Insurance Choice and Benefit Design

Our work in Insurance Choice and Benefit Design

-

Georgia’s 1332 Waiver Violates the ACA and Cannot Lawfully be Approved

Christen Linke Young and Jason Levitis explain why Georgia’s 1332 waiver would fail the affordability guardrail and is based on several assumptions.

Categorized in -

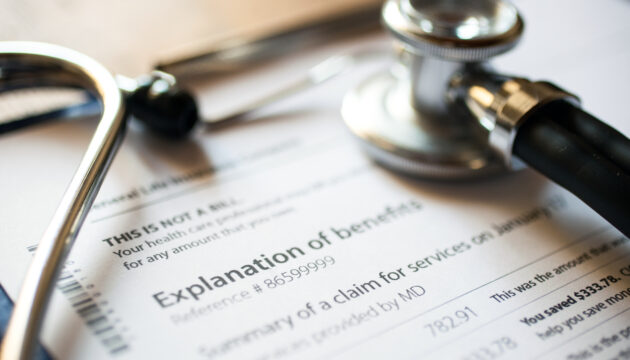

What the Trump Administration Gets Right About Hospital Price Transparency

Would you buy a pair of shoes without knowing the price? Consumers have bought medical care from hospitals for years without knowing the costs, but new regulations will change that.

Categorized in -

The Success of Medicare Advantage Makes it a Better Policy Choice than ‘Medicare for All’

This public-private partnership is delivering high-quality health care at comparatively low cost.

Categorized in -

The Affordable Care Act and Health Insurance Coverage Among People With Diagnosed and Undiagnosed Diabetes: Data From the National Health and Nutrition Examination Survey

Insurance coverage can change the health trajectory of people with diabetes by facilitating timely diabetes diagnosis and management.

Categorized in -

Why Your Employer-Sponsored Insurance May Ultimately Not Be Good For You

Nearly 160 million Americans get insurance through employers, but that does not mean it’s good social policy.

Categorized in -

Is This the Healthcare Policy Both Republicans and Democrats Can Agree On?

A mix of universal catastrophic coverage and private insurers would be cheaper than Medicare for All, Dana Goldman wrote in MarketWatch.

Categorized in -

Value-Based Contracting in Healthcare: What Is It and How Can It Be Achieved?

Value-based contracts must incentivize the clinical decision maker, usually the physician, to allocate treatment based on both price and value. Changing certain elements in the financing system could create an environment for successful value-based contracting without having to reform the entire system.

Categorized in -

Insurance Status Churn and Auto-Enrollment

Sobin Lee and Christen Linke Young of the USC-Brookings Schaeffer Initiative estimate how effective prior-month data about the uninsured would be in predicting the number of individuals currently uninsured.

Categorized in -

The Trump Administration’s Final HRA Rule: Similar to the Proposed but Some Notable Choices

USC-Brookings Schaeffer Initiative fellows analyze the Trump Administration’s final rule on allowing employers to pay for their workers’ health insurance through subsidies on the individual market, concluding that it is a step in the wrong direction.

Categorized in -

Three Ways to Make Health Insurance Auto-Enrollment Work

Successful auto-enrollment likely requires changes to the way we determine eligibility for Medicaid and Marketplace financial assistance, to make the system easier to navigate and more generous, writes USC-Brookings Schaeffer Initiative Fellow Christen Linke Young.

Categorized in