Editor’s Note: This analysis is part of the USC-Brookings Schaeffer Initiative for Health Policy, which is a partnership between Economic Studies at Brookings and the University of Southern California Schaeffer Center for Health Policy & Economics. The Initiative aims to inform the national healthcare debate with rigorous, evidence-based analysis leading to practical recommendations using the collaborative strengths of USC and Brookings.

As COVID-19 cases mount in states across the country, uninsured consumers may be newly attempting to get health insurance coverage. A number of states are offering consumers the opportunity to enroll in comprehensive subsidized coverage through the Affordable Care Act under a special enrollment period (SEP), and those who have recently lost another form of coverage (e.g. because they lost their job) will qualify in all states for an SEP to enroll in comprehensive coverage. But many others may not qualify for existing SEPs, and may instead turn to various forms of non-compliant coverage that offer continuous enrollment but limit coverage and may exclude those with pre-existing conditions.

Recent analyses have highlighted that insurance agents and brokers selling these plans do not always deal transparently with consumers. On March 18, 19 and 20, we conducted a series of phone conversations with health insurance agents, brokers, and other salespeople[1] to investigate marketing practices associated with COVID-19. Posing as a 36-year-old woman seeking coverage because of concerns about COVID-19 (additional details appear in the Appendix), we were offered a variety of short-term or other non-compliant plans from nine different brokers. In these conversations, we discussed plan coverage and asked questions about how the coverage would apply if the enrollee were to need care related to COVID-19. Salespeople were quick to reassure us that COVID-19-related costs would be broadly covered, despite plan documents or other statements indicating that the coverage would not be nearly as robust as promised. In the conversations, we heard misleading – and sometimes false – information about how COVID-19-related testing and treatment would be covered by the plan and the circumstances under which it would be a pre-existing condition.

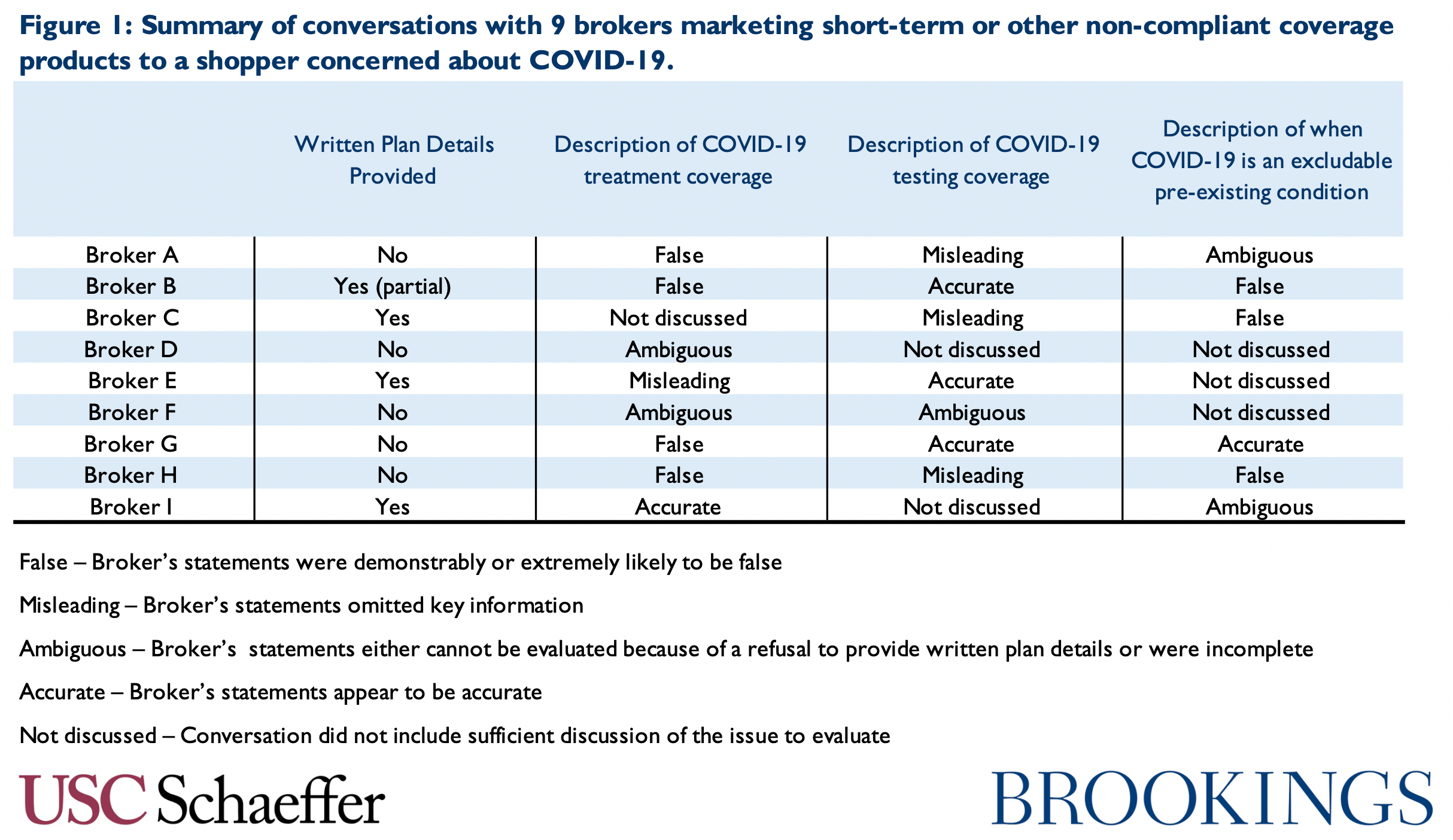

Our brief survey suggests three major areas of concern: coverage of treatment, coverage of testing, and the way pre-existing condition exclusions are applied. Figure 1 summarizes the results of our conversations across these domains. In our 9 conversations, 5 included statements that we would characterize as demonstrably false, as described below. Though an admittedly imprecise metric, we had no conversations where we would characterize the broker as having accurately and clearly described the terms of coverage and the relevant plan limitations. Because of our small sample size and because the brokers we spoke do not constitute a representative sample of brokers selling short-term plans, there are limits on how far these 9 conversations can be generalized. Nevertheless, the ease with which we came across false and misleading information suggests that additional scrutiny of these plans’ marketing strategies may be warranted and that consumers should exercise caution.

The remainder of this piece describes our conversations in more detail.

False and Misleading Statements About Treatment

Some patients who are diagnosed with COVID-19 will require hospital care, and fear of those costs may be a major factor leading people to seek coverage now. A recent analysis from the Kaiser Family Foundation examined hospital claims for pneumonia patients with commercial coverage, as a proxy for what COVID-19 patients may experience. They found average treatment costs ranging from $9,800 to $20,300, depending on the degree of co-morbidities. Moreover, hospital stays that involve mechanical ventilation, which is commonly required in patients hospitalized for COVID-19, are likely to be considerably more expensive. Medicare payment rates for hospital stays involving mechanical ventilation are two to four times higher than its payment rates for even the most complex category of pneumonia admissions examined by KFF.

With these costs in mind, in our conversations we inquired about whether the plan would include coverage in the event of hospitalization or other treatment for COVID-19. None of the plan brochures we obtained referenced a blanket exclusion for COVID-19 treatment, nor did any brokers suggests such an exclusion would be applied. (It is certainly possible a complete exclusion would appear in the final policy contract, which will generally only be made available once a consumer has paid for the policy, but we have not discovered evidence of such behavior.) But even if not subject to a blanket exclusion, the plans we were being marketed have significant gaps that would limit the value of coverage in the event of a serious hospitalization. However, agents and brokers often significantly overstated the degree of coverage a plan would provide and sometimes misrepresented the terms of the plan.

Broker H, attempting to sell a short-term plan, assured us:

“This plan is gonna give you $250,000 worth of hospitalization [after a $7,000 deductible], in case you have any hospital or emergency issues throughout the year.”

It is true that this plan has a $250,000 annual limit on hospital claims. But it also includes daily benefit limits for specific services that are likely to be far more important in the event of a hospital admission. The plan brochure explains that the hospital benefit is capped at $1,000 in covered services per day and the ICU benefit is capped at $1,250 per day in the Intensive Care Unit (ICU). It is unclear if these amounts are additive, but even assuming they are, a payment of $2,250 is likely insufficient in many cases. It could leave a patient admitted to the ICU responsible for thousands of dollars in uncovered costs, which would not count towards the deductible.

Broker E was marketing a fixed indemnity plan, which pays a flat $5,000 per day in the event of hospitalization. Asked about how this coverage would work if hospitalized for COVID-19, the broker said:

“You’re gonna have $5,000 a day, which is huge, alright, because your average stay in a hospital if you’re in intensive care is $2,500 [per day], so what that means is that you basically have $1.8 million in coverage for 360 [sic] days a year.”

Without considering COVID-19-specific costs, suggesting that a $5,000 per day benefit is equivalent to $1.8 million per year is extremely misleading, especially in the context of a consumer asking about an acute care stay which is likely to last no more than a few weeks. Moreover, as noted above, “intensive care” costs could be greater than suggested, though it may be adequate for some individuals. (Later in the conversation, the broker added that the plan included an additional $3,000 per day for ICU care; the plan does include a supplemental ICU benefit, but it is only $2,000.)

Brokers also provided an unreasonable degree of certainty that plans’ coverage would be sufficient. Broker D, who never provided plan documents, said simply “You have a max out-of-pocket of $2,000, you have a deductible of $2,500, so that’s really gonna have you when it comes to any hospitalization.” Plan documents were not provided, but the reality is likely considerably more complicated, especially given that the broker appears to be using the phrase “max out-of-pocket” in a way that is inconsistent with its usual meaning.

We also heard general statements suggesting that all COVID-19 related care would be covered. Broker H, who did not provide any written plan details, stated generally:

“This plan is going to cover you for your doctors, specialists, urgent care, hospitalizations, surgery, emergency room, brand name and generic medications. So, I guess if you did, quote unquote, god forbid, get the coronavirus, you would have to go to a doctor; this plan does cover doctor visits. If the doctor provided you with medications, this plan does cover you for your medications. So this plan would cover you, god forbid, if you did get the coronavirus.”

It is difficult to assess the veracity of that claim without seeing a plan brochure, but it seems highly unlikely that coverage is as broad as suggested. For example, from the description provided, the plan does not appear to include lab services or imaging, which would likely be needed services. Moreover, it seems implausible that the broker has sufficient familiarity with the types of medical care involved in treatment to provide this degree of assurance.

On another call, after asking about COVID-19 treatment, Broker A told us:

“It’s a state mandate that your plan does give you that type of coverage. We give you that notification, anything dealing with any symptoms related to coronavirus, anything like that, that your insurance company has to cover it.”

The relevant state does not appear to have issued any state-level requirements, and even in states that have taken steps, states have generally focused on coverage for testing, not treatment. This salesperson refused to provide written plan details.

Indeed, Broker G, who is located in a different state that has required short term plans to cover testing but not treatment, responded to questions about coverage for treatment by saying:

“[The state] has included it in all major medical and short-term major medical… The CDC requires certain plans, those major medical plans, as I told you – it’s 100% coverage because it’s a pandemic disease worldwide, so this plan does cover that.”

There is no applicable CDC guidance, and the state testing mandate does not reach treatment.

Finally, Broker B, who appeared to be selling a bundled short-term plan and critical illness policy claimed that a COVID-19 diagnosis would result in a lump sum payment (to cover cost-sharing or other expenses) under the critical illness portion of the policy. The critical illness plan documents were not provided, but the broker claimed that even though it “doesn’t specifically name” COVID-19, it would still be included. This is almost certainly untrue, as critical illness plans are only exempt from consumer protections (like the requirement to cover people without regard to pre-existing conditions) to the extent they provide payment for a “specified disease or illness.” Therefore, the plan likely limits payments to named diseases.

False and Misleading Statements About Testing

Consumers may also be concerned about what coverage would be provided if they needed testing for COVID-19. Costs might include the test itself as well as an associated visit to a physician, urgent care center, or emergency department. In the absence of a blanket exclusion for COVID-19, some of these costs – especially a visit to a health care provider – are likely covered, but agents and brokers often made statements about testing coverage that exceeded the plans’ true benefits.

Some plans do not appear to include a lab services benefit at all, yet we were assured testing services would be covered in those plans. Broker H, as noted above, listed covered plan benefits on multiple occasions as “doctors, specialists, urgent care, hospitalizations, surgery, emergency room, brand name and generic medications.” He never referenced lab or diagnostic services, or anything that would suggest coverage of the test itself. Yet when asked about testing, he indicated it would be covered by the plan.

Broker C provided a plan brochure that indicates the plan does not include a lab services benefit, but when asked about lab testing the broker said:

“They’re giving free tests out right now at a lotta places, but if you had to pay for the test you get a 35 or 55 percent discount on the price, but right now I think the price is zero, so it’s not really an issue.”[2]

This is, at the very least, a misleading statement about the nature of the coverage. Testing may be free for many people under current rules, but a more accurate statement would have acknowledged the plan’s limitations before explaining that testing may be available for free through other routes. Moreover, the reference to a “35 or 55 percent discount” suggests that the broker is aware of some sort of negotiated rate with lab services companies that is available in place of actual coverage (details did not appear in the plan brochure), yet the broker did not explain that to the consumer.

False and Misleading Statements About Exclusions for Pre-Existing Conditions

All of the plans being marketed in these conversations exclude benefits arising from pre-existing conditions. Most (but not all) brokers did mention these limitations in our conversation, though did not initiate any attempt to explain what that meant in practice. This is particularly important in light of evidence that post-claims underwriting is common in these plans. Indeed, one of the early suspected COVID-19 patients in the United States (who ultimately had the flu) was enrolled in a short-term plan and subject to an extensive underwriting review after seeking COVID-19 testing. To investigate how these issues were being discussed with potential customers, we asked additional questions about the circumstances under which COVID-19 might be considered a pre-existing condition and generally received incomplete, misleading, or false answers.

Broker H, when asked “Say I was symptomatic now, would it be considered a pre-existing condition?” responded:

“No, not until a doctor says you got it. Nope, you can have symptoms all day long; you don’t know what that is. That could be a flu, it could be something else, so no, no, no, not until the doctor puts it into the system that you have a diagnosis of something, so that’s why it’s good that you get something now, before that happens.”

This is flatly inconsistent with the definition of pre-existing conditions appearing in the plan documents the broker provided, which define a pre-existing condition as any disease that produced symptoms for which a “reasonably prudent person” would seek diagnosis or treatment. Moreover, the plan has a (fairly common) “waiting period,” specifying that benefits will not be paid unless “occurrence of symptoms” begins 5 days after enrollment. That is, if any symptoms appear within 5 days, they entire illness would be excluded from coverage.

Similarly, Broker B, asked about whether current cold symptoms could make COVID-19 a pre-existing condition said:

“Basically, the question is, have you consulted a health care professional about some sort of illness that hasn’t been diagnosed or determined what it is yet… so you should be good there, I mean, because if you just, you know, whatever, have a cough or something, I mean, I don’t know, that could be allergies. So the only way it wouldn’t cover you is if you were told by a health care professional you need some follow-up on this…. I mean, if you haven’t consulted a health care professional yet, then there are no pre-existing conditions because it hasn’t been determined.”

That statement is clearly contradicted by the plan brochure the broker provided, which defines a pre-existing condition as any illness that “produced signs or symptoms during the 1 year period” prior to enrollment.

When another broker, Broker I, was asked a question about symptoms showing up shortly after enrollment she did disclose the existence of a 7-day waiting period, one of only two conversations in which this feature was acknowledged. Even in that case, however, the waiting period was described in language that most consumers likely could not understand:

“If you’re sick-sick, if you got the plan today, there’s a 7-day waiting period that you wouldn’t be able to be covered basically if you were sick. So if you got it today and you were sick in that 7 day period, then basically it’s not covered. So you sign up today, you have 7 days, okay, and, um, yeah.”

This statement is largely impenetrable, though perhaps leaves the impression that the plan does not pay benefits during the first 7 days, not that the entire episode would not be covered. In any case, it is unlikely to leave a consumer informed about how waiting periods would work in practice.

In other cases, in response to inquiries about whether COVID-19 would be a pre-existing condition generally or based on the appearance of symptoms, brokers made a general statement indicating that if an enrollee did not have the disease now, it would not be a pre-existing condition. “If you get the coverage now and were diagnosed with it tomorrow, you would be covered,” said Broker C. In fact, that assessment requires knowing if a person is or has shown symptoms, and even then, accurately answering the questions would usually require a discussion of the applicable waiting period.

The Need for Oversight and Consumer Caution

The results of this collection of brief conversations raise concerns. Consumers seeking coverage for COVID-19 related care may find themselves exposed to significant misinformation about their coverage. And, of course, the impact of misleading marketing practices is considerably more significant in market segments that are not compliant with ACA protections, since these plans are subject to much less regulation and benefits can be excluded or denied to particular consumers. In addition to the COVID-19 related concerns described above, our conversations were consistent with problems that other analyses have identified, including an absence of discussion of financial assistance options and Medicaid and difficulty obtaining written plan details, though we did not systematically investigate those issues.

These results reflect a need for enhanced oversight by state regulators. Clear guidance should be provided to agents and brokers on how to describe plan limitations, and state insurance regulators (and other consumer protection agencies, where applicable) should make clear they intend to take enforcement action against brokers or other salespeople that violate state law standards for accuracy and transparency. State regulators should also provide guidance to consumers warning them of the limitations of these plans for individuals seeking COVID-19 related care, and encouraging everyone to review written plan details. State regulators can also access to full underwriting screens and policy contracts that are generally not available until after payment, and they can review plan and broker behavior in underwriting. Moreover, additional oversight about how short-term plans and other forms of non-compliant coverage provide COVID-19 related care is appropriate as the situation continues to evolve.

Appendix: Methods

Using three pre-selected zip codes (which are not listed here to avoid identifying the brokers involved) selected from states that do not restrict short-term plans and are not currently experiencing a major outbreak of COVID-19 cases, we called three websites marketing insurance from each state. The agencies were chosen by searching “short term health insurance in [state]” in Google and selecting the first three results, which were all advertisements. To call these brokers (or lead generators), we used a temporary phone number with area codes in the selected to states.

The identity used in these calls was a 36-year-old single woman looking for a short-term health insurance for under $300 after having been uninsured for three months. The woman asked a series of questions based on her concerns around coronavirus. These questions included inquiries about whether treatment and hospitalization “for the coronavirus” would be covered, whether testing and labs for COVID-19 would be covered, and how the pre-existing condition exclusion would apply for someone who was “symptomatic right now,” who had a “little cold” at this time, or who developed symptoms of COVID-19 in the near future.

[1] In this piece, we refer to all of these individuals as brokers, though we do not know their state licensure status.

[2] At the time this conversation occurred, federal legislation creating a pool of funding to reimburse providers for testing delivered to those in short-term plans (or otherwise un- or under-insured) had passed the House but not the Senate.

You must be logged in to post a comment.