Editor’s Note: This perspective was originally published on Health Affairs Forefront on July 13, 2023.

Persistent favorable selection to Medicare Advantage (MA) generates large annual overpayments because beneficiaries who switch to MA systematically use fewer medical services than those who remain in traditional fee-for-service (FFS) Medicare even after risk adjustment. Our findings that favorable selection overpays MA plans by 14.4 percent are reinforced by the recent Medicare Payment Advisory Commission (MedPAC) report estimating overpayments of 11 percent from favorable selection.

A recent Health Affairs Forefront article from two of us (Ginsburg and Lieberman) explored broad policy directions that would reduce MA overpayments from favorable selection. In this article, we flesh out one of these directions: reforming the current administered payment approaches linking spending in FFS to MA rates. We outline short-term, intermediate-term, and longer-term approaches to reduce overpayments under the current approach.

Continuing rapid growth in MA underscores the importance of reforming MA payments. From December 2022 to June 2023, private plan enrollment grew by 2.5 million beneficiaries (3.6 percentage points), from 49.7 percent to 53.3 percent of beneficiaries with both Medicare Parts A and B.

Favorable selection, MA overpayments and failure of MA risk adjustment

In 2020, the 11.3 million MA beneficiaries who had switched from FFS Medicare over the 2006-2019 period constituted 46.9 percent of MA enrollment. Recent research reveals that MA’s risk adjustment model does not correct the extremely skewed distribution of expenditures by enrollees in FFS. Even for beneficiaries with the same risk score in a year, the 20 percent with the lowest spending in 2019 average $533 in annual costs and account for 0.9 percent of total spending, while the 20 percent with the highest spending average $40,180 and account for 73.3 percent of total spending; the mean of $11,439 exceeds the median of $3,742 by 427 percent. The comparable amounts without risk adjustment are $308 and 0.7 percent for the lowest quintile, $33,187 and 76.6 percent for the highest quintile; the non-risk-adjusted mean of $8,663 exceeds the median of $2,494 by 347 percent, suggesting that the Centers for Medicare and Medicaid Services (CMS) risk-adjustment model does not effectively limit the variation in spending by beneficiaries with the same risk score.

CMS has designed its hierarchical condition categories (HCC) risk adjustment model to generate risk scores that make the expenditures of beneficiaries with differing diagnoses and demographics comparable to those of a “standard” beneficiary with a risk score of 1.0. CMS focuses on group-level averages, explaining:

At the individual level, predicted medical expenditures can be lower or higher than actual medical costs, but at the group level, below-average predicted costs balance out above-average predicted costs…

Unfortunately, massive increases in MA enrollment, the decline in FFS beneficiaries since 2006, and a highly-skewed distribution of risk-score-adjusted expenditures undermine this precarious assumption of neutral selection for the millions of beneficiaries who switch from FFS to MA. As a result, the current approach to risk adjustment is the equivalent of the proverbial “bringing a knife to a gun fight.” The result is massive MA overpayments.

Improving risk adjustment to reduce MA overpayments

We explore three different approaches to correcting MA overpayments by altering risk adjustment. The first two entail incremental changes that could be accomplished quickly, reducing MA overpayments starting in 2025 and 2027, respectively. The third approach amounts to a fundamental redesign of the HCC risk adjustment model and would require more time. After describing each approach and their strengths and weaknesses, we conclude with our recommendations.

Alter MA rates to reflect switchers’ risk-score-adjusted FFS spending

One way to directly address the problem of paying average MA rates for switchers with below-average expenditures would be to reduce MA payments for recent switchers based on their recent risk-score-adjusted FFS spending. We use the term “risk-score-adjusted spending” to reflect an individual beneficiary’s expenditures relative to the mean expenditure of all beneficiaries with the same risk score in a year.

From a given year, CMS could group together beneficiaries by risk score. For all beneficiaries with the same risk-score, CMS could use their expenditures to assign percentiles and calculate the average expenditure for each percentile. The final step would entail computing the ratio of each percentile’s average expenditure to the mean for all patients with that risk score. Conceptually, this ratio would quantify the extent that each percentile of expenditures is above or below mean expenditures for a given risk-score in a year.

CMS could use these ratios as multipliers that adjust downward or upward county-level rates paid to MA plans for each switcher based on whether she has below- or above-average FFS expenditures for her risk score. The policy could be further customized through three factors. First, policymakers would specify the extent to which MA rates are adjusted to account for overpayment due to favorable selection. A maximal policy would adjust the entire MA rate by the ratio; a more moderate adjustment would blend the current (average risk-adjusted) rate and the risk-score-adjusted percentile rate.

Second, assuming it applied only to switchers newly enrolling in MA, the policy would specify the number of years after beneficiaries switch to MA for which the rate would be adjusted by risk-score percentile ratios, and whether to incorporate a phase-out. As an example, policymakers could phase out the risk-score-adjustment from 75 percent in the first year, to 50 percent in the second, and 25 percent in the third, after which plans would receive average MA rates.

The third variable would involve specifying a “regression to the mean” factor to account for the tendency of switchers’ expenditures to move closer to average over time. A regression to the mean factor would acknowledge that these ratios likely underestimate spending in subsequent years after a beneficiary switches into MA. Policymakers could incorporate a regression to the mean factor as a technical adjustment to the options outlined in the second approach.

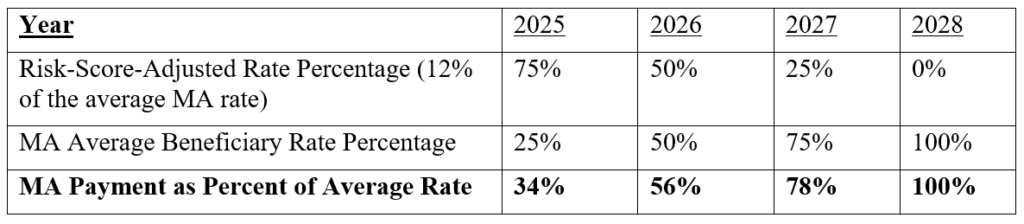

As an illustration, assume the policy starts with beneficiaries who join MA in January 2025, based on electing to switch from FFS in the October—December 2024 annual enrollment period. Assume also that the most recently available FFS expenditures are from the prior year (2023) when a switcher’s spending was at the 20th percentile and equaled 12 percent of the mean for their risk score. A policy might specify that CMS pay MA plans a 75/25 blend between the risk-score-adjusted ratio and the normal MA rate in 2025, or 34 percent of the risk-adjusted rate (i.e., 75 percent of the 12 percent risk-score-adjusted rate summed with 25 percent on the average MA rate). Policymakers could further phase out the adjustment over a four-year period (see exhibit 1 for full example). If adopted, a regression to the mean factor would increase over time the percent of the average MA rate paid to plans.

Exhibit 1: Blended MA rates for 2024 switcher: 20th percentile is 12 percent of mean, four-Year phase-out

Source: Authors analysis

The impact on MA plan revenues would depend on the policy specifications. The example outlined above would alter payments for each new cohort of switchers for three years by diminishing the amounts paid to plans. Plan payments for other MA beneficiaries, whether they had already switched to FFS or joined MA immediately (without the necessary history of FFS claims), would not change.

Reinsurance, not risk adjustment, for high-spending beneficiaries

The extremely skewed spending distribution for beneficiaries with the same risk score makes it highly challenging to pay prospectively set rates to MA plans and limit overpayments from favorable selection. Mean risk-score-adjusted expenditures fall dramatically from $11,439 for all FFS beneficiaries in 2019 to $3,815 if the expenditures of the most expensive 20 percent of beneficiaries are excluded. Opting to pay plans through reinsurance for the top quintile of beneficiaries (who account for 73.3 percent of total spending) would greatly mitigate the skewed spending distribution; however, this most likely would severely compromise plan incentives to curtail costs by paying only 26.7 percent of costs prospectively, with the remainder reimbursed based on plan spending.

A hybrid system that limits overpayments but incentivizes efficiency would balance retrospective reinsurance payments with prospective monthly capitation adjusted by risk scores. Conceptually, this payment approach is similar to the outlier pool specified in the Medicare hospital inpatient prospective payment system (IPPS), which limits hospitals’ exposure to financial risk from high-cost inpatient stays that qualify for outlier payments. To avoid having too much of spending paid retrospectively based on costs, MA plans would be paid a percentage of prospective MA rates based on expected FFS expenditures, with reinsurance paid for high-cost MA beneficiaries equal to the remaining spending.

Policymakers would choose the share paid prospectively through monthly capitation rates and the share paid retrospectively (reinsurance) based on encounter data. For example, MA rates could reflect spending by beneficiaries with the lowest 80 percent, 90 percent, 95 percent or 99 percent of expenditures, with reinsurance calibrated to 20 percent, 10 percent, 5 percent or 1 percent of spending, respectively. Each beneficiary’s risk score would adjust the monthly capitation paid to an MA plan and reinsurance payments could be tied to either the actual plan cost or standardized costs computed by CMS for patients with given diagnoses and/or risk scores.

The Medicare Actuary would annually set thresholds (i.e., “attachment points”) above which plans would receive reinsurance payments for high-cost beneficiaries in a process similar to how Part B premiums are set. In the aggregate, expected reinsurance payments would approximate the difference between capitation paid to an MA plan and the qualifying expenditures of high-cost beneficiaries. Other policy choices would involve deciding whether to apply nationally uniform thresholds or to vary them in relation to county-level FFS spending, and whether reinsurance payments would be made after the end of the year or on a monthly, estimated basis that would be reconciled with expenses after the end of the year, as occurs in Medicare Part D.

Incorporating reinsurance into risk adjusted MA payments is more complex to operationalize than altering MA rates to reflect risk-score-adjusted expenditures of switchers. Introducing reinsurance changes MA rates because the proportion of qualifying costs paid by reinsurance changes the share of expenditures paid through prospective risk adjustment. Linking reinsurance payments for high-cost enrollees to encounter data has the added benefit of strengthening incentives for plans to capture and accurately report all services provided to MA enrollees. To the extent that reinsurance reduces mean FFS expenditures that factor into MA rates, the approach would reduce overpayments associated with favorable selection as well as ameliorate the tendency of the current risk adjustment model to overpay beneficiaries with low expenditures and underpay those with high expenditures. Other countries have successfully implemented this hybrid approach.

Comprehensively redesign risk adjustment model

Although CMS has repeatedly updated, refined and improved the HCC model, the fundamental underlying design has remained unchanged and does not effectively adjust for the extremely skewed distribution of risk-score-adjusted expenditures. In 2004, when HCCs were first implemented and FFS enrolled 87.9 percent of beneficiaries, assuming individuals with “below-average predicted costs balance out above-average predicted costs” at the group level might have been tenable—but not in 2023.

Our research suggests that the current HCC model does little to explain the extreme cost-variation of Medicare beneficiaries: as we noted at the outset, variation in expenditures is virtually the same when examining beneficiaries with the same risk scores and in the entire population without any risk adjustment. Redesigning the risk-adjustment model to have more predictive power would reduce the extent favorable selection results in MA overpayments. Other countries have made significant advances in risk adjustment using models that incorporate prescription drug data and reinsurance; these and other advances are worth pursuing. Below, we outline three potential innovations that would fundamentally revise the current HCC model to illustrate examples of important research that should be funded.

First, a comparatively simple revision to the current model structure would incorporate more sophisticated clinical interactions. Because most of the HCCs are additive, the model assumes that the annual expenditures for a patient with multiple comorbidities is (on average) the sum of each of these comorbidities. However, clinical evidence suggests that many comorbidities are, in fact, synergistic, not simply additive. For instance, diabetes increases the likelihood that a patient with coronary artery disease will experience a myocardial infarction. Conversely, myocardial infarctions can precipitate dangerous diabetic complications such as ketoacidosis.

A more sophisticated model would capture clinical interactions that better explain the relationship between expenditures and clinical complexity associated with comorbid conditions. CMS might prioritize targeted “proof of concept” projects, concentrating initially on a limited number of conditions that are costly to Medicare, have clinical coherence, and can involve significant variation in costs.

A second revision would explore replacing the current “one-size fits all” HCC model and developing separate risk-adjustment models for individual comorbidities known to be particularly complex or expensive. Diabetes, heart failure, chronic kidney disease, and cancer are examples of diseases that are associated with concurrent comorbid conditions and predispose patients to expensive complications. Choosing to have a single risk adjustment model leads to the current HCC model assuming that a specific comorbidity has the same expenditures for all patients. Because it is likely that heart failure complications, for instance, have substantially different costs for patients with and without diabetes, adopting multiple models would permit risk adjustment to better predict expenditures. CMS should fund research that informs policymakers about the extent to which the expenditures for specific conditions vary when in the presence of other comorbid conditions.

A third revision would incorporate prescription drugs and other services (e.g., procedures and admissions) into the risk adjustment model rather than relying only on diagnosis codes supplemented by demographics. Having the HCC model rely on diagnosis codes but not services (including drug data) reduces model complexity but permits rampant upcoding by MA plans. Adding services to the risk adjustment model would constrain upcoding by making diagnoses more difficult to game, and would also inform the severity of illness.

Rather than simply depend on the diagnosis code, CMS could use services to confirm the presence of the comorbidity. As illustrations, insulin is almost exclusively used among patients with insulin-dependent diabetes and dialysis is almost always provided only for patients with ESRD. Services could also provide granularity on the severity of specific conditions. An example is examining whether a patient with peripheral arterial disease has received an arterial angioplasty, bypass surgery, or limb amputation, which are procedures conducted in patients with more severe disease.

These three projects would require investing in research but have the potential to change fundamentally the HCC model, improve risk adjustment, and reduce MA overpayments. They complement the more immediate approaches we’ve outlined that would save money by adjusting MA rates for switchers by the ratio of a beneficiary’s expenditure to the mean for their risk score and adopting a hybrid reinsurance and risk adjustment model.

Recommended improvements to MA risk adjustment

Recognizing that 20 percent overpayments from favorable selection and upcoding will apply to $0.5 trillion in MA spending underscores the importance of both immediately reducing overpayments and markedly improving the current approach to risk adjustment. We’ve outlined a policy that could be implemented almost immediately, a second that could be implemented in the near (but not immediate) future, and examples of more fundamental changes to risk adjustment with a somewhat longer timeline. We recommend policymakers aggressively pursue all three.

Congress could legislate these reforms, either as a pay-for to fund an unrelated Medicare provision that increases spending or as part of a comprehensive initiative to reduce the deficit. Alternatively, CMS could quickly begin the necessary rule-making, sub-regulatory actions, contracting and investments in research, and model development to implement these recommendations.

Authors’ Note

Steven Lieberman and Paul Ginsburg report a grant from Arnold Ventures to USC that provided salary support for this project. Paul Ginsburg served as a Commissioner and Vice Chair of MedPAC from 2016 to 2022. The Commission has taken a number of policy positions during that time period relevant to the content of this post. Eugene Lin receives salary support from grants from the NIH/NIDDK (K08 DK118213, R03 DK131239) and the American Society of Nephrology’s KidneyCure. He also consults for Acumen, LLC, a federal contractor. The content is solely the responsibility of the authors and does not necessarily represent the official views or official policy of the US government.

Lieberman, S. M., Ginsburg, P. B., & Lin, E. (2023). Lowering Medicare Advantage Overpayments From Favorable Selection By Reforming Risk Adjustment. Health Affairs Forefront.

10.1377/forefront.20230712.603114

Copyright © [2023] Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.

Sign up for Schaeffer Center news

You must be logged in to post a comment.