Overview

Financial fraud is a prevalent issue in the United States and can have significant financial and psychological impacts on its victims. Some estimates suggest the direct costs of financial fraud on individuals in the U.S. to be as much as $50 billion annually. Consequently, numerous organizations and institutions have sought to provide educational programs aimed at reducing individuals’ susceptibility to fraud. However, despite their prevalence, we still know little about whether educational interventions are effective in reducing adults’ susceptibility to scams.

In a recent study, researchers from USC’s Center for Economic and Social Research and the FINRA Foundation examined whether short, online educational interventions can improve adults’ ability to spot fraudulent investment opportunities. We drew a sample of 2,000 individuals from the Understanding America Study, a nationally representative probability-based internet panel of U.S. adults aged 18 and above. Participants were randomized into one of three groups: a video treatment in which subjects viewed a three-minute educational video about techniques often present in investment fraud; a text treatment in which participants received the same information as the video treatment in textual form; and a control group which received no educational intervention. Half the participants in treatment were also randomly assigned to a second “reminder” intervention that was provided three months after the original intervention in the form of the educational mode they had not already seen (e.g. participants in the video treatment would receive the text treatment as a reminder, and vice versa).

The interventions were focused on educating participants about five techniques fraudsters often employ: (1) promising exorbitant rates of return (“phantom riches”); (2) presenting themselves as legitimate experts (“source credibility”); (3) claiming that many individuals like the target have already taken advantage of the opportunity (“social consensus”); (4) creating a sense of urgency (“scarcity”); and (5) creating a sense of obligation by providing freebies or discounts (“reciprocity”). The text and video treatments contained the same information – only the format in which it was delivered varied.

We measured fraud susceptibility immediately after the initial intervention and six months later, using investment pitches drawn from real-world examples and enforcement actions initiated by the U.S. Federal Trade Commission. We interspersed legitimate investment pitches among the fraudulent investments to examine effects on willingness to invest generally. For both the fraudulent and legitimate investment opportunities, we examined respondents’ willingness to invest. We also asked for their beliefs about the potential outcomes of investing in these opportunities. We also measured participants’ knowledge on the content included in the educational interventions to examine the mechanisms through which the intervention might have an effect.

Findings

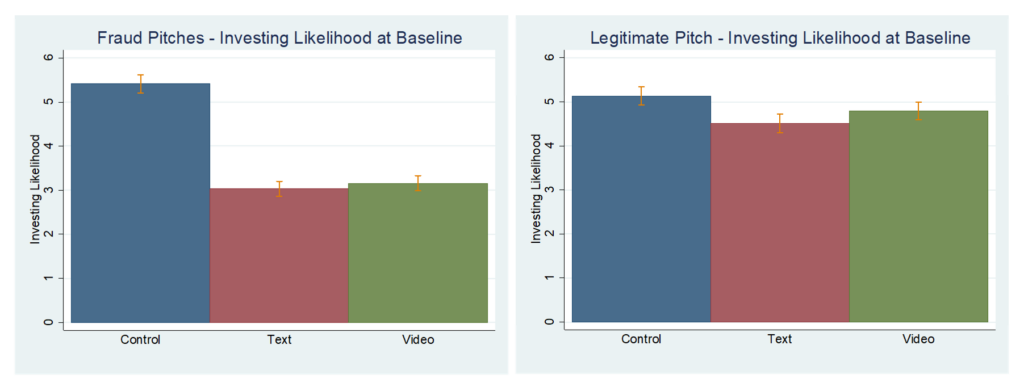

We find that short, online educational interventions can meaningfully reduce individuals’ susceptibility to financial fraud. Shortly after receiving the initial intervention at baseline, participants in both the video and text treatments were significantly less likely to express interest in investing when presented with the fraudulent investment opportunities (p-values < 0.001, Figure 1). However, we find much more muted effects on the likelihood of investing when presented with the legitimate opportunities, suggesting that respondents became better at identifying likely fraudulent schemes, rather than becoming dissuaded from investing generally.

Figure 1: Likelihood of Investing at Baseline by Treatment and Investment Opportunity

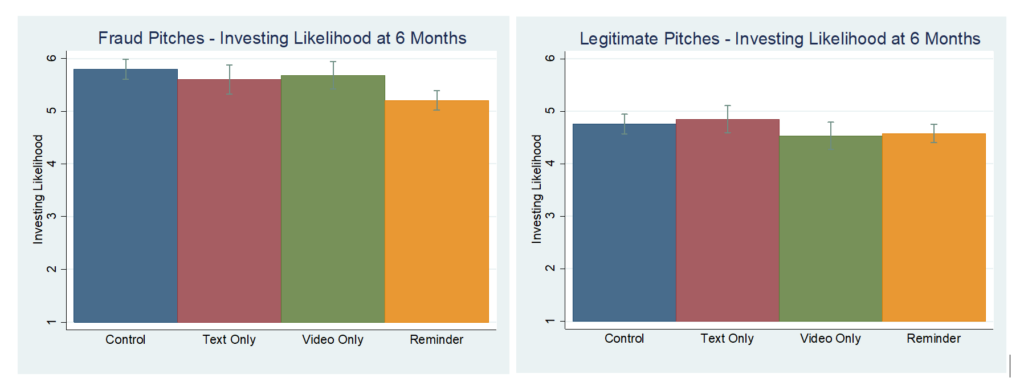

To examine whether the intervention’s effects persist, we resurveyed our study participants six months after the initial survey, adding new fraudulent and legitimate investment opportunities to those presented at baseline. As with many educational interventions, we find that effects decay over time. Individuals who saw only the video or text treatment at baseline were no better at identifying fraudulent investment opportunities than those assigned to control six-month post-intervention. However, we find that effects persist if consumers are provided reminders: respondents who received the reminder intervention three months after baseline were less likely than control to express an interest in investing in the fraudulent schemes (p-value < 0.001) at the six-month mark (Figure 2).

In contrast, we find no differences in willingness to invest, or beliefs over potential outcomes from investing, between treatment conditions (including those who received reminders) and control for legitimate investment opportunities at the six-month mark. This suggests that the reminder intervention did not reduce participants’ general willingness to invest but did improve their ability to spot fraudulent investment opportunities.

Figure 2: Likelihood of Investing at Endline by Treatment and Investment Opportunity

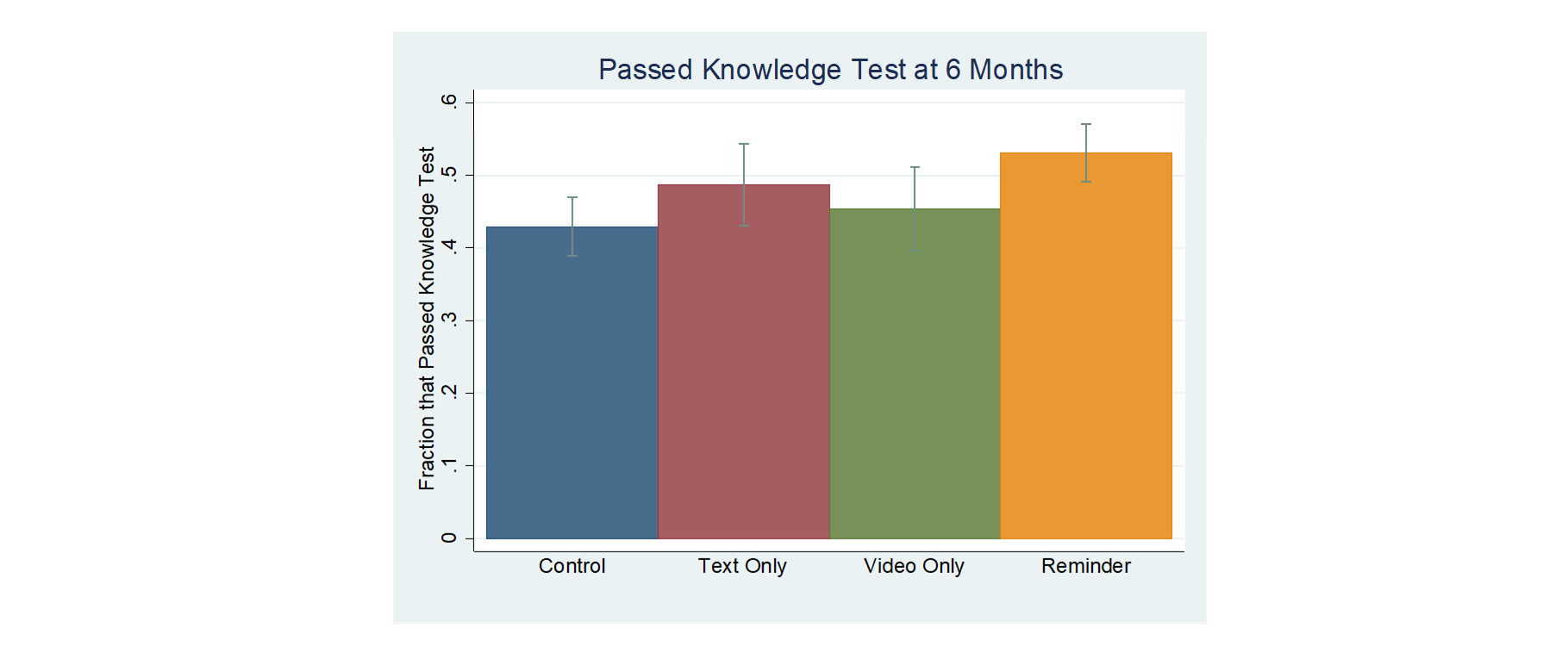

To examine mechanisms through which the intervention had an effect, we also measured respondents’ knowledge of the contents of the educational interventions with a five-item quiz. We find that, at the six-month follow-up, individuals who received the reminder intervention were nine percentage points (p-value = 0.002) more likely to pass the knowledge test (answer all five questions correctly) than participants in control (Figure 3).

Figure 3: Likelihood of Passing Knowledge Test

Implications

Altogether, our results indicate that short, easily scalable online educational interventions can meaningfully reduce individuals’ susceptibility to investment fraud and that these effects may persist over time, when coupled with reminders. Our findings are supportive of efforts to reduce susceptibility to financial fraud through education, though suggest that approaches that feature a single educational intervention may be ineffective. However, we find that approaches that feature repeated exposure to targeted educational content can causally increase individuals’ abilities to spot financial fraud and may meaningfully reduce its occurrence.

You must be logged in to post a comment.