The U.S. biosimilar drug market emerged in 2015 to provide safe, effective, and more affordable alternatives to existing biologic drugs, but it has been slow to develop compared with Europe.

Now, eight years into the U.S. experience with biosimilars, researchers at the USC Schaeffer Center have studied the cancer drug trastuzumab (Herceptin) and its five biosimilar entrants as an example of biosimilars’ potential to reduce drug prices. Published today in Health Affairs, the study is one of the first to look at several biosimilar competitors in terms of U.S. market share, price, and physician prescribing.

“With multiple biosimilar competitors entering the U.S. market quickly, trastuzumab is the best example to date of biosimilars fulfilling their promise to reduce biologic drug prices,” said study co-author Alice Chen, associate professor and vice dean for research at the USC Sol Price School of Public Policy and senior fellow at the USC Schaeffer Center. “In just three years, the trastuzumab market displayed important hallmarks of competition: doctors could choose among six products; new entrants rapidly captured market share from the originator; and prices steadily declined on all six options. Prices of some versions declined by more than half, and the originator lost half of the market.”

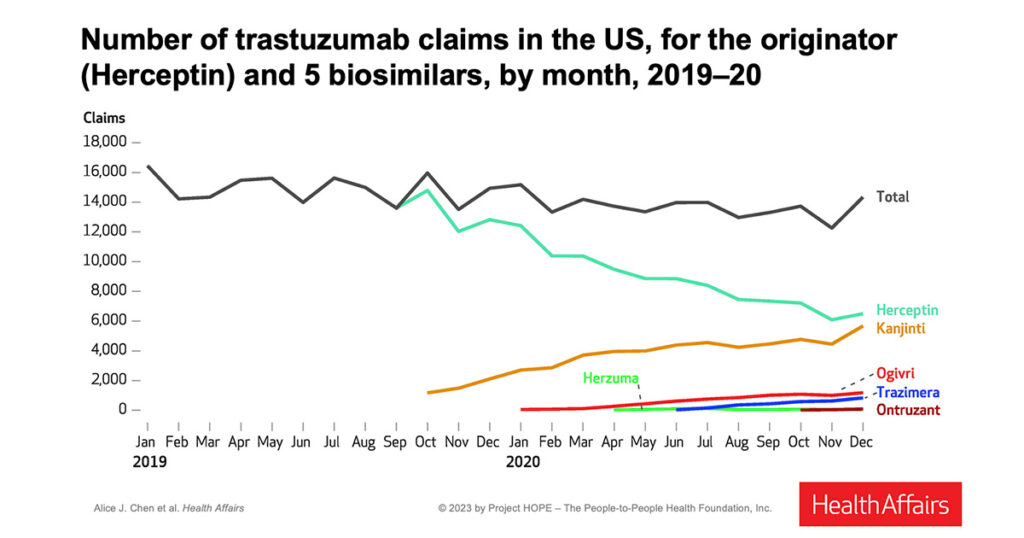

Researchers evaluated changes in average sales price, net price, and the extent to which the first biosimilar retained its advantage over later biosimilar entrants. Data show that the originator, Herceptin, began losing market share immediately after the first biosimilar, Kanjinti, entered the market. Herceptin continued to lose market share with subsequent entrants including Ogivri, Trazimera, Herzuma, and Ontruzant.

The data also show that while the existence of biosimilar options did not expand the total market for trastuzumab, multiple biosimilar products were viable and resulted in declining average sales price of all products.

Key findings

- By the second quarter of 2022, the biosimilars’ average sales price ranged from 28% to 58% of Herceptin’s first quarter 2019 average sales price; the biosimilars’ net prices ranged from 15% to 46% of Herceptin’s pre-competition net price.

- Monthly costs for biosimilar trastuzumab were as low as $1,693 (average sales price) and $813 (net price) compared with the originator’s cost of $4,829 (average sales price) and $4,213 (net price).

- Herceptin’s average sales price fell 21% from $101 to $80 per 10 milligrams.

- Kanjinti maintained a strong and persistent “first-mover advantage” over the subsequent four biosimilar entrants. While subsequent entrants achieved a higher market share in eight states, Kanjinti maintained the majority market share among biosimilars in most states.

- Hospital-based physicians prescribing trastuzumab tended to prescribe either the biologic or a biosimilar, but not both, whereas office-based physicians prescribed more evenly across the drug choices.

“Our analysis applies to a physician-administered drug under Medicare Part B, and provides the best evidence so far that biosimilars can reduce originator drug prices quickly, in the same way that generics reduce prices of small-molecule drugs,” said co-author Karen Van Nuys, executive director of the Value of Life Sciences Innovation program and a senior fellow at the USC Schaeffer Center. “Our findings support the growing body of evidence that biosimilars do in fact reduce biologic drug prices in the physician-administered market. Whether they can do the same in the retail drug market remains to be seen, as the industry brings more of these products to the market.”

Additional study authors included Katrina M. Kaiser, Laura Gascue, and Maria-Alice Manetas. Funding for this paper was provided by the USC Schaeffer Center.

Related Work

-

Journal Articles

Uptake of Infliximab Biosimilars Among the Medicare Population

-

Journal Articles

Provider Differences in Biosimilar Uptake in the Filgrastim Market

You must be logged in to post a comment.