April 22, 2021

Schaeffer Center fellows have long championed innovative prescription drug payment models and reforms, urging policymakers and private sector leaders to look to value-based options such as pay-for-performance or subscription models. While much work remains to be done, federal and state leaders have heeded this call for innovation. Through timely analysis, peer-reviewed publications, op-eds, and media engagement, the Schaeffer Center has and will continue to be the go-to resource for insight and policy solutions focused on innovative payment models for prescription drugs.

Learn More:

Informing the Debate: Diagnosing the Issue

When it comes to healthcare, all can agree that we should pay for “value.” But how one defines value often depends on where they sit and what their incentives are. For payers, including employers, health insurers and the government, value often means short-term savings over long-term financial or health benefits. This might lead payers to limit access to expensive drugs even though doing so leads to worse health outcomes and higher long-term costs.

Consider an employer’s drug formulary, for example. As branded drug prices have risen, employers have shifted costs to patients by placing these drugs on higher formulary tiers. In many cases, drug tiering incentivizes patients to switch to less expensive generic drugs, but it can also lead to reduced access, worse health outcomes, lower productivity, and higher healthcare costs for medicines that do not have a cheaper option.

Government price controls are another often-cited solution to addressing high costs. Schaeffer Center experts have shown that price controls would harm long-term population health by reducing incentives for drug development. These long-term effects are often masked during the legislative process, leaving members of Congress without the information needed to consider these tradeoffs and weigh the short- and long-term consequences of drug pricing proposals.

Our best estimate — published in the journal Health Affairs — is that once controls are fully implemented, life expectancy at older ages would be reduced by about 3%. This may not seem like a lot, but that is similar to the effect if the U.S. “forgot” how to reopen blocked cardiac arteries after a heart attack.

Dana Goldman, writing in STAT

Raising this issue in an op-ed for STAT, Dana Goldman argued the Congressional Budget Office’s (CBO’s) 10-year budget window underestimates the long-term impact proposed federal legislation that would cap drug prices will have on new drug development and innovation. This is because the process to develop and win approval for new drugs can take 15 years. The 10-year budget window thus misses the window when new legislation might have its most significant effects. Schaeffer experts and their colleagues have raised similar concerns about the long-term effects of global budget caps on innovation.

Chronic “short-termism” in the healthcare system is among the reasons why Schaeffer Center experts have encouraged policymakers and the private sector to rethink what it means to promote value in healthcare and to invest in long-term solutions. Below are just some of the examples of innovative payment models that could help meet these needs.

Policy Solution: Pay-for-Performance Models for Prescription Drugs

Clinical pay-for-performance programs, such as Medicare’s hospital value-based payment program, are generally uncontroversial and accepted as key to improving quality and outcomes. Schaeffer Center experts argue that similar initiatives for prescription drugs—where reimbursement remains dominated by price-per-dose payments—are long overdue.

Yet, our nation’s pharmaceutical manufacturers and health insurers have traditionally priced drugs per dose rather than by effectiveness. This can distort the incentives for payers and patients — as in the case of standalone Medicare drug plans that actually penalize insurers for encouraging patient adherence. As an alternative to the price-per-dose approach, value-based pricing seeks to better align incentives between payers and providers. The system links pricing to a drug’s benefits as demonstrated in clinical trials and other data-driven methods that are reproducible and transparent.

Citing a new class of cardiovascular drugs known as PCSK9 inhibitors, Goldman and Darius Lakdawalla argued that the dominant price-per-dose model is outdated and limited for many types of drugs, especially novel drugs. As they explain, drug manufacturers set a single price for each dose based on the expected (not actual) value to the group of patients that stands to gain the most—even though the clinical benefits of a new drug vary across patient groups. When the expected value to some patients is high, it leads to high prices for every patient, including those who stand to gain only moderate amounts from a new drug. High prices, in turn, lead payers to restrict access and impose high cost-sharing even for high-need patients.

A pay-for-performance model offers a different path. Under this model, a payer and a drug manufacturer agree that reimbursement will be tied to achieving certain clinical outcomes. If, for instance, a new PCSK9 inhibitor does not reduce mortality or strokes as the drug manufacturer claims it will, the manufacturer bears some financial risk. This model better aligns incentives between payers and clinicians, to the benefit of patients. Payers only pay high prices for new drugs or treatments that work. And innovators know that they will be compensated if their intervention works, which incentivizes the further development of new cures and treatments.

Ultimately this kind of system, which elevates the hard proof to the market, will enhance competition and that will bring down prices.

David Agus and Dana Goldman, writing in Fortune

Beyond PCSK9 inhibitors, Schaeffer Center fellows have highlighted the potential of pay-for-performance contracting for oncology drugs and other expensive biopharmaceuticals. They have also urged policymakers and the private sector to consider postponing major financial rewards until a drug’s efficacy is established, which would allow each drug to be priced based on its clinical benefits.

Policymakers and the private sector have slowly embraced pay-for-performance models for prescription drugs. For instance, Harvard Pilgrim Health Care agreed to pay the full price for Amgen’s PCSK9 inhibitor if Amgen fully refunded the cost of the drug for patients who had a stroke or heart attack. Federal officials at the Centers for Medicare and Medicaid Services (CMS) explored a similar arrangement for a first-of-its-kind gene therapy used to treat leukemia. Although this arrangement was later abandoned, CMS agreed to pay the full price of the drug only if patients responded to it by the end of the first month of therapy.

Questions have been raised about the effectiveness of some pay-for-performance agreements, suggesting additional study may be needed. But public and private payers—from state Medicaid programs in Colorado, Michigan, and Oklahoma to insurers like Aetna and UPMC Health Plan—continue to pursue these novel models for drugs to treat conditions that include seizures, retinal dystrophy, skin infections, and heart attacks.

Policy Solution: Revisiting the Medicaid “Best Price” Rule

“The law here is complex, and moving to a pay-for-value model for drugs will require close coordination between manufacturers, payers and regulators,”

Darius Lakdawalla and his coauthors write in the Journal of Health Politics, Policy, and Law.

Under federal law, drug manufacturers must extend their lowest, “best price” offer to state Medicaid programs. This means that state Medicaid programs can always buy a drug at the cheapest price at which the manufacturer can afford to sell.

Schaeffer Center experts have argued that this best-price rule is well-intentioned but contributes to market dysfunction by inflating drug prices in the private sector. If a large share of the drug manufacturer’s patients are Medicaid enrollees, the manufacturer is incentivized to charge higher private sector prices to collect a higher best price payment from state Medicaid programs. By incentivizing higher, not lower prices, the best rule undermines—or at least creates uncertainty for—payers and manufacturers that want to pursue value-based contracting.

CMS agreed and recently amended the best price rule to further enable value-based contracting in Medicaid and beyond. CMS noted that the prior rule “hinder[ed] providers, insurers and prescription drug manufacturers in their efforts to develop innovative payment models for new drug therapies and other innovative treatments

Policy Solution: The Netflix Model

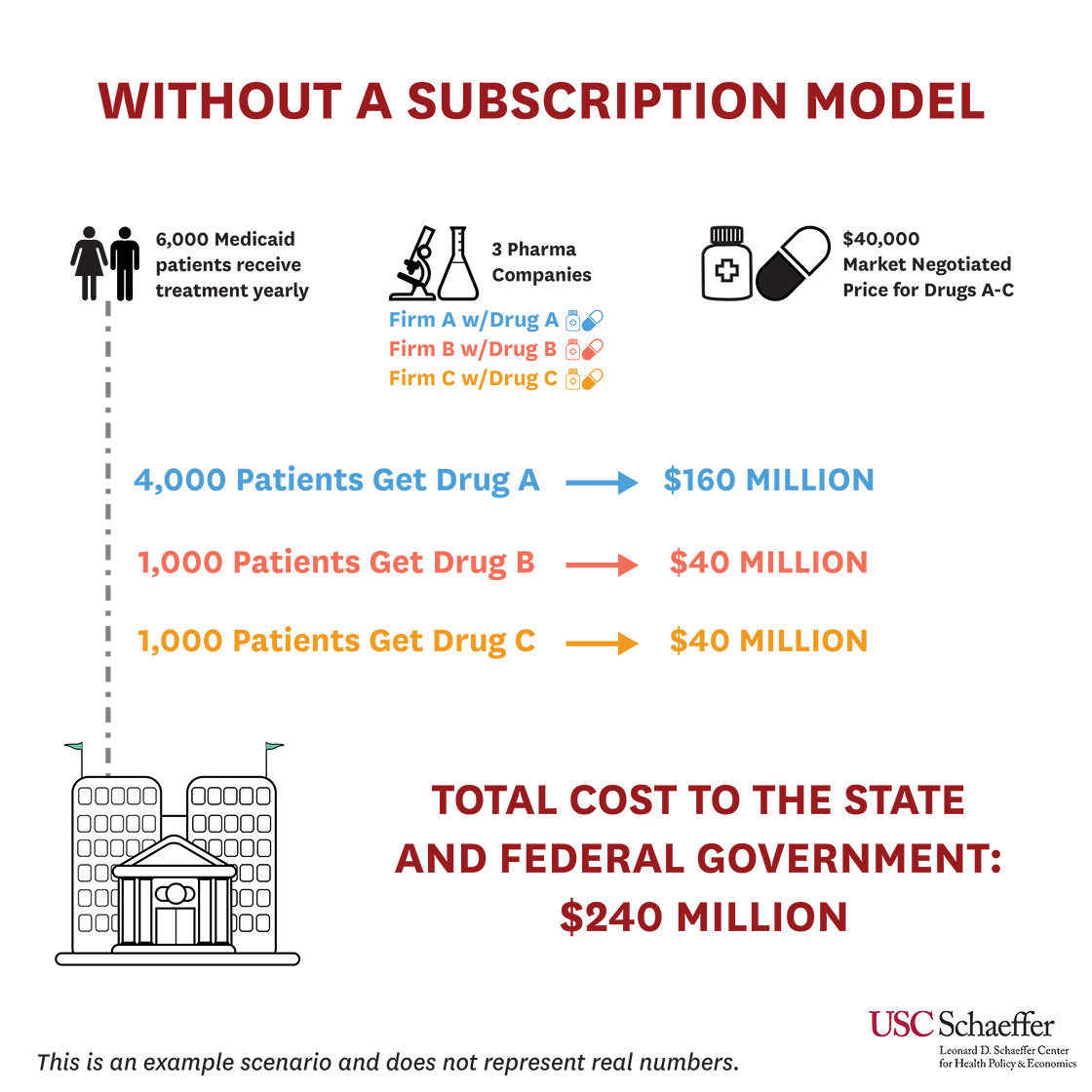

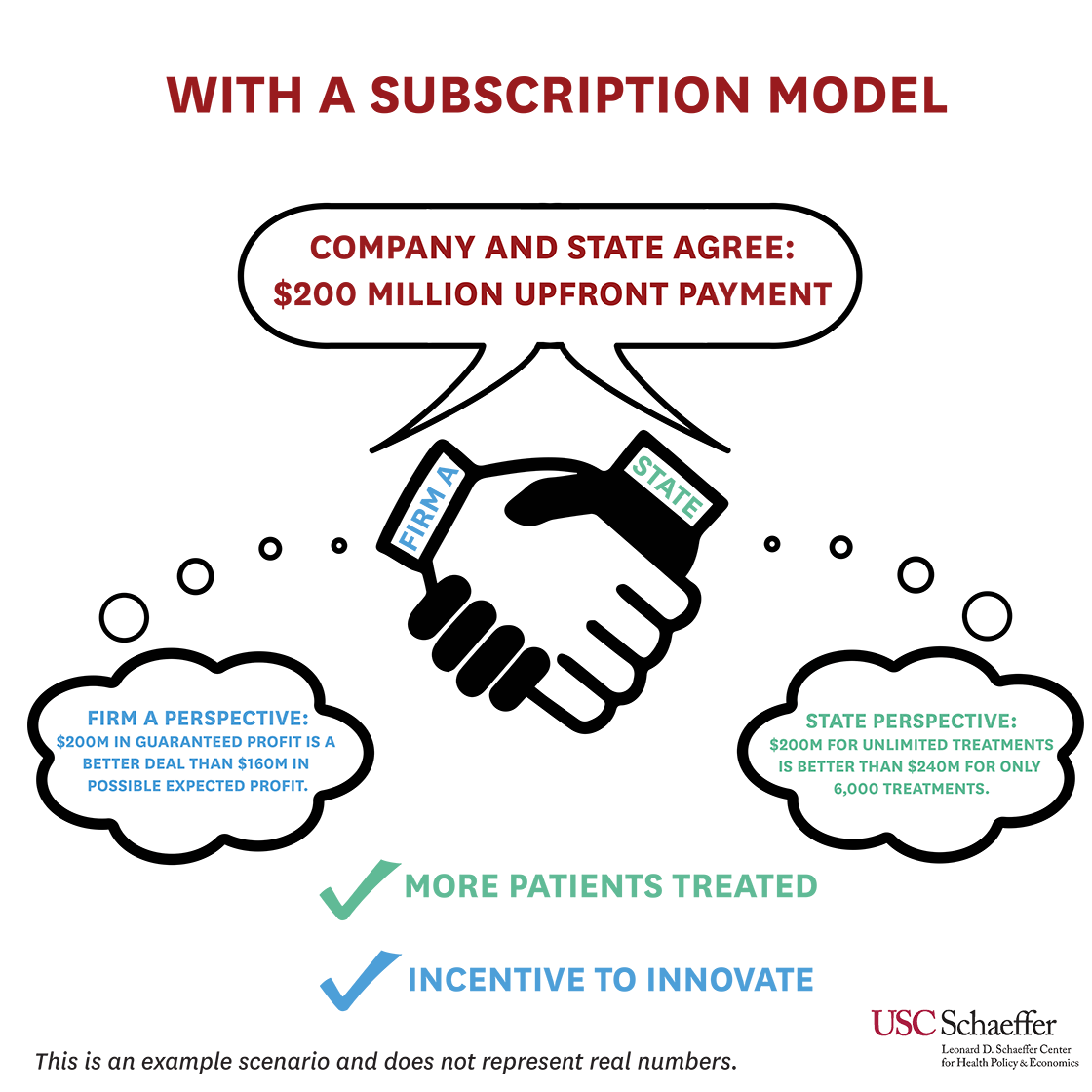

Schaeffer Center experts have also developed and analyzed drug license or subscription models—also known as the Netflix model—since at least 2008. Under the licensing model, individuals could purchase an annual drug license that would provide unfettered access to a clinically optimal number of, say, statin prescriptions each year. This model, Dana Goldman and colleagues argued, provides a better balance of patient access, payer costs, and drug manufacturer profitability.

New blockbuster treatments for hepatitis C—which afflicts nearly 3 million Americans and can lead to liver failure and death—presented an opportunity for state Medicaid programs to test this hypothesis. These new drugs are highly effective but expensive, leading some states to restrict access except for the sickest patients. Restrictions were devastating: in Louisiana, only 384 patients were treated in 2017 even though an estimated 35,000 Medicaid beneficiaries had the hepatitis C virus. In response to these concerns, Neeraj Sood and colleagues argued that a novel state-based strategy was needed and that CMS’s best-price rule, discussed above, should be addressed in enabling states to use this model.

State and federal officials agreed, recognizing that existing efforts would not be enough to eradicate hepatitis C. In 2019, Louisiana, with CMS’s blessing, launched a modified subscription model where the Department of Health and the Department of Corrections would pay a fixed price per treatment to Gilead Sciences up to a certain cap. Once that cap is reached, Louisiana will receive additional treatments at no cost through the end of 2024, with the goal of treating at least 30,000 people by then. Louisiana’s model was discussed at length during a 2019 Schaeffer Center event that featured Louisiana Department of Health Secretary Rebekah Gee, Sood, and other policymakers and experts.

Louisiana is not alone. Other states—including Colorado, Michigan, Oklahoma, and Washington—have explored or adopted the subscription model for hepatitis C and other costly treatments. This model is particularly attractive for states because treatment costs are predictable from one year to the next. Assuming the Netflix model remains successful, states could extend it to other types of drugs, such as naloxone and pre-exposure prophylaxis. In the meantime, manufacturers of other therapies, such as insulin, may soon offer subscription models for their products as well.

On the Horizon: The Future of Innovative Payment Models

Realignment of incentives has never been more important as policymakers confront the COVID-19 pandemic, looming Medicare insolvency, and new high-priced treatments and cures. As a new Congress considers additional action on prescription drug prices, analysis and commentary by Schaeffer Center experts will prove critical to ensuring that federal leaders balance short-termism with long-term gains and incentives for innovation. In the meantime, state and private sector leaders are likely to continue to lead the way in championing novel arrangements.

You must be logged in to post a comment.