-pharmacy-benefit-managers-pbms.html.

- Van Nuys, K., G. Joyce, R. Ribero and D.P. Goldman. (2018). “Frequency and Magnitude of Co-payments Exceeding Prescription Drug Costs.” JAMA, 319 (10): 1045–47. https://jamanetwork.com/journals/jama/article-abstract/2674655.

- Jaffee, S. (2018). “No More Secrets: Congress Bans Pharmacist ‘Gag Orders’ on Drug Prices.” Kaiser Health News, October 10. https://khn.org/news/no-more-secretscongress-bans-pharmacist-gag-orders-on-drug-prices.

- Kreling, D. (2000). “Cost Control for Prescription Drug Programs: Pharmacy Benefit Manager (PBM) Efforts, Effects, and Implications.” Assistant Secretary for Planning and Evaluation. https://aspe.hhs.gov/cost-control-prescription-drug-programs-pharmacybenefit-manager-pbm-efforts-effects-implications.

- Yost, D. (2018). Ohio’s Medicaid Managed Care Pharmacy Services: Auditor of State Report, August 16. https://audits.

ohioauditor.gov/Reports/AuditReports/2018/Medicaid_Pharmacy_Services_2018_Franklin.pdf. - Association for Accessible Medications. (2021). “New Generics Are Less Available in Medicare Than Commercial Plans,” July. https://accessiblemeds.org/sites/default/files/2021-07/AAM-New-Generics-Are-Less-Available-in-Medicare-2021.pdf.

- Socal, M.P., G. Bai and G. F. Anderson. (2019). “Favorable Formulary Placement of Branded Drugs in Medicare Prescription Drug Plans When Generics Are Available.” JAMA Internal Medicine,179 (6): 832–33. https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2728446.

- Fein, 2021.

- Association for Accessible Medicines, 2021.

- Trish et al., 2021.

- IQVIA, 2021.

- Smith, A. (2020) “Transparent vs. Traditional Pharmacy Benefit Management (PBM).” Sana Blog, September 14. https://sanabenefits.com/blog/transparent-vs-traditionalpharmacy-benefit-management-pbm.

You must be logged in to post a comment.