Editor’s Note: This analysis is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between Economic Studies at Brookings and the University of Southern California Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national healthcare debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings.

For more than a year, Georgia policymakers have been pursuing a 1332 waiver that would make major changes to the way Georgians access affordable health insurance. Two prior waiver proposals from the state suffered from major deficiencies that made clear the federal government could not lawfully approve the state’s plan. Georgia is now on its third attempt, but has still failed to offer a vision that is permissible under the statute. While the most recent iteration avoids some of the more serious pitfalls of prior versions, it still does not comply with the statutory “guardrails” for 1332 waivers. Specifically, despite the state’s claims to the contrary, the waiver proposal would likely cause tens of thousands of Georgia residents to lose their health insurance coverage, especially in the first year, and therefore fails to satisfy the statutory requirement that a 1332 waiver may not decrease the number of people with health insurance coverage. The proposal’s analysis also entirely omits the consideration of factors that will increase premiums in the state. Further, the waiver proposal continues to suffer from procedural deficiencies that would make it unlawful for the federal government to approve the state’s application. On August 17, 2020, the Trump Administration deemed the application complete and opened a 30-day period for public comment, running through September 16. The waiver may not lawfully be approved, and the application in fact fails to satisfy the completeness requirements.

Georgia’s Prior Proposals and the Current Submission

Georgia has been pursuing sweeping changes to its individual health insurance market since early 2019, and is now on its third 1332 waiver proposal. The first iteration, released in November 2019, proposed allowing the sale of individual market health plans that did not offer all of the ACA’s mandated Essential Health Benefits. It also would have converted the ACA’s open-ended premium tax credit into a capped, state-administered financial assistance program that would place consumers on a waitlist when funding ran out. Using modest assumptions, experts estimated that this proposal would cause 110,000 Georgians to lose financial assistance (and therefore, in all likelihood, their health coverage). Such a waiver clearly violates the statute and cannot be approved by the federal government. In December 2019, the state proposed a new plan: benefit requirements would remain unchanged, but plans would be permitted to impose deductibles and other cost-sharing more than $5,000 greater than otherwise allowed under the ACA. This second iteration also proposed limiting financial assistance and using a waitlist when funding ran out; it was also expected to cause coverage losses and reduce the affordability of coverage, and it violated a number of other legal requirements for ACA waivers.

Both prior waiver proposals would have ended the state’s use of the HealthCare.gov enrollment platform. But they did not set-up a State-Based Marketplace (SBM) in its place. Instead, Georgia said it would operate a state-run eligibility engine but would outsource all consumer-facing activities to private web-brokers and insurance companies. That is, consumers who wanted to enroll would be required to use the website of one of several competing private companies to complete an application and select a plan; the state’s role would be limited to “back-end” functions like verifying eligibility and maintaining official records of enrollment.

The state’s latest waiver proposal, released in July 2020, does not propose making changes to benefits, cost-sharing, or financial assistance, so traditional ACA-regulated plans will continue to be sold to Georgia consumers with the standard financial assistance under the law. However, the new version continues to propose eliminating HealthCare.gov as an option for Georgia consumers but not replacing it with an SBM. Indeed, this change in enrollment platform is now the entirety of the proposal’s Georgia Access Model.[1] As in prior iterations, Georgia consumers will be required to shop on the websites of private vendors if they want to enroll in ACA coverage. Notably, these private vendors already sell plans in Georgia (and other states) as a complement to HealthCare.gov through a process called Direct Enrollment. Therefore, the waiver proposal does not create any new options for Georgia consumers to enroll; it simply takes away the HealthCare.gov option. The state proposes to regulate vendors in a manner “similar” to existing federal regulation, with the notable exception of allowing these vendors to market plans that do not comply with ACA requirements alongside Marketplace plans.

Georgia’s most recent waiver proposal certainly avoids some of the shortcomings of prior versions. However, it is still proposing a major change to the way Georgia consumers shop for and obtain health insurance. A state cannot obtain a waiver under section 1332 unless it provides coverage to “at least a comparable number of its residents” as existing law, and as described in the following section, Georgia’s proposal cannot satisfy that condition.

The Transition Away From HealthCare.Gov Will Likely Reduce the Number of Georgians With Coverage

Georgia’s waiver proposal contains an economic and actuarial analysis that purports to show that 25,000 state residents will gain coverage under the waiver. Specifically, the state asserts 33,000 new individuals will enroll and 8,000 existing consumers will lose coverage. Both of these figures are based on entirely unsupported assumptions, and more realistic analysis reflects that the waiver should be expected to reduce – not increase – the number of people with coverage.

Let’s begin with the state’s assertion that by disallowing enrollment on HealthCare.gov and moving entirely to private vendors, the waiver will draw 33,000 new consumers. The purported mechanism for this new enrollment is as follows:

Allowing multiple, private web-brokers to participate will create competition and provide market incentives to offer improved plan/product selection and enrollment assistance, as well as local, customized customer service to attract uninsured individuals into the market. Web-brokers are typically paid on commission for enrollment, creating strong market incentives to provide education and outreach to drive enrollment and reduce the number of uninsured without cost to the state.

But that explanation fundamentally misstates what the waiver proposal does as compared to current law. As other parts of the application discuss, web-brokers are already allowed to sell Marketplace plans, and already receive commissions for doing so. Indeed, they are a growing feature of Georgia’s enrollment landscape, encompassing 21% of the state’s enrollment for plan year 2020. The state does not contemplate providing any additional inducement or advantages for web-brokers or other private entities; to the contrary, it repeatedly emphasizes that it will build on existing functionality and establish operating standards “similar” to current policy. That is, to the extent private entities face “market incentives” to drum up new enrollment, those incentives already exist, and nothing in the application creates new incentives that could plausibly bring in new business.

Other parts of the application seem to acknowledge this fact. The state explains that it calculated the supposed 33,000 gain by trending forward past growth in enrollment through private vendors. Specifically, between 2018 and 2020, the share of enrollments through private online vendors increased from 13% to 21% – an increase of 4 percentage points per year. If that growth was repeated between 2020 and 2022, the state, claims that would mean about 33,000 additional private-vendor enrollments in 2022 as compared to 2020. Therefore, the state says, the waiver will bring in 33,000 new consumers.[2]

But this reasoning is nonsensical for several reasons. First, it conflates two different and uncorrelated measures: the share of enrollment that occurs privately (which has increased), and the total amount of enrollment (which they assert will increase in the future). There is no reason to assume such a relationship. Indeed, if HealthCare.gov were eliminated, private enrollment would account for 100% of enrollment – an increase of 79 percentage points over the 2020 share – even if total enrollment dropped precipitously. Second, the state provides no explanation for why this increase would occur under the waiver but not absent the waiver. This is a basic error in applying 1332 rules, which gives credit only for changes that are contingent on the waiver. If the trend from 2018 to 2020 is expected to continue absent the waiver, then the waiver does not get credit for it. Finally, the state does not explain why the trend between 2018 and 2020 is likely to continue in the first place.

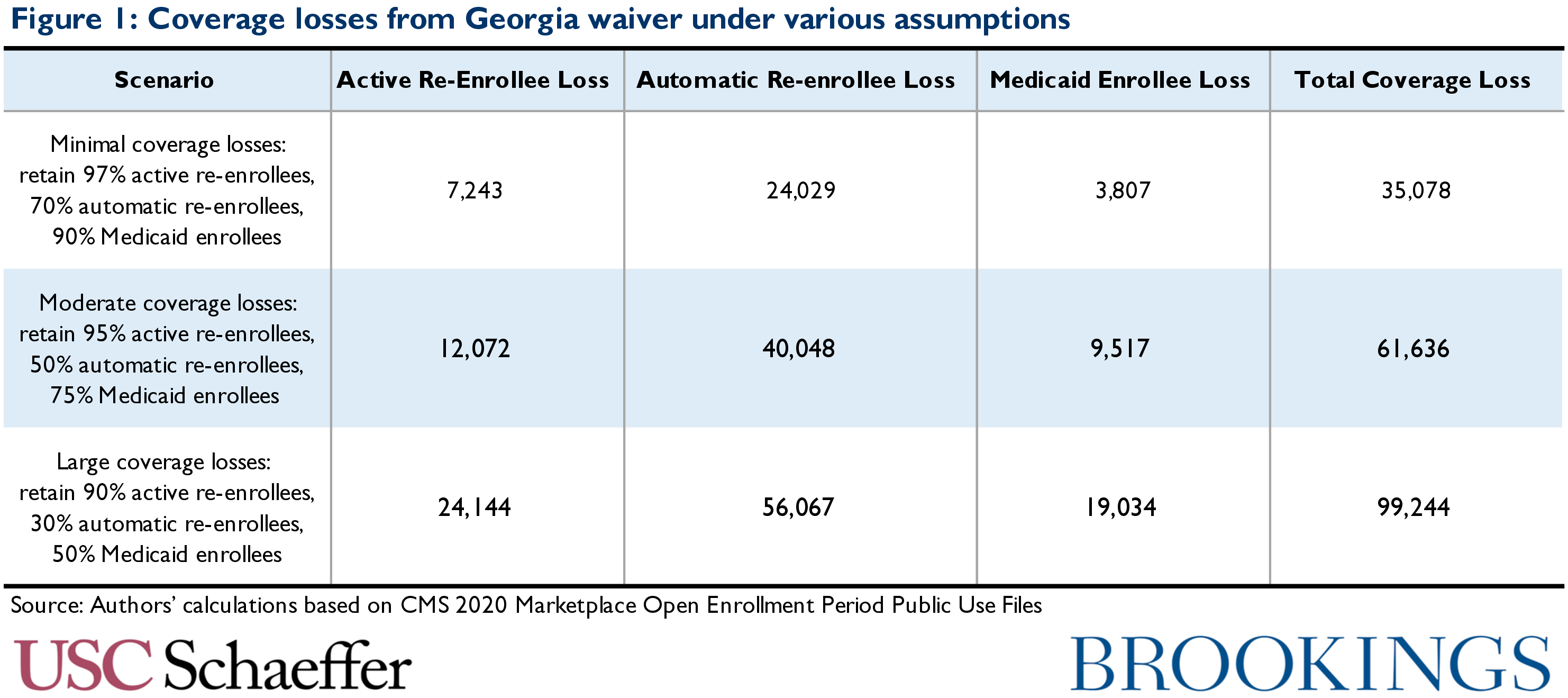

Georgia’s assumption that only 8,000 people would lose coverage without HealthCare.gov is equally implausible. As discussed, Georgia is not asking for a waiver to create a web-broker enrollment pathway; it is asking for permission to disallow consumers from using HealthCare.gov or any other Marketplace website. The abolition of HealthCare.gov is likely to lead to a loss of coverage much greater than 8,000. Transitioning away from HealthCare.gov would require all existing consumers to identify a private vendor platform, create an account, and complete a new enrollment; automatic re-enrollment would not be possible. But for 2020, more than 80,000 Georgia enrollees (25% of returning consumers) did not respond to HealthCare.gov’s repeated encouragement to make an active plan selection and instead were automatically re-enrolled in their coverage. If automatic re-enrollment were not possible, some fraction of this group might be motivated to seek out an active enrollment pathway, but assuming without evidence that 90% will do so is unreasonably optimistic. Moreover, even consumers who might normally make an active plan selection would need to find a new enrollment channel and navigate a new enrollment process – barriers that would likely cause some to drop out of the process. Indeed, even if 95% of previous active re-enrollees and 50% of previous auto-enrollees successfully navigate the new process, 52,000 people would still lose coverage. And the actual impact could be larger, as shown in Figure 1. Georgia’s engagement with these issues is limited to observing that “moving from the FFE to the Georgia Access Model will require a detailed transition strategy” – the state provides no information on what that detailed strategy might be.

The waiver proposal also does not address how the state would compensate for the Medicaid enrollment support provided by HealthCare.gov today. In recent years, during each annual open enrollment period about 40,000 Georgia consumers have visited HealthCare.gov and been assessed as eligible for Medicaid under existing eligibility rules. Thousands more likely receive a similar assessment outside of open enrollment, though data are not publicly available. When consumers are assessed as Medicaid-eligible, HealthCare.gov “transfers” those applications to the state Medicaid agency, which works with the consumer to complete enrollment. Private web-brokers, however, have no incentive to support this process. As Georgia repeatedly emphasizes, web-brokers are incentivized by commissions paid for private enrollments, but Medicaid does not pay commissions. Indeed, one investigation found that some web-brokers do very little to support Medicaid enrollment and may provide misleading information to Medicaid eligible individuals that deters them from enrolling. Eliminating HealthCare.gov in favor of web-brokers could therefore substantially reduce Medicaid coverage. As shown in Figure 1, even a 25% reduction in effective Medicaid enrollment during open enrollment could cause an additional 10,000 person reduction in the number of people with coverage under the waiver in each year.

Georgia could also face reduced enrollment on an ongoing basis as consumers struggle to complete administrative tasks necessary to retain their coverage. Consumers receiving ACA financial assistance must navigate a variety of complex enrollment tasks, including providing income documentation, and, in some cases, providing proof of tax filing. HealthCare.gov and SBMs today engage in extensive outreach to support consumers through these processes, but Georgia will not be assuming any of these outreach functions. Some of today’s web-brokers support consumers in these processes, but others do not. As a result, the transition off of HealthCare.gov could result in meaningfully less post-application support to help consumers maintain enrollment, further eroding coverage.

Finally, the foregoing assumes that Georgia successfully builds a new and unprecedented administrative apparatus in approximately one year on a budget of $6 million – far less time and far less money than the federal government and states had to stand up Marketplaces after the ACA’s passage. Given the technical complexity involved and past challenges, there is reason to be concerned about a smooth and timely launch.

But even taking the state’s numbers at face value, Georgia’s application also makes major errors in the timing of its enrollment effects. In particular, the waiver proposal models all effects as if they occur in the very first year of the waiver – the state’s assumed 33,000 person gain (associated with “market incentives”) and 8,000 person loss (associated with the “transition”) all occur in 2022. But while losses associated with the transition would in fact occur in the first year, gains would be expected to phase in over time, since the alleged gains presumably arise from web-brokers enrolling a slightly larger fraction of the reachable market at any given time. If one assumes the 33,000 gain phases in linearly over the 5 years of the waiver, then even on Georgia’s own terms coverage losses exceed gains in the first year of the waiver.[3]

To summarize, it is clear that Georgia’s waiver proposal cannot satisfy the requirements for approval of a waiver under Section 1332 of the ACA. The statute directs that to be approved a waiver must “provide coverage to at least a comparable number of its residents as” current law. The Trump Administration’s 2018 guidance on waivers further explains a waiver can be approved only if “for each year the waiver is in effect, the state can demonstrate that a comparable number of state residents eligible for coverage under title I of PPACA will have health care coverage under the section 1332 state plan as would have had coverage absent the waiver” (emphasis added).[4] Georgia suggests that 25,000 people will gain coverage under the waiver, but that claim is unwarranted for three distinct reasons:

- The state offers no plausible support for the assumption that 33,000 additional consumers will enroll, or, indeed, that any additional consumers will enroll because of the waiver.

- The state’s assertion that only 8,000 people will lose coverage is inconsistent with available evidence. Simple modeling based on the most recent enrollment period (with assumptions very favorable to the state) suggest more than 50,000 Marketplace and 10,000 Medicaid consumers could be lost.

- Even taking the state’s figures at face value, coverage losses would still be expected to exceed coverage gains in the first year of the waiver.

The Waiver Application Makes Other Major Analytic Errors

Beyond the state’s problematic assumptions about the coverage impacts of the waiver, the actuarial and economic analyses included with Georgia’s waiver submission make several other major analytic errors. These errors or so severe that they render the analyses incapable of meeting a variety or requirements in the statute and applicable regulations and underscore that the submission cannot provide a basis for approval.

Fails to consider premium impacts of increased broker commissions. Transitioning all enrollment to private vendors (most of whom are commission-supported) is likely to meaningfully increase the total volume of broker commissions paid in Georgia, which will in turn increase premiums. As of 2018, 42% of HealthCare.gov enrollments were supported through a broker (either a web-broker or otherwise), which means that insurers were required to pay commissions on less than half of their enrollees. While that figure may have risen somewhat in the intervening years, there is likely still a significant fraction of enrollment that occurs without a commission. But under Georgia’s proposal, insurers would pay a commission for the much larger volume of consumers enrolling via web-brokers. Further, consumers who do not enroll through brokers must enroll through an insurer’s website, which the insurer also must support financially. The cost of broker commissions and the insurer’s own enrollment infrastructure is baked into premiums, so an increase in these costs would directly increase premiums in the state. Yet despite touting the importance of commissions in enrollment throughout the waiver application, the state never considers this obvious premium impact. Indeed, the state repeatedly notes that broker-supported enrollment is “without cost to the state” – but neglects to consider who those costs are passed on to.[5]

Increased premiums will meaningfully affect the calculation of deficit neutrality under the waiver and must be accurately modeled in order to be offset against other deficit impacts associated with Georgia’s proposal. It also could affect the calculation of affordability under the waiver and may feed into further losses in coverage.

Fails to consider premium impacts associated with increased marketing of non-compliant plans. The waiver is likely to lead to an increase in enrollment in non-compliant plans, which will also increase premiums for compliant plans. Specifically, while Georgia’s waiver application generally anticipates that private vendors selling Marketplace coverage will be required to comply with standards that are “similar” to those partnering with HealthCare.gov, there is one notable exception: Georgia will allow private vendors to display plans that do not comply with ACA consumer protection requirements alongside regulated plans. (Under current law, the same vendors can sell both types pf plans, but must display them separately.) The state explains its rationale as follows:

By enabling diverse plan types to be offered side-by-side with QHPs and Catastrophic Plans, consumers will be able to view the full range of options available to them within the State and select a plan that best suits their needs and price point. The goal is to increase healthcare coverage options across the State without eroding the QHP market to provide consumers with expanded options.

This statement (and the rest of the waiver proposal) fails to acknowledge the trade-offs that are inherent in this approach. It is not possible to promote underwritten and non-compliant plans that the state believes some consumers will prefer without “eroding” the regulated market – if healthy enrollees can receive lower premiums from underwritten plans, that will, axiomatically, worsen the ACA risk pool and increase premiums. This is the trade-off associated with the promotion of non-compliant products, and, indeed evidence on web-broker operations to date suggests that some web-broker entities are likely to aggressively promote unregulated plans given their larger commissions. The state entirely ignores these premium impacts in their consideration of the waiver. As above, this failure means that the state’s deficit neutrality, affordability, and coverage analysis are also inadequate.[6]

Makes unsupported risk profile assumptions. The waiver analysis also makes unsupported assumptions about the relative health risk of individuals leaving the market due to transition difficulties. In two other contexts, the federal government has examined the age profile of those losing coverage due to administrative obstacles, and found that young people are about 25% less likely than older people to respond to requests for documentation. This suggests that people losing coverage during the transition to web-broker driven enrollment (likely to number in the tens of thousands, as described above) will be younger and healthier than those who remain. Yet the state does not mention this impact in discussing the group that would lose coverage. In addition, the state assumes that 88% of new enrollment would be into bronze plans, and that the risk profiles of those enrolling into bronze plans would match those of current bronze enrollees – with by far the best profiles of any metal level.[7] By contrast, only 21% of 2020 enrollees selected bronze plans. No explanation is given for this assumption.

Miscalculates user fee impacts. As in prior versions of the waiver, the state asserts that the state’s migration away from HealthCare.gov will not affect federal administrative costs. As we have argued elsewhere, this is incorrect. Some HealthCare.gov functions entail fixed costs, and so the absence of HealthCare.gov user fees from Georgia will not be fully offset by reduced operating costs. The federal government is clear that such costs must be accounted for in deficit neutrality calculations, and the state fails to do so.

Conflates with- and without-waiver impacts. As noted above, in modeling the waiver coverage gains, the analysis trends forward data on the current performance of web-brokers. These are effects under current law and would be expected to occur in the absence of the waiver. But the analysis treats that as a “with waiver” impact despite the fact that it should be reflected in the “without waiver” baseline.

Lacks a plausible sensitivity analysis of coverage impacts. The application also foregoes any plausible sensitivity analysis of the coverage impacts of the waiver. It asserts without evidence a net gain of enrollment of 25,000 people as described above, and then models alternative scenarios where either 15,000 or 35,000 additional people enroll – and uses those alternative scenarios to claim that the analysis is robust to potential losses of coverage. But simply assuming a coverage gain does not, in fact, actually demonstrate that the waiver will result in increased coverage.

The Waiver Application Suffers From Procedural Deficiencies That Render It Unapprovable

The analytic deficiencies described above create significant procedural issues that make it unlawful for the federal government to approve Georgia’s waiver (or even deem it complete) and are compounded by other procedural problems with the waiver.

First, the submission Georgia has provided does not meet federal criteria for a complete waiver application. Therefore, it was not lawful for the federal government to have declared it complete and proceed to the next phase of waiver consideration, and it cannot serve as the basis for approval. Specifically:

- The waiver proposal does not include adequate actuarial and economic analyses. Federal regulations require analyses that “support the State’s estimates” of coverage, affordability, comprehensiveness, and deficit neutrality under the waiver. The documents provided by the state fail to do so. As described in detail above, the state makes entirely unsupported (and unsupportable) claims about coverage gains and losses, neglects to consider important and obvious factors that will raise premiums in the state and makes other related errors. The analyses provided by the state fail to meet the standards for actuarial and economic analyses under the regulation.

- The waiver proposal fails to specify the provisions of federal law it seeks to waive. The regulations require that an application must include “a list of the provisions of law that the State seeks to waive including a description of the reason for the specific requests.” Georgia does not do so. It simply states that “Section 1311 would be waived only to the extent that it is inconsistent with the operation” of the proposal. Elsewhere, the state offers, “Georgia is requesting waiver of Section 1311 in part, to provide the State flexibility to determine the operations to best support its innovative consumer-centric model…. Georgia will remain in full compliance sections of PPACA that are not waived.” But section 1311 is a massive and multifaceted provision with over 100 subsections, paragraphs, and clauses. It includes not only extensive standards for Marketplaces but also rules on CMS responsibilities, plan certification, navigators, quality improvement, and mental health parity. Thus, Georgia does not make “specific requests” for provisions it seeks to waive as required by the regulations, nor does it include “a description of the reasons for the specific requests.” This basic omission renders the waiver incomplete and unapprovable. It also makes it impossible for the federal government or stakeholders to judge whether the state will, in fact, be in “full compliance” with portions of the law not waived – since it is not clear what provisions are encompassed.

- In important respects, the application also fails to include an adequate description of the state’s waiver plan. A complete proposal must include “comprehensive description of the… program to implement a plan” under Section 1332. Georgia has certainly articulated a vision – removing the state from HealthCare.gov and shifting operations to private vendors. But it says very little about how this program would operate. The application briefly notes that the state will take on a variety of complex functions around maintaining enrollment records and reconciling data with plans and with the IRS – but it does not describe how it will conduct or fund those initiatives. Indeed, it is unclear the extent to which the state is even aware of the complexity of the operational processes it proposes to undertake. Similarly, as noted above, the state offers that it will have a “detailed transition strategy” but does not tell stakeholders or the federal government what it will be. These are not mere details; they are critical to the successful operation of the plan as Georgia envisions it, and without further explanation the application cannot satisfy the standard for a “comprehensive description.”

Second, the state has not conducted an adequate public comment period. Regulations require that, prior to submitting the application, the state provide “a public notice and comment period sufficient to ensure a meaningful level of public input.” (This is in addition to the requirement for the federal government to provide a comment period following the application’s submission.) But Georgia offered only 15 days for public comment on its proposal. While the federal government has not specified a minimum time period, it has noted that complex waivers will require longer comment periods in order to be “meaningful.” Given that Georgia proposes to disrupt existing arrangements for hundreds of thousands of people who currently shop through HealthCare.gov, additional time is required for comment to be considered meaningful, and, indeed, many commenters made that very clear in their own submissions to the state. Nor can the state rely on the public comment period it conducted in 2019 on a prior waiver proposal. Public comment was provided on an entirely different proposal that affected EHB and financial assistance, and would not be reflective of stakeholder concerns or feedback on the current set of ideas.

Finally, we have argued elsewhere that Georgia lacks the necessary legal authority to implement the waiver it proposes because the state has not enacted authorizing legislation. Georgia has enacted legislation allowing the state to apply for a waiver, but state statute does not authorize the state to implement this specific set of waiver proposals. Under the statute and regulations, the federal government cannot approve a waiver unless the state has adequate authority, and Georgia also fails that test.

Better Solutions Are Available

Ultimately, it is unclear what problem Georgia’s waiver is intended to solve. The proposal’s narrative highlights the 1.5 million Georgians who remain uninsured, “one of the highest” uninsured rates in the country, and bemoans the drop in enrollment in the Marketplace in the early years of the Trump Administration. The state insists that coverage “will continue to decline” across the state absent the waiver. But, in fact, between 2019 and 2020, premiums fell in the individual market and enrollment in the Marketplace increased. Preliminary rate information suggests premiums in the individual market will continue to drop in 2021.

Georgia has proposed a waiver that by their own analysis will capture less than 2% of the uninsured in the state, and, in fact, should be expected to cause large losses in coverage – exacerbating the problem they claim to address. If Georgia wants to make meaningful progress in reducing it’s uninsured rate, it should expand Medicaid so that 518,000 uninsured Georgians below 138% of the federal poverty level can access affordable coverage.

Footnotes

- All three iterations of the waiver have proposed a reinsurance program, similar to that operated in other states; the reinsurance provisions are generally not a focus of this analysis.

- As the state explains, “While the FFE has experienced declining enrollment, DE/EDE vendors have experienced increasing enrollment over the last couple of years, both nationally and within Georgia. Infrastructure has continued to improve and DE/EDE has been promoted by HHS guidance as an enrollment pathway. Proxy DE began in 2018 and accounted for 13% of enrollments within Georgia’s marketplace; EDE began in 2019 and the combined DE/EDE partners represented 15% of total enrollment in 2019 and 21% in 2020 accounting for 88,351 consumers enrollments. This is an average of 4 percentage points growth over the past two years. Assuming this trend continues, this percent will grow to 29% by PY22 or increase by 33,658 (122,009 = 88,351 / 21% * 29%).”

- Nor does the reinsurance program compensate for these effects. Georgia’s reinsurance program is estimated to increase enrollment by less than half a percent, or 1,500 people in the waiver’s first year.

- We and others have argued elsewhere that the 2018 guidance is itself unlawful for procedural and substantive reasons.

- Nor can Georgia point to the absence of Marketplace user fees as an offsetting effect; Georgia will continue to collect a user fee and use it to fund the reinsurance program in the state.

- Waiving the ACA’s standards to promote the sale of non-compliant plans also likely violates section 1332’s comprehensiveness guardrail, which requires waivers to “provide coverage that is at least as comprehensive as the coverage” under the ACA. Guidance promulgated by the Administration in 2018 purports to judge compliance with the comprehensiveness guardrail by assessing the coverage made “available” to consumers, rather than the coverage consumers actually obtain. This interpretation is inconsistent with the statute. If the waiver proposal is measured against the statute – as it must be – then the fact that the waiver will intentionally facilitate the purchase of unregulated and limited coverage among people who would otherwise obtain comprehensive coverage generates a facial violation of the comprehensiveness guardrail.

- Specifically, Georgia assumes metal-level-specific risk scores of 0.902, 1.764, and 2.160 for Bronze, Silver, and Gold respectively.

You must be logged in to post a comment.