Editor’s note from Marco Angrisani, Senior Economist, Center for Economic and Social Research, USC Dornsife: The measurement of financial and consumer behavior mainly relies on self-reports, which can be burdensome for respondents and inaccurate. Since most financial outcomes (transactions, balances, etc.) are recorded in electronic form, direct access to electronic records may both improve accuracy of measurement and greatly reduce respondent burden. Yet, the mere availability of transaction data does not typically suffice to examine heterogeneity in consumer behavior. The combination of rich survey information and transaction data would be ideal for both research and policy intervention purposes. In partnership with the Financial Health Network, the Understanding America Study has pioneered the “passive” collection of electronic financial transactions of study participants for whom a wealth of survey information is also available. This blog briefly describes how the combination of these two types of data can lead to methodological advances in the investigation of individuals’ financial behavior and outcomes.

This post originally appeared in Financial Health Network on August 19, 2022.

In our unpredictable economic landscape, customers are looking for support from their financial institutions. When financial institutions step up to support their customers’ financial health, those relationships grow stronger, but how can financial institutions figure out what each customer truly needs?

Gaining these insights across the customer base requires a financial health measurement strategy. In practice, this often means deciding whether to collect survey data, use existing administrative data, or rely on both.

In the Financial Health Pulse project, we merge bank account transaction data with nationally representative survey data to offer some unique insights that survey data or transaction data alone may miss. Here, we consider how institutions can use each data source effectively to measure financial health.

Sign up for Schaeffer Center news

The Forest vs. the Trees

Choosing whether to use survey or administrative data can be a bit like deciding whether to focus on the “forest” or the “trees” of financial health.

Surveys offer an effective shortcut to the “forest” view. The eight indicator questions in our FinHealth Score methodology ask about spending, saving, borrowing, and planning to capture consumer behavior and perspectives efficiently, but this method offers only limited insight into day-to-day activity.

Administrative transaction data, on the other hand, produce the most granular and precise picture of customer activity, though often only for a limited number of accounts. If the activity in the accounts that a financial institution has access to doesn’t capture the most important aspects of a customer’s financial life, then we’re “missing the forest for the trees.”

For example, data from a credit card that a customer uses purely for building credit won’t reveal whether the customer is able to spend less than their income or manage debt overall – two important indicators of financial health.

Survey data can reveal what’s happening outside of the accounts you can see.

In Financial Health Pulse research, we observe transaction-level data for financial accounts that survey participants have consented to share with our online platform. However, we don’t know whether someone has provided access to all of the accounts they use regularly until we merge administrative data with survey data. As a result, our ability to measure financial health using administrative data alone is limited, much like a financial institution’s. For some respondents, we’re missing way too many of the individual trees to get a clear picture of the forest.

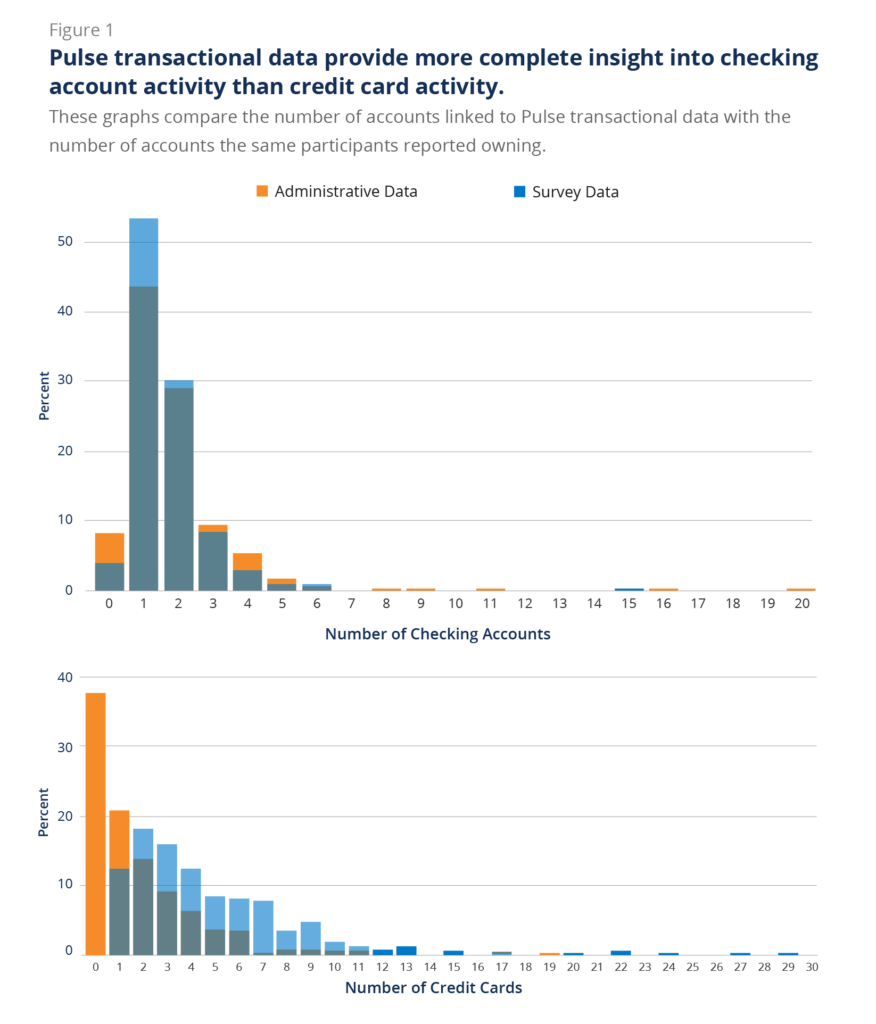

To illustrate, we compared the number of checking accounts and credit cards that participants linked to our platform with the number that they reported owning on a separate survey. Among those who both participated in the survey and linked at least one account to Pulse, respondents reported roughly the same number of checking accounts as they had linked to the platform.

On the other hand, respondents reported owning far more credit cards than they had linked on average. This suggests that our administrative data give us a more complete view of checking transactions than credit transactions.

If we wanted to assess the borrowing capacity and behavior of these participants, relying on the credit card data we have access to may not help us much, because we only see information about a fraction of the credit cards they own.

When you can see the accounts your customers use regularly, administrative transaction-level data offer the most granular method to measure spending and saving behavior.

Limitations of administrative data aside, if you are confident you have enough account data on a customer to put together the “forest” view of their financial activity (or of at least one component of their financial health), administrative data can be an extremely insightful measurement tool.

Detailed survey questions about account balances and patterns in spending are likely to yield inconsistent and imprecise answers – your survey respondents are only human, after all. Surveys also only allow for periodic data collection.

Administrative account data, however, are collected continuously and do not rely on error-prone self-reporting. Our analysis comparing Pulse administrative account data with self-reported transaction-level data in another survey shows that more payments are captured in administrative data on average, especially among the respondents who have linked most of their accounts.

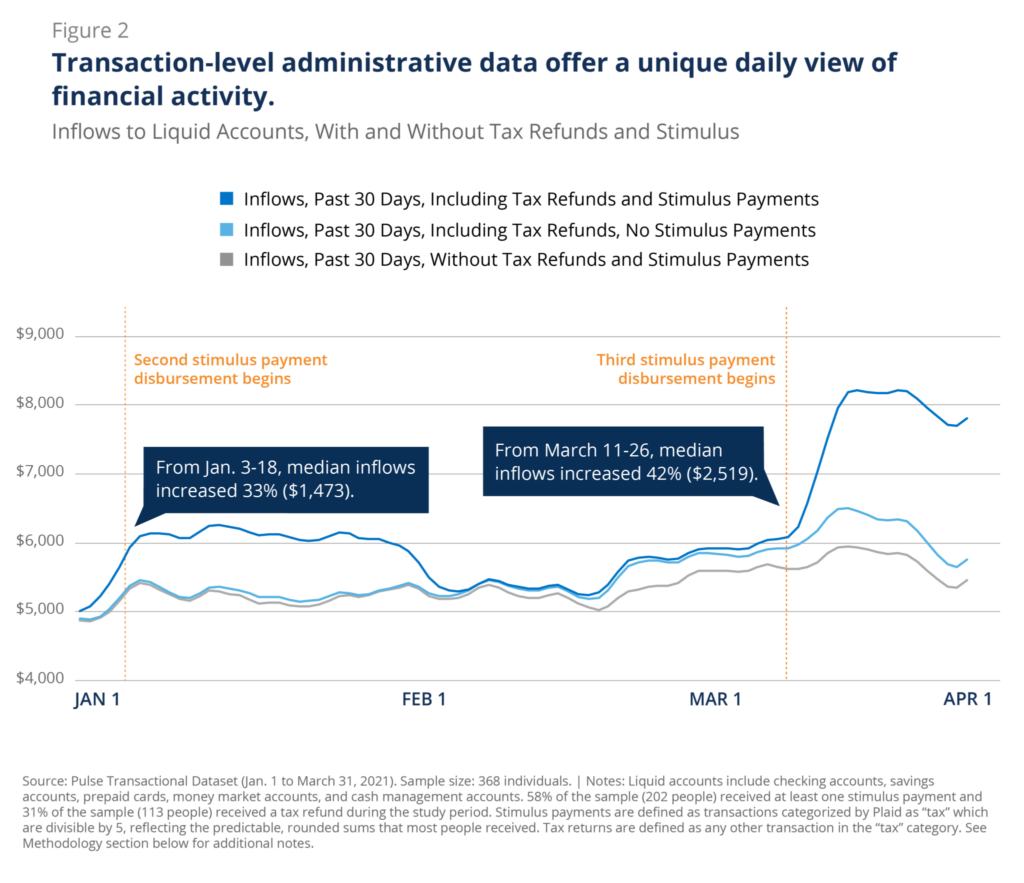

Another example of the power of administrative data is our research on the impact of tax refunds and stimulus payments on checking and savings balances in 2021 in real time (Figure 2). Pulse annual survey data give us the most complete view of general trends in financial health over time, but they cannot capture day-to-day movement in account activity like administrative data can.

Putting Different Data Sources To Work

Consumers are looking to financial institutions to support their financial health. So which approach to financial health measurement can help your organization gain the greatest visibility into customer needs? Our data reveal some insights into the advantages of each:

- Institutions can use both survey and administrative data to measure financial health, and combining the two will yield the deepest insights.

- Surveys can efficiently produce a holistic assessment of a customer’s financial health, including how they feel or think about their finances, but they are limited by what respondents can remember and self-report accurately. See our FinHealth Score page for tips on conducting surveys.

- Administrative data can provide detailed insights into specific areas of a customer’s finances, while also requiring fewer steps to collect data with no active participation needed from customers. However, while some customers may conduct almost all of their day-to-day financial activity in the accounts you can see, others may only offer you a small window into their financial lives. Read our brief for ideas on using administrative data effectively at your company, depending on your unique goals and data assets.

Explore Our Resources

For more insights from our unique data assets, take a look at our Pulse Points publications and stay tuned for upcoming publications. If you’re interested in exploring measurement solutions that meet your customers’ needs and complement your data resources, reach out to us at info@finhealthnetwork.org.

For businesses looking for a fast and efficient way to measure customer financial health with surveys, the Financial Health Network’s Attune platform can be deployed in just a few days and provides customizable dashboards for valuable business insights. Learn more at https://attune.co.

Methodology

Read more about our transactional data and methodology here and our Pulse research here. For analysis comparing administrative data to survey data, we merged our Pulse transactional data with survey data from the Atlanta Federal Reserve Bank’s Diary of Consumer Payment Choice, which is also fielded through the Understanding America Study.

Acknowledgements

We partnered with Marco Angrisani at USC and Kevin Foster at Federal Reserve Bank of Atlanta to complete this analysis.

You must be logged in to post a comment.